Operating Margin Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 17, 2022Precisely, expenses are to be met, and how efficiently a company meets its expenses is what operating margin determines, which can be commuted using out Operating Margin Calculator. Investors are generally worried about the interest payments, and if the company is capable of paying them.

This is portrayed in the formula, as operating margin refers to the earning leftover after the company pays all the operating expenses but not the interest and tax. This term is in some way similar to the Earning before interest and tax term.

Operating Margin Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Operating Margin Calculator Details

The factors commuters ought to gather are:

- Operating income

- Sales revenue

One needs to refer to the cash flow statement, where the current year’s expenses are recorded and paid off using the earnings. Though, the earnings which need to be taken into account are the figures which stick around the cash flow statement, before the firm makes the interest and tax payment.

The second factor is clear by the terms and refers to the total revenue made by the company. Both the factors when applied to the terms give us the reading of the company’s efficiency in the form of operating margin.

Check out more Financial Calculators here –

Operating Margin Calculator Product Details

Product is well configured using the factor. You need to abide by the thumb rule of the formula and do as the formula instructs you to; this will open the doors to the product which in this case is the operating margin.

Investors have their own and personal reasons of opting to find this formula, while analysts who work for the betterment of the company, evaluate this formula to improve the prospects of the company, where all the payment obligations are met, ensuring the company gets designated with a good value. A good value will help the company grow and prosper.

How to use Operating Margin Calculator?

Calculator may sound just normal and you may claim to have one embedded in your phone itself. But, what if you say there is a catch and we have a calculator which is embedded with the formula in concern. Sounds good, right? Well a lot of aspects are to be measured and so a calculator may forever come handy.

You will find one at the end of the page, just when you scroll down. The calculator will not ask you a lot, other than the factors of course. Make sure you have the right set of them and then move on to fill them up at their adjacent names. There you go; you will have the answer in seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Operating Margin Calculator Usage

An analyst discovers the company he works for has an operating income of Rs.100000 and a sales revenue of Rs.400000, in order to find the operating margin, he will:

Use the formula:

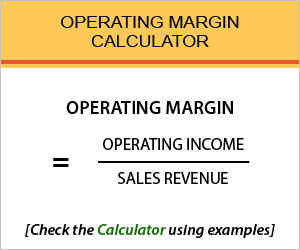

Operating Margin = Operating Income / Sales Revenue

And then work it out:

Operating Margin = 100000 / 400000

At the end of the working, he will discover that the product is 25%, which says the company has got 25% of its revenue earned. This way he will be able to take constructive decisions, in case a need arises.

What is the use of Operating Margin Calculator?

Companies aspire on maintaining its own records, in the process of analysis and strategical decision. Though several, let us focus on its attempt to improve the efficiency by finding the shortcoming and then successfully rectifying them. analysts can find the flaw and develop strategies which will eventually increase the operating margin, as higher margin reflects greater capacity.

As for the investors, they commute this formula in order to understand how the company has been acting up, or if all it brings is the risk of making defaults. Operating margin, along with a lot of other profitability formulas, helps investor determine how great of the deal it is investing with the company, or why not.

Operating Margin Calculator Formula

Let us get past the formula for another time being.

Company needs to ensure it successfully manages to retain after paying operating expenses. It is because after the company pays in the operating expenses, it needs to further pay the non operating ones.

Investors also happen to commute this formula as they will have a basis of what they will get paid all the while they invest with the company, or if there are significant dangers of company making default on account of lack of funds.

A significant attempt at improvement shows a change in the operating margin over different years.

Operating Margin – Conclusion

Risk may be the essence of investment but it does not mean investors make decisions without evaluating the company’s performance.

They eliminate the risk criteria associated with investment, investors are subject to various findings, and one such finding include the operating margin, subject to display the height of efficiency it is able to put up with.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles