Zero Coupon Bond Value Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Zero Coupon Bond Value Calculator is used for calculating Zero Coupon Bond Value using Face Value of Bond and Time of Maturity.

There are distinctive type of bonds people opt to invest in. One among them is the zero coupon bond. As the name itself reveals, such bonds do not pay a couple amount, rather a lump sum amount at the end of the maturity period.

Such bonds are basically offered and traded at a great discount level, which when redeemed at its face value, earn a great deal of return for the investors of the particular bond.

Zero Coupon Bond Value Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Zero Coupon Bond Value Calculator Details

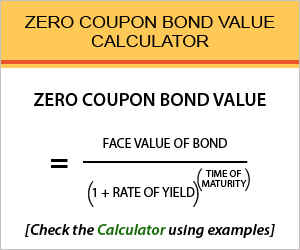

There are these following factors you would need in order to solve the formula.

- Face Value of Bond

- Rate of Yield

- Time of Maturity

You will need the above three variables in order to find the formula, i.e. the value of the bond to be paid while investment.

The first variable is the face value of the bond, wherein the face value for which the bond will be redeemed in future is referred. The rate of yield is the return made over the course of time while the bond is held. The last factor would be the period for which the zero coupon bond is to be held.

Check out more Financial Calculators here –

Zero Coupon Bond Value Calculator Product Details

All the above mention factors are necessary and needed in order to find the result of the formula. The formula in question is the point of going through everything which is also the product to be evaluated at the end.

The value here is important to commute as the returns earned by the investor solely depend on them, because the zero coupon bonds do not have an annual payment of interest in the form of coupon, rather the lump sum amount.

How to use Zero Coupon Bond Value Calculator?

It may be pretty easy to commute the formula, especially because we have attached a calculator at the end of the article which will do the commutation job for you.

You need to sort only the factor requirements, as we have already sorted the product requirement in the form of the calculator in this article, which commutes the product.

Gather the 3 different factors and then use them all to fill in the blanks of the calculator and then press the enter button on the keyboard to see the results for yourself. You will find the working of the formula as well at the end of the calculator.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Zero Coupon Bond Value Calculator Usage

A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it.

The formula is:

Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity

Following which the workout will be:

Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5

When we solve the equation barely by hand or use the calculator we put up, the product will be Rs.747.26. So, the original price of the share in question is Rs.747.26, which can then be redeemed at a face value of Rs.1000.

What is the use of Zero Coupon Bond Value Calculator?

This formula can be used only in the context of the zero coupon bond where there is no payment of interest or coupon. No interest in the form of coupon or dividend is to be enjoyed by the investors, rather a benefit of lump sum amount at the end of the period is what happens in this formula.

So, investors who are considering investing in such bonds also need to weigh in the best options and based on the discount rate, i.e. the required rate of return and the redeemable price i.e. the face value is taken into account. Investors can compare the bonds and opt for the bond which provides the greatest of return in lump sum.

Zero Coupon Bond Value Calculator Formula

Let us go through the formula again after using it for example, this time clearly.

This formula is the amount which the investor is willing to pay for a particular faced value bond, keeping into view a fixed required rate of return will be received at the time of maturity.

The face value discounted to present value is what the investors are required to pay for the bond, while they enjoy the discounted rate benefit when the bond is redeemed at the end of the period, for the face value.

Zero Coupon Bond Value – Conclusion

For calculating the lump sum amount earned, the normal way of commuting the price of a share or other bonds do not apply. The reason for the same is that no interest amount should be paid.

So, if you are targeting and willing to purchase a zero coupon bond, use this formula and if you face any issues, leave a comment below and we shall help you with it.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles