PV with Zero Growth Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 11, 2022This formula on Stock – PV with Zero Growth Calculator is on the contrary to the formula of present value of a stock with constant growth, as here there is literally no growth stated in the dividend payout.

This is another aspect of the Dividend Discount model where the theory takes into account all the future dividend payments, in order to reveal the present price of the stock.

This will let the investor know if the present value of the stock is worth the thereby obtained result or if the stock is overvalued.

PV with Zero Growth Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

PV with Zero Growth Calculator Variable Details

The items which are to be determined in order to find the Present value of stock based with zero growth are:

- Estimated Dividend for the Next Period

- Required Rate of Return

The estimated dividend for the next period variable is to be determined from the company. It is the sum which it would pay for the future period, i.e. the estimated dividend for the next period.

The required rate of return is basically the rate of return the investors agree, where they would be receiving the dividend at the same rate.

The resulted amount is then compared with the market price of the share where it is weighed to either be overvalued or worth the investment.

Check out more Financial Calculators here –

PV with Zero Growth Calculator Details

This formula will basically get you an idea of two different factors. The formula will give you two different results, each of which can be used to research about the information you please to.

So, if you have the above-mentioned variables, you can proceed with the calculator and get the final result. The first result is the formula itself where the present value of stock with zero growth is obtained.

The second results is the same theory but based on per share basis. In other words, the present value of stocks per share. Make sure you know the variable requirements; then shall it be easy for you to commute the results.

How to use Stock – PV with Zero Growth Calculator?

The variables and the end results have been clearly stated in the above two paragraphs. Above paragraph also makes the task of fetching the variables easy.

The second paragraph would make it easy for you to understand the significance of the product. This way you will complete your investment option research successfully.

We are here to give you the information on commutation and also contribute to the commutation process. We have attached a calculator of the formula, at the end of the article to ensure ease of calculation for lot of combinations.

You need to enter the two different variables in the blanks of calculator, and you will find the answer when you press enter.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Stock – PV with Zero Growth Calculator Usage

The growth rate being zero, a company pays a dividend of Rs.1000000 where the required rate of return is 10%.

The formula is:

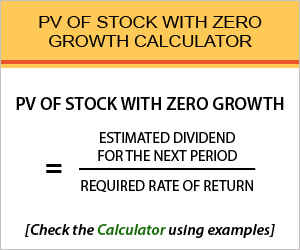

PV of Stock with Zero Growth = Estimated Dividend for the Next Period / Required Rate of Return

This is how you need to work on the formula:

PV of Stock with Zero Growth = 1000000 / 0.01

So, if we solve the above mentioned figures, present value of the stock with zero growth will be Rs.10000000. Then, for present value of stock per share value, we need to divide Rs.10000000 with Rs.1000000 which will give us the result as Rs.10.

What is the use of Stock – PV with Zero Growth Calculator?

This formula applies rather theoretically then practically, as there are barely any companies which have no growth rate at all.

Taking the investment option of a stock, for this formula, it is based only on the future dividend payments, while the fact is that the price does have a tendency to alter based on many other factors which include economy fluctuations, news of future earnings, and appreciation because of retained earnings.

So, we suggest the use of this method for any theoretical basis and not in real. There are a lot of other formulas which can be used in the place of Present value of stock with zero growth, if one wants to know the worth of the stock.

Stock – PV with Zero Growth Calculator Formula

We should get to the formula again so you can do the further commutations easily by yourself.

If you are trying to find the present value of stock which belongs to a company that has no growth rate, this formula is to be put to use. But, you need to be sure, you take the returns and dividend of a particular or same period, that is annually or monthly, whatsoever, they need to be same.

Stocks do not have an expiration date and so, an investor can choose to enjoy the benefits of dividend for a long period, as much as he wants and so, the formula is based on the assumptions that the company goes on forever paying infinite series of dividend.

Stock – PV with Zero Growth – Conclusion

Being a variation of the dividend discount method, this formula is only used as a theoretical concept since few companies can be based on the concept of zero growth rates.

It is based on the concept that the stock has no growth in the cash flow, i.e. the dividend and the dividend is provided in infinite series.

For further reference and queries regarding this article, you may contact us through the comment section below.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles