Real Rate of Return Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 12, 2022Inflation is real and the way it hits the economy reducing the purchasing power of the users has to be taken into account for an investment. Keep yourself updated with the formula, using the Real Rate of Return Calculator.

Investment is supposed to benefit you for the entire tenure that you keep your money invested, but then when inflation happens, the returns will definitely not be enough if enough precautions are not taken by the investors.

The return will be of nominal rate and it has to be ignored as the rate of return here is not adjusted according to the inflation, therefore leading to downfall of money value.

Real Rate of Return Calculator

Real Rate of Return Calculator Details

We prefer mentioning in advance the factors so the process of commutation will be smooth for you.

- Nominal rate

- Inflation rate

Above mentioned factors are just easy to find, as a matter of fact, you already have one of them. If you are considering an investment option, the nominal rate is just the rate of interest or return the investment option offers.

As for its counterpart, the inflation rate in the present prevailing inflation rate of the economy. Gather in a lot of investment options and calculate them all, this way you will be able to find the investment worth selecting.

Check out more Financial Calculators here –

Real Rate of Return Calculator Product Details

If you have been searching for the formula you know the obvious use of the formula, but if you stumbled upon this article randomly or are new to the term, we suggest you take a keen look at the entire article, probably the factors for the first thing.

If you have been through it, it is probably time to keep up with the product, which in this formula is one, the real rate of return. The formula, i.e. the real rate of return is to be expressed in the form of percentage at the end and so, you need to remember to do it.

How to use Real Rate of Return Calculator?

Factors may and may not vary for this formula, as one of the factors stays constant even when a lot of formulas are commuted. Now, this would be a time barrier if you have a lot of investments options in mind and get on to commuting them all.

You can only estimate the time that would go by, and how does it sound if we say we have the means for saving up your time.

Well, there is a real rate of return calculator attached at the bottom of the page, where you may try as any combination of figures as you want. Hit up the calculator with the factors and it would do to rest and provide you the product.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Real Rate of Return Calculator Usage

Investor has been wondering the real of return on an investment he is determined into investing. It successfully manages to find that the nominal rate of return will be 12%, while he also figures out that the inflation rate will be 7%.

The formula is:

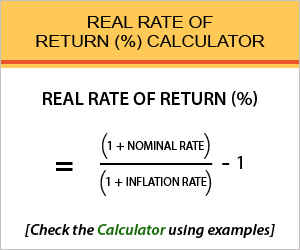

Real Rate of Return (%) = ((1+Nominal Rate) / (1+Inflation Rate)) – 1

Here is how he would do it:

Real Rate of Return (%) = ((1+12) / (1+7)) – 1

The end product of the formula is 4.67% real rate of return.

What is the use of Real Rate of Return Calculator?

Safeguarding the investments through unpredictable and unforeseen loss is why investors concern to calculate this ratio.

Where normal rate of return is the return before inflation, interest and tax is taken into check, real rate has the inflation rate adjusted within it, so as the provided the expected returns to the investors, without the money losing its potential buying capacity.

Inflation is a major phenomenon of change in money value and real rate of return accounts for it, but what it doesn’t is the opportunity cost and the tax. Safeguarding can be done to only an extent if the inflation rate is misleading.

Real Rate of Return Calculator Formula

Investments ought to perform better but it is inflation which snatches away its growing power, suppressing it over time as it hits the economy, along with the taxes.

Risk is associated with every investment and this formula gives the investor an idea of the expectations which shall be kept with the option.

Nominal rates of return exceed real rate as the inflation is not adjust into it, and therefore no clearer picture of the actual return over the future time being can be depicted. Hence, the rate of inflation needs to be adjusted.

Real Rate of Return – Conclusion

Normal rate of return is to be overwritten where you have to find out the real rate of return which is bound with the adjustment of inflation rate.

Protecting your investments is always better than letting them go out of hand, just with a mere fluctuation in the inflation rate. If you have confusion about the normal rate of return and the real rate of return, yet, let us know what bothers you via the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles