Interest Coverage Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 17, 2022This article has all the necessary information about the Interest Coverage Ratio Calculator, including the base number which is considered appropriate for lending.

Lenders want assurance for their money, they want to know the borrower and how capable they are in paying timely interest of borrowed funds. Based on this, the future borrowing criteria is judged, and the lender or the creditor lends money based on the assurance.

Interest coverage ratio can be taken up as the assurance which lender evaluate, off their borrowers, for a guarantee of interest payment.

Interest Coverage Ratio Calculator

Interest Coverage Ratio Calculator Details

Factors, when put together, will helps find the formula, and we need:

- Earning before interest and taxes (EBIT)

- Interest expenses

A couple of factors need to be figured out in order to calculate the product. The factors are EBIT an interest expenses.

Earning before interest and tax is generally the income which is made by the company, before it pays off the interest and taxes associated with it. EBIT is found in the income statement of a company.

Interest expense is the non-operating expense which is borne by a company and is deducted from the earnings, which as well can be found in the income statement.

Check out more Financial Calculators here –

Interest Coverage Ratio Calculator Product Details

All the factors, when together put into the formula, will give us the product. The product for this formula is the Interest coverage ratio. Companies happen to search for a threshold of product which is recommended by the analysts.

A period’s cash flow is considered if the lending period is supposed to be short. If lending is done for a long proportionate period, company study the past couple of year’s analysis to ensure there is no constant drift of interest coverage ratio, as a drift indicates the company will not be able to pay interest over the borrowing in the future.

How to use Interest Coverage Ratio Calculator?

You need to search for a favorable product, as each of the industry has different standards therefore changing the average interest coverage ratio.

Perform thorough analysis on the given industry standards before you go on with the commutation, because we made it easy for you.

You will find a calculator at the end of this article which works on the formula interest coverage ratio. So, you do not need to worry about the commutation, as you need to enter in the details, i.e. the factors, in the given blanks and the calculator will do the rest.

You will find the result just below the calculator, along with the working.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Interest Coverage Ratio Calculator Usage

A company has managed an earning of Rs. 100000 during a period of time and it is before interest and taxes are paid. The same company also has debt amount to Rs. 30000 which needs to be paid. In order to find its borrowing capacity, a lender will have to do the following.

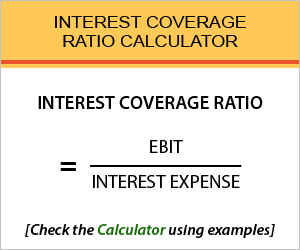

The formula is:

Interest Coverage Ratio = EBIT / Interest Expense

The working of which would be:

Interest Coverage Ratio = 100000 / 30000

With the given information, if would be safe to conclude that the company has a brief and well constructed payment system, where dues are met on time.

What is the use of Interest Coverage Ratio Calculator?

This ration is generally used as the measure of risk which is tagged along with a company in context with its debt and future borrowings.

Interest coverage ratio tells how likely a company is, to make a default in payment of interest, and so, the parties who use this formula are generally lenders and creditors, to have an idea of the company’s financial position, to whom them have lent.

Investors as well calculate this ratio to understand the performance of the company and in order to determine if investing in the particular company would be a safe bet, and how likely will they prosper in future, ensuring all the debts are paid off, with due interest payment.

Interest Coverage Ratio Calculator Formula

Let us consider understanding the formula in a better way.

Where,

EBIT = Earnings before interest and tax

Debt which remains outstanding, yet to pay, needs to be fed with interest for the period of holding, this is the common rule of lending.

But, the capacity of paying interest differs from company to company and the interest coverage ratio is the aggregate of how much cashflow is accessible by the company, to meet the interest payment obligation easily.

A period’s interest coverage ratio is calculated and 1.5 is considered as a favorable product, where 1.5 or lesser product is an indication of the company’s inability to pay interest.

Interest Coverage Ratio – Conclusion

Lenders generally look out for stability is payment of interest, which means they are in favor of a company having a constant interest coverage ratio, rather than a declining one.

A declining ratio is a head-up on future likely prospects of the company, where the company may not be able to pay the interest.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles