Price/Earnings Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 19, 2022Comparison of a company’s stock to another company’s stock is always a point but, the P/E ratio is an exception, as the investors or the analysts are quite determined to use this ratio for a one to one comparison rather than a one to two. You will find details of Price/Earnings Ratio Calculator in this article

Also, it can be used for comparison of the same company’s historical records for aggregate market comparison over a certain time. The reason for the comparison of companies, all of which meet certain standards is briefly mentioned in the article.

Price/Earnings Ratio Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

PE Ratio Calculator Details

The factors required to be put into the formula to work out the same are:

- Price per share

- Earnings per share

The prior factor required is the price per share, which can be determined by the market listing and taken into consideration.

The second factor is the earning per share, which can be obtained when the net income of the company which is found in the company’s income statement is divided by the weighted average of outstanding shares.

We suggest you to use this formula for determining the value of the stock of a company, rather than comparing one stock from another, because each company’s accounting method differs, thereby making it difficult to form a basis of comparison.

Check out more Financial Calculators here –

Price/Earnings Ratio Calculator Product Details

Well now we are well versed with the factors of the formula and it is time we get discussing about the product thereby received.

The product of the formula shall be the Price to Earnings ratio, which is the point of calculating the formula itself. If the product is higher, the investors happen to assume the price of the stock is simply overvalued or they expect a higher return on the investments they make, maybe in the future.

For a company which is on loss, the ratio won’t exist in the first place as the denominator will be zero for the same.

How to use Price/Earnings Ratio Calculator?

Factors are clear and so, you need to use them in the best possible way to know which company is worthy of investment and which is not.

The product will determine the underlying question and to obtain the same, you need to calculate the formula, which is made easy by the calculator we included along, in this article along with the information on Price to earning formula.

Keep the factors handy always and then, move ahead and enter them in the calculator which you will find at the bottom of the page in their places they need to be.

When you press enter after filling the factors, you will be able to get the product you’re in search of.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of PE Ratio Calculator Usage

Let us assume a company with a price per share of Rs.100 makes an earning of Rs.7 per share. If the interest investor wants to calculate the value of the stock, he would have to find the product this way.

The formula is:

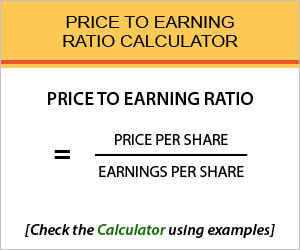

Price to Earning – P/E Ratio = Price per Share / Earnings per Share

Let us calculate the formula from the example now:

Price to Earning – P/E Ratio = 100 / 7

Therefore, the company we have been trying to calculate the product of has a price to earning ratio of 12.29.

What is the use of Price to Earnings or P/E Ratio Calculator?

The ratio is a basis of calculating how the market perceives the share as compared to the earnings it makes.

The use of this ration therefore has some restriction and limitation because the net income is calculated on a different basis for different industries.

It also differs when companies belong from different nation. Hence, use the ratio to compare the price for companies belonging to a single industry and also to one country.

There are industries which are perceived to have a better and increased growth for the future, while the others are perceived to fetch a normal and steady growth rate i.e. an established growth rate.

Price to Earnings (P/E Ratio) Calculator Formula

Here is the formula of future value we have been speaking of.

The main idea behind calculation of this formula is to understand how much a company is earning, while how much the market thinks it must be of worth.

If the obtained ratio is higher, then it is considered to be a better investment as according to the market. This formula is also known as the price multiple or the earnings multiple.

There are also shortcomings associated with this formula, one of which is mentioned for the terms and conditions, while the others are companies having net loss and of self-referencing.

Price to Earnings (P/E Ratio) – Conclusion

The end note here would be, even though the formula has a certain number of shortcoming, keep in mind the terms and conditions referred, and you shall be able to find the formula to be worthy enough for you decision making process.

If you get stuck anywhere in the article, unable to understand it, you can ask for our help through the comment section below.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles