Tax Equivalent Yield Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 17, 2022Ascertain the formula using the Tax Equivalent Yield Calculator of this article. You will as well encounter all the details of it, starting from the introduction of the formula.

Investment strategies have many facets to it and some investors rather stick onto one, while other like exploring each facet of the investment, basically the perception differs.

It doesn’t matter if the person takes the tax free criteria into account as a small factor, or if he wishes to only invest over the factor of tax, this formula will definitely serve all of them who fall into either of the categories, revealing the answers they seek out for.

Tax Equivalent Yield Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Tax Equivalent Yield Calculator Variable Details

The items of the formula are as below:

- Tax free yield

- Tax rate

The first variable is the tax free yield which the investor is considering, in order to compare with the other taxed investments. If comparing different taxed investments is the motive, the tax free yield for all of them will remain the same.

The second variable is the tax rate, here each of the taxed investments has different tax brackets and they are to be considered.

So, a marginal tax bracket can be obtained, based on which the decision to invest on taxed investment or tax free investment can be easily taken.

Check out more Financial Calculators here –

Tax Equivalent Yield Calculator Details

The formula variable have been clearly explained, if you take into account one of the alternative investment option and wish to compare both of them or, wish to take a bunch of alternative investment options and then compare all of them. The therefore obtained result is the final value of the formula.

In this formula the result will be the formula itself, i.e. the Tax equivalent yield. The tax equivalent yield is basically expressed in the form of percentage as well, so do not forget to keep the conversions in mind in order to get the correct comparable figures.

How to use Tax Equivalent Yield Calculator?

With the access to information on the tax free alternatives and the taxed investment in question, one can easily find the worth enough investment among the two simply by using this formula.

So, if a person wants to do so, he may consider this article and the calculator we have to offer. Readers are free to use the calculator added at the end of the article which is set up with the formula of Tax equivalent yield.

Hit up the calculator with the information you have and then press the enter button of your keyboard. You shall find the answer displayed in seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Tax Equivalent Yield Calculator Usage

An investor wants to invests in two bonds and is confused about the one to invest in. One of the bond pays him 7% but is taxed, whereas the other one offers a 5% pay but is not taxed. The tax rate levied is 30%.

The formula is:

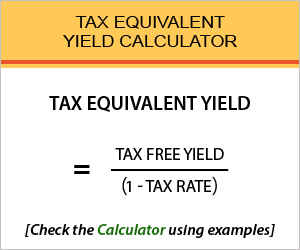

Tax Equivalent Yield = Tax Free Yield / (1 – Tax Rate)

Here is the workout:

Tax Equivalent Yield = 0.05 / (1 – 0.30)

So, if the tax free investment is calculated using the formula, the tax equivalent yield would be 7.1%. Thereby, making the decision of investment easy.

What is the use of Tax Equivalent Yield Calculator?

Investors may get caught in the investments who levy a huge rate of tax. It is when they realize they have been paying a higher tax rate, is when they begin having second thoughts into holding onto that investment.

They begin to dig up a lot of investments which have different tax rates and use this formula to compare the investments on the basis of tax.

Higher tax payments make the tax free investments appealing for the investors and they start comparing all of them in order to know which of the investment is best to invest in.

It is also important to invest taking everything into account, about a share and not only its tax free phenomenon.

Tax Equivalent Yield Calculator Formula

Let us count on the formula and understand how it works.

Tax equivalent yield is the rate of yield which stands before the tax is levied for a taxed investment and this ought to be equal to the rate of the tax free investment option, say a municipal bond.

It may also be referred to as the after tax yield. It basically comes to rescues when the investor wants to change the tax pay category and move to a lower taxed investment, and adds on to a lot of investment decisions.

Tax Equivalent Yield – Conclusion

If you wish to invest in investments on the basis of tax or if you have been looking out for the investments which are tax free, being tired of paying huge taxes, this formula may come handy for you to compare investment options and change your strategy of investment by investing fresh.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles