Retention Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 12, 2022Here is the entire coverage and usage of the ratio, which can be obtained from our Retention Ratio Calculator in this article.

Net income is distributed and used in many ways, and the first portion of net income which a company earns goes towards the payment of dividend to the shareholders of the company.

The company may choose to pay the entire amount or it may even decide on suppressing a proportion of the income to put it to use someplace else. The suppressed amount is referred to as the retained earnings of the company and it remains back at the company itself.

Retention Ratio Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Retention Ratio Calculator Details

There are two simple factors the commuters need.

- Net income

- dividends

Here are the factors which you need to get through the formula. The end result will only be collected from the formula if you fuel in the factors.

The first factor to be required for the formula is net income, which can be extracted from the income statement of the company which clearly mentions the term net income.

The dividends are the money which is provided to the shareholders on common stock can be found in cash flows statement. The reason they are not mentioned in the income statement is because they are not an expenses for the company.

Check out more Financial Calculators here –

Retention Ratio Calculator Product Details

Gear yourself up with the factors required to find the formula and the product will just be a step away. Take notes of the factors, because the product cannot be commuted even with one missing factor.

Also, the figures of the factors need to be right, so make sure you cross check every figure for another time.

These factors will lead you to the product, which is the Retention ratio, so you aren’t too far away from commuting the formula. You can take the help of the calculator we put up in the article, which can be found by the end.

How to use Retention Ratio Calculator?

Using the calculator will actually add on to the commutation process, for good. The calculator is all set to make your work easy.

But the responsibility of finding the factors fall over you, so you have to visit the place in order to stuff in the factor details along the formula, because it is needed.

Then you can straight away head up to the calculator, rather than solving the formula yourself, which would obviously consume a greater amount of time.

The calculator is embedded with the formula – retention ration, so providing it with the details of factor is all to be done. It will commute the product all by itself in seconds, and appropriately.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Retention Ratio Calculator Usage

An investor want to know the retention ratio of the company XYZ he invested in, and he finds out the net income company made for the year is Rs.200000, whereas the dividends it paid amounted to Rs.20000.

The formula is:

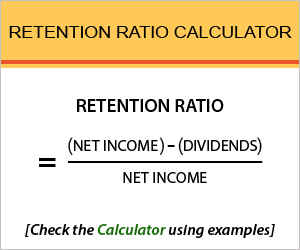

Retention Ratio = (Net Income – Dividends) / Net Income

Use the calculator to find out the product:

Retention Ratio = (200000 – 20000) / 200000

The investor discovers that the company does not pay a lot of dividend out to its shareholders. The ration of earnings which it retains amounts to 90.0%, which is also known as the plowback ratio.

What is the use of Retention Ratio Calculator?

Companies use this ratio too, but this ratio is majorly used by investors, who invest in a company expecting good and valuable returns.

This formula can be used by investors who wish to know the earning which the company retains back, cutting on the dividend payments.

Some companies do pay all of their earnings through dividend, but this only means the company will not prosper, which would in turn affect the value of the shares. So, retention is important, but then, the company also has to be responsible where it puts every single penny of the retained earnings, so it doesn’t lead to the path of excessive debt.

Retention Ratio Calculator Formula

Understanding how to calculate the product is important through the formula:

Growth is aspired by every company, irrespective of the industry it belongs to. Growth is possible through expansion, adoption of new technologies etc, which again needs investment.

So, when the company has constructive plans, retains some money from the net profit earned, after some or no proportion of dividend is paid out.

The amount retained by the company is derived though this ratio, which is often commuted by investors as well. Also, retention does not mean definite growth, for it wouldn’t work if the company does not be efficient.

Retention Ratio – Conclusion

Strategic decisions lead to retention of earnings made, and it is for the betterment of the company if any investors wonder. It is basically assumed that company has some great plans in store which need reinvestment, which is why money is retained.

This further adds on to the performance and value of the company. For retention related queries, you may use the comment section to reach out to us.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles