Assets to Sales Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022In this article, we bring to you all about Assets to Sales Ratio Calculator. Though this calculator is no so much in use, but you will definitely know, Is the firm worth investing for?

Before investing in any firm, it is critically important for an investor to know how a company is performing in terms of Assets to Sales Ratio.

Here we can get an idea; how does the assets of a company perform when we talk of sales revenue.

Assets to Sales Ratio Calculator

Assets to Sales Ratio Calculator Details

So, below are the details you must know to get the ratio:

- Total Assets

- Sales Revenue

Beginning with the first factor required to enter in the formula is Total Assets i.e., the total value of assets which is owned by a company that can be converted into cash.

The second factor for the calculation is Sales Revenue. Sales revenue refers to the total income received by the company after the sale and purchase of good and services.

If you have these two details, you can easily find out the ratio to have current status of any firm’s worth. The formula is discussed further in this article.

Open Demat Account Now! Save upto 90% on Brokerage

Assets to Sales Ratio Calculator Output Details

Once you have correctly entered the factors in the formula, the output received is Assets to Sales Ratio. With no intense research, investor directly gets to know how well a company is making use of its assets to widen up its business and generate good amount of revenue from it.

Here, you need to know that rise in the Assets to Sales Ratio determines that company is not making much use of its assets.

This calculator just requires exact value to get the ratio.

Check out more Financial Calculators here –

How to use Assets to Sales Ratio Calculator?

Giving an opportunity to investor, to get the exact value of Assets to Sales Ratio via this article. Keeping it very simple for our investors, we have built up a formula to calculate the ratio.

Further you will see a simple calculation procedure where you need to correctly enter the factor details, Total Assets and Sales Revenue of the company.

These details can be easily obtained by referring the balance sheet and income statement of the company.

Example of Assets to Sales Ratio Calculator Usage

Elaborating the concept of calculating assets to sales ratio with the help of a simple example. As illustrated, Total Assets of any company is calculated to be Rs.400000 for a definite period of time.

Further, Sales Revenue generated for the same period of time is Rs.100000.

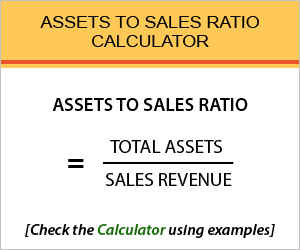

Hence, the formula to calculate the assets to sales ratio is:

Assets to Sales Ratio = Total Assets / Sales Revenue

Inputting the details in the formula mentioned:

Assets to Sales Ratio = 400000/100000

Therefore, the calculated Assets to Sales Ratio is 4 of the company which has Total Assets of Rs.400000 and Sales Revenue of Rs.100000.

Find out other Financial Ratios & Technical Analysis Calculators here

What is the use of Assets to Sales Ratio Calculator?

Investor can compare various other firms with the help of this concept. Investors have always a concern for the financial performance of the company they are interested to invest in.

Moreover, this calculator gives an idea of what amount can be generated by the assets of the company.

It is one of the primary ratios, that certainly tells the worth of the company. The concept of Assets to Sales Ratio is famous amongst investors to choose the right firm.

Assets to Sales Ratio Calculator Formula

Let’s discuss the basics of formula for better understanding.

The formula illustrated above is very easy and takes less than a minute to know the exact ratio, if you know the Total Assets and Sales Revenue of the firm.

The said details can be generated by going through the balance sheet and income statement of the particular firm you are looking for.

Here, the net profit earned by the company is not revealed, it is just to know worth of total assets in comparison to others in market.

Assets to Sales Ratio – Conclusion

Comparing the companies on the basis of Assets to Sales Ratio is one the ways to know how well a company would be for you in future. The above discussed Assets to Sales Ratio Calculator gives the exact ratio to the investors in very less time.

Open Demat Account Now! Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles