Dividends Per Share Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Dividend is the income investors make from investing in shares. Dividend promised from a company can be taken into account to calculate the total income made by the investor for the time period the stock is held. Use our Dividends Per Share Calculator to determine the same.

This way the income made from the entire time period the stock was held is calculated by investors. Investors check for shares earning potential before investing for a desired period also use this formula to make an estimate of the income.

Dividends Per Share Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Dividends Per Share Calculator Details

Factors which are part of the dividend per share go by:

- Sum of Dividend Paid Over a Year

- Special, One time Dividends paid in the Period

- Number of Outstanding Shares

The first factor is the dividend paid by the company for a particular year. The special dividend is not included in the formula, and therefore is to be subtracted and includes every such dividend which is occasionally paid, for once.

The last factor is to be obtained through weighted average of shares, just as it is done EPS. But, for weighted average of share in dividend per share, dividend is taken into consideration contrary to earnings.

Check out more Financial Calculators here –

Dividends Per Share Calculator Product Details

Each of the factors given above is clearly illustrated in the best possible way. The information on how to gather them is as well briefly given. If you manage to get your hands on the factors the next step would be to use the calculator. The calculator will determine the product, which in this formula case is the Dividend per Share.

With your distinctive needs, you may hit up the calculator which we have put at the end of the article, to make your job of commutation easy. Obtained various products yourself is difficult and so, on your quest of evaluating every investment option, we provide you the calculator.

How to use Dividends Per Share Calculator?

Dividend per share calculator is pretty easy to use once you are able to figure out what the factors are and what the product obtained will be.

Make sure you figure out all the rights reasons to calculate this formula along with what you aspire. This would make the use of calculator beneficial and also would add on to the process of planning for you.

Once you caught hold of all the factors, simply move on to the calculator we put up in the article and enter in the details in the blanks. Make sure you entered in the right details, and then click on the enter button.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Dividends Per Share Calculator Usage

Let us assume that a company XYZ released dividend worth Rs.1000000, where the Special, One time Dividends paid in the Period stood to be Rs.100000 and the outstanding shares were of Rs.2000000.

The formula is:

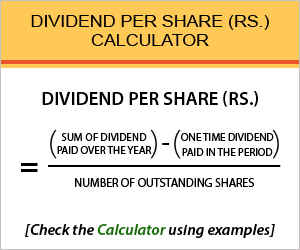

Dividend per Share (Rs.) = (Sum of Dividend Paid over the Year – Special, One time Dividend Paid in the Period) / Number of Outstanding Shares

Here is the workout:

Dividend per share = (1000000 – 100000) / 2000000

We want you to use the calculator to pull out the product as referred earlier, and the product will be Rs.0.45.

What is the use of Dividends Per Share Calculator?

Being related to dividend, this formula is just an estimate of dividend paid for every single share. This is not necessarily the overall prediction of the company, but just the annual possible income made by the investors.

Hence, is highly used by investors with such needs. This formula is also used to calculate a series of other dividend related formulas, such as dividend payout ratio, retention ratio etc.

The payout ratio is what the company pays to the shareholders out of its net income as dividend, whereas the retention ratio is opposition to the dividend payout, as in the amount which is retained by the company for personal reasons.

Dividends Per Share Calculator Formula

We want you to go through the formula again so, any existing confusion is taken away.

This formula basically features the growing capacity of the company and its ability of rending quality performance. So, companies which manage an increasing trend of DPS, are forever in demand.

This is commonly witnessed in well emerged companies which make sure it’s DPS has a steady yet increasing trend.

Dividends Per Share – Conclusion

Investing in companies which pay dividend is your motive, we understand. So, this article will help you evaluate the annual income you are likely to make from various stocks you took into consideration.

As explained, this formula is just in context with the dividend paid out, hence it is advised the overall performance of the company is to be taken into consideration before final decision is taken. Let us know if we can help you further, in the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles