Dividend Yield Stock Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Dividend yield often portrays a different view of company’s performance and the fluctuation of share prices. Find our Dividend Yield Stock Calculator and calculate the formula seamlessly.

Investors have their own ideas of investing in stocks as, there are some who invest based on the high dividend yield of the company, while others invest on the basis of growth potential.

It is obvious, the investors would earn a pretty good returns if they hold the stock till the time its prices rises, but they also need to know that unusual high dividend yield would make the share prices fall quickly.

Dividend Yield Stock Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Dividend Yield (Stock) Calculator Variable Details

To start with the formula, you need a couple of items, and here is what you need.

- Dividends per Share for the Period

- Initial Share Price for the Period

As mentioned, you will need both the above details to commute the formula. The dividend plus the appreciated stock prices are what the investors will be able to make from the investment.

This formula on the other hand, is all about the returns the investor will be able to fetch, given dividend. You will find the dividend which the company pays in retained earnings statement, and based of which you shall calculate the dividend per share, the first item.

Check out more Financial Calculators here –

Dividend Yield (Stock) Calculator Details

The product of the stock will be the final result you get after putting in the items into the formula, followed by its workout. So, simply put up, product in this formula is the Dividend yield.

If you have understood the variables and where they can be found, and successfully managed to fetch them, you will be able to keep up with the formula, which would extract the product.

Rely on the calculator by all will, and it will serve you best for multiple stock Dividend yield commutation. This would make your comparison process easy with a series of results put right in front of you.

How to use Dividend Yield (Stock) Calculator?

We have kept up with the pace which is required to calculate the Dividend yield formula and if you did follow up with the variables and the product, we will find it easy to calculate the formula.

Well part of your job will be done by the calculator which you will find at the end of the article. Refer to the calculator when you are done finding the items.

Scroll down to the end and enter in the details of variables as mentioned in the calculator. After you are done with entering in the details you need to press enter. You have the details in front of you immediately.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Dividend Yield (Stock) Calculator Usage

A company has its stocks trading at the rate of Rs.100 per share, and it provides a divided of Rs.2 on each of the share, the possible dividend yield would be obtained by:

The formula is:

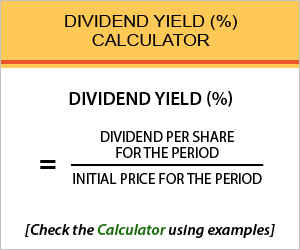

Dividend Yield (%) = Dividend per Share for the Period / Initial Price for the period

Here is the workout:

Dividend Yield (%) = 2 / 100

So, if an investor wants to make a decision solely based on the dividend yield percentage of the company, he will have to calculate it using the formula, as shown above. The result will be 2.0%.

What is the use of Dividend Yield (Stock) Calculator?

Once the concept of how the dividend yield will benefit is understood, investors must then begin to search for a particular class, high dividend class or low diving yield class, and then invest accordingly.

High dividend yield for sure does provide a good yield, but that does not mean it would be able to retain the same prices of stocks over the coming year.

Similarly, the low dividend class companies do not have lower priced share, and this is where the investor must research of the company is retaining a part of investment and trying to make higher returns in the future.

Dividend Yield (Stock) Calculator Formula

Let us get along and understand every aspect of the formula precisely.

Dividend yield is conveyed in the form of percentage. It is fair enough for the investors to search for a company which has the highest dividend yield, but the fact remains that such companies often compromise on their growth potential which would likely pull down the price of share.

The reason being reduction in the reinvestment capacity of the company, as the income is spent out in dividend.

Dividend Yield (Stock) – Conclusion

The decision is based upon the investors, and they may take decisions based on their prior experience or own set of perception.

The investors can invest in stocks which have a high dividend yield, but it depends upon the investors to choose for the appropriate percentage which is likely to fetch a reasonable return.

We would love to account for your understanding on this formula and if you think you have issues regarding it, please leave a comment and we would rectify it.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles