Rate of Inflation Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 12, 2022Inflation is a phenomenon each one of us is familiar with and, you can keep track of the formula using our Rate of Inflation Calculator, provided in this article.

We are well aware of how our purchasing power has been on a decrease, simply because there has been a rise in the cost of prices. An item which could be fetched for an amount of Rs.100 rupee a couple of decades earlier cannot be fetched using the same amount now.

This is the effect of inflation, where the cost prices rise resulting into an inverse effect on the purchasing power. The percentage change in the purchasing power can be defined using the rate of inflation formula.

Rate of Inflation Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Rate of Inflation Calculator Details

The factors which are needed in order to calculate the rate of inflation are:

- Initial Consumer Price Index

- Ending Consumer Price Index

The factors revealed here are two, which would help you find the rate of inflation which is witnessed by the economy.

Both the initial consumer price index and the ending consumer price index are released by the Central Statistics Office of the Ministry of Statistics and Program Implementation 9 in India.

Different indices are used in the place of CPI as per the need and then the CPI has to be replaced by the concerned Index.

Check out more Financial Calculators here –

Rate of Inflation Calculator Product Details

Having a clear view and understanding of the topic, inflation and the factors required in the formula rate of inflation is pretty important.

If you did this already, we believe the tough part is over as we aim at keeping this article pretty simple and easy to understand.

So, given the factors, you can solve the formula by your own or use our calculator to find the result. The product here is the rate of inflation, the percentage change in the purchasing power of the citizen.

The cause of inflation is the rise on prices which are directly or indirectly influenced by a lot of factors.

How to use Rate of Inflation Calculator?

It is how our economy function is what you shall consider as the difficult part. We assume you have your reason for calculating these values and the increase in the inflation rate.

Understanding inflation and obtaining the factors is difficult as you will need a lot more research for them. Now, if you did your research already, we are here with this article to make things easy further.

Scroll down to the end of the page and search for a calculator which is attached to this article. The calculator works on the basis of the formula rate of inflation and if you enter the factors and press enter, the calculator will commute the answer for you.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Rate of Inflation Calculator Usage

Let us assume we wish to know to know how much purchasing power has reduced for an amount over a course of 5 years, say Rs.1000. With the given above stats, we can find the same.

The formula is:

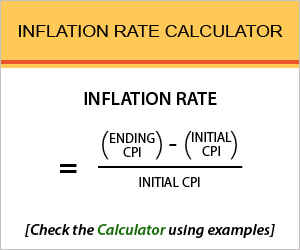

Inflation Rate = (Ending CPI – Initial CPI) / Initial CPI

Let us consider the working now:

Inflation Rate = (217 – 210) / 210

So, solving the above equation, we know that the purchasing power of Rs.1000 has affected by 3.33% because of the rise in the inflation rate for the referred 5 years.

What is the use of Rate of Inflation Calculator?

Inflation is basically the concern related to economy and so, it is majorly used by the economists who some way or the other need to calculate the rate of inflation to keep the economy in check through their research and findings.

Other than the economists, it is companies and the organizations, which use the rate of inflation from different years so as to compare the expense, profits, sales and other related things from the past and present.

Companies built up a lot of strategies to make sure the cash inflow is constant, and one such phenomenon used in the process of creating strategies, is the finding of the rate of inflation rate.

Rate of Inflation Calculator Formula

Let us check out the formula for a clearer perspective.

Where,

CPI = consumer price index

The inflation rate is always mentioned in percentage value, and the percentage change can be easily stated. This formula lets us know how much increase in witnessed in the cost of prices in our currency rupee, which leads to the fall in the purchasing power of people.

The reasons for inflation are numerous, but it affects people who have a constant income, because a product which they could afford a few years ago cannot be afforded by them now.

Rate of Inflation – Conclusion

Research on the different indices which are used as alternative to the consumer price index and how do they differ depending upon the distinctive goods and services.

The indices are Wholesale price index, producer price index. So, if you wish to expand your knowledge you can know when the other indices are applicable.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles