Current Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022A major set of liquidity ratios are used by any company to ensure the short term requirements are met. The liquidity analysis performed in this article is of Current Ratio, obtained by the evaluation of Current Ratio Calculator.

Just like a company is obligated to fulfill the long term obligations, it is majorly obligated to fulfill short term ones as well.

Short term need requires keen determination, as instance liquid funds may be required at any point of time. Availability of such funds, likewise current ratio, speaks of the company’s efficiency.

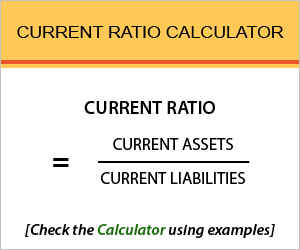

Current Ratio Calculator

Current Ratio Calculator Details

The variable requirements here are:

- Current Assets

- Current Liabilities

Variables are the need, and the formula doesn’t work without them. Good news is, even though this formula serves you the entire company’s capability in terms of liquidity, it needs just 2 variables to work.

The first variable is the Current Assets which includes all the short term assets with a convertible period of a year. Current liabilities as well have a convertible period of one year, but are the debt company owes.

Furthermore, not only the current assets but also the current liabilities are found in a company’s balance sheet.

Check out more Financial Calculators here –

Current Ratio Calculator Product Details

The result of the formula will be fulfilled, if the pattern is cautiously followed. Start with keeping up with the interested investment option records, especially the variables as mentioned above. This shall be followed by understanding the formula and how to commute it.

Your commutation task has been made easy with the calculator we put at the bottom of the article. If you follow up with everything we mention, you are more likely to get your hands on the appropriate product.

This shall become a pattern for each of the investment option you try commuting. Each of the option’s Current ratio described will be appropriate.

How to use Current Ratio Calculator?

Liquidity and performance are relatable and showcase each other with strong bounds. A company performing better is a result of good liquidity maintenance and vice versa. While this ratio features both of them, investors are keen to know the product.

Such interested investors can hit the calculator provided at the end of the article to evaluate the product of each of the investment option they have in mind.

The calculator needs the above mentioned variables and if you gather them, you are good enough to use the calculator. Enter in the details of the variables against their blanks and you will find the product displayed at the bottom of the calculator.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Current Ratio Calculator Usage

Mr. A wants to invest in a company and so he wishes to know its management’s efficiency in terms of liquidity. He discovers the company has current assets worth Rs. 100000, while the Current Liabilities stood at Rs.70000.

The formula is:

Current Ratio = Current Assets / Current Liabilities

Let us get into solving it:

Current Ratio = 100000 / 70000

Mr. A finds out the current ratio of the company is 1.43. Being satisfied he would invest in the company, if he would not be satisfied, he can always go for the other options in store.

What is the use of Current Ratio Calculator?

Current ratio is likely to serve as useful for both the analysts and the investors. If we speak of the investors, they want to invest with company which is efficient, and relativity of the term efficiency with this ratio is explained already.

Performance and great returns drive them to choose a likely investment option. The analysts, working for the company commute its current ratio to keep p with the liquidity standards.

Keeping the company going, where all the short term debts are paid is their responsibility and they ensure it via this formula. Appropriate maintenance is great, but in case of deficiency, necessary measures are taken by them.

Current Ratio Calculator Formula

“Current”, the term itself signifies the items of the balance sheet which can be converted into cash in a matter of a year. The assets have to account for the current liabilities and the proportion maintained by the company to meet the short term obligation described effectiveness.

Analysts are responsible to manage the short term debt with the short term assets, to ensure there is no chance for a default to take place.

Investors, on the other hand, are determined to select an investment option with a Current Ratio more than one, as it portrays efficiency. The standard likely figure 1 may differ as per different industry standards.

Current Ratio – Conclusion

Similarly, analysts keep this ratio accounted as well. It lets them keep a check on the liquidity, as in, if the current assets will suffice for the debt payment obligations.

Short term debts are always to be paid instantly and the cash and cash equivalent assets, also known as the current assets come handy here. If the formula or any aspect is not clear, you may seek for our detailed explanation through the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles