ROI Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 12, 2022Return on investment is an easy and versatile metric, which makes it a popular metric as it can be easily adopted by all means for investment related decisions, real estate related transaction and the growth prospects of the company. Calculate the formula using the ROI Calculator, embedded into this article.

The very nature of the metric is why it is versatile and easily applicable for a lot of situations. If you wish to calculate this formula, being an investor, we suggest you look for positive and higher prospects in percentage.

ROI Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

ROI Calculator Variable Details

The variable details which will make up the formula are:

- Earnings

- Initial investment

There are two simple items which need to be taken into consideration, in order to find the formula. The first is the earnings which is basically the amount which is made from the selling of the investment, and you can also consider it as the present price, during the sale of investment.

The second item is the initial investment, which is the price at which the investment option was purchased. This shall be all as there is literally no time to be taken into account.

Check out more Financial Calculators here –

Return on investment or ROI Calculator Details

So, the variable items are pretty easy to obtain and once you do, you are just a calculation away from obtaining the results. The product here is the return on investment, which is provided to the investor on the investment.

A lot of investors, almost all of them, want to know the returns they actually managed from the investment, so this is a great metric to determine the return. You always need to convert the thereby obtained product into percentage by multiplying it with 100 in order to get the result you want.

There are a couple of shortcomings for this formula, but this does apply for a number of situations, where correct percentage earned can be found.

How to use ROI Calculator?

variables are mentioned, and so is the result from the formula. Now, for everything to fall into place and to know how much return an investment has provided the investors, the burden fall upon the right commutation.

You can always choose to do it by yourself, but might become daunting it you have many investment options to consider.

Also, errors are the possibility of calculating the formula by yourself, and so, in order to facilitate you with the rightful commutation, we have added a calculator embedded with the formula of return on investment at the end of the page.

Hit it up with the variables and then press the enter button to safely and quickly get the result.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of ROI Calculator Usage

Let us assume, Mr. A sold his purchased a stock at Rs.1000, which he later on went to sell at the rate of Rs.1200 and now wants to know the return on investment he made with the investment. Here is what he needs to do:

The formula is:

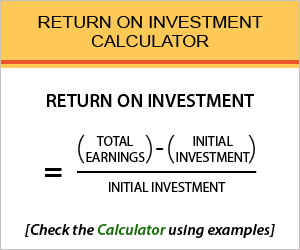

Return on Investment (%) = (Earnings – Initial Investment) / Initial Investment

Solving the formula would be:

Return on Investment (%) = (1200 – 1000) / 1000

The return he would make would be 0.2 which when converted into percentage would be 20%. So, the return on investment the person made on the stock would be 20%.

What is the use of ROI Calculator?

Being a simple formula, which is easy to use, it also has a great and versatile significance, including the investment options decisions.

Use for investment option decision is done in a great extent but this does not limit the use of return on investment to only investment. It is greatly used for finance by companies for a lot of reasons.

Corporations, companies, individuals tend to use the formula for their own reasons. It is also used as a metric to evaluate the returns fetched from asset investment, which is subject to appreciation.

This goes along with all the other profitability measuring ratios which are used interchangeably.

ROI Calculator Formula

Let us go through the formula again, and see what the formula actually implies.

This formula shows how much an investment has successfully managed to fetch you profits. This is basically the percentage of returns the investors made by investing in a particular company’s stock.

This way, you can ensure the profits made for any time periods. Make sure you convert the numbers you got as results, into percentage.

It is because percentages are easy to compare as you can select the investment which would fetch you the highest of returns.

ROI or Return on investment Calculator – Conclusion

Returns on the investment are the basic reason why one invests in the first place. Common motive being highest returns, people try evaluating options to know which would provide the highest returns.

So, if you can relate to this, look for options which have the highest return on investment percentage.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles