PV with Constant Growth Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 11, 2022The price of stock is basically the measure which is used by investors to know the company’s performance, the earnings and also the possible future aspects of return which it shall fetch. Find details of the PV with Constant Growth Calculator in this article, alongside all the major details of the formula.

PV of a stock with constant growth takes into account the Gordon growth model, which is based on the assumption that the growth of the company’s shares and dividend payout keeps growing in a constant pace.

Another assumption is that the company will go on forever and will pay infinite series of dividend.

PV with Constant Growth Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Stock – PV with Constant Growth Calculator Variable Details

There are three variables you will need in order to commute the formula and they are:

- Estimated dividend for the next period

- Required rate of return

- Growth Rate

Starting with the first item, the estimated dividend for the next period is the annual payment which is released to the common shareholders in the form of dividend.

Likewise, the second variable is the required rate of return which is the rate at which the investors agree to invest money with the company.

The final variable is the growth rate, which is the percentage change between the dividend from previous dividend and present dividend, which is the growth that took place in dividend.

Check out more Financial Calculators here –

Stock – PV with Constant Growth Calculator Details

So, in order to determine the present value of a stock for the companies which have a constant growth rate, we need some variables which are well sorted in the above context.

Keep them handy so you can extract the product out of them which in this equation are two. The first result is the Present value of stock with constant growth i.e. the formula itself where the recent value of the stock is determined.

The second product is the present value of stock per share which lets us know how much per stock of the company is valued at.

How to use Stock – PV with Constant Growth Calculator?

The variable put together, in fact put in their respective places in the formula can fetch the product. Finding the variables is the only tough job you need to do, as we took care of the further solution process by adding a calculator at the end of the page which would do the solution for you.

You need to enter in the variables in the calculator and press enter followed by which you will obtain the product – PV of stock with constant growth.

The second product is for determining the per share price, which as well can be obtained with the calculator we put up.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Stock – PV with Constant Growth Calculator Usage

A company trading in the stock exchange has an estimated dividend payout of Rs.1000000 for the next period with a growth rate of 4%. Moreover, the required rate of return is 10%.

The formula is:

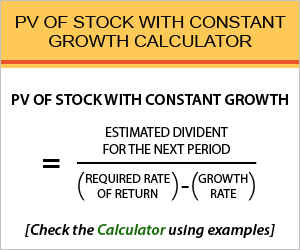

PV of Stock with Constant Growth = Estimated Dividend for the Next Period / (Required Rate of Return – Growth Rate)

Here is the workout:

PV of Stock with Constant Growth = 1000000 / (0.10 – 0.04)

Commuting the above formula, we will have Rs.16666667 as the PV of stock with constant growth. Further, trying to evaluate the PV of stock per share, you divide the PV of stock with constant growth with the estimated dividend for the next period.

What is the use of Stock – PV with Constant Growth Calculator?

The formula is used for companies which have a record or claim of having a growth in dividend, precisely of constant pace. This is used to establish a comparison among the present value of the stock and the Present value obtained through the formula.

It can be used beside a number of different formulas adopted by investors to form a basis of comparison between investment options.

But the terms and conditions for this formula remains that, the stable companies are only to be taken into account, all of which have a steady growth which is obtained in the form of percentage. If the formula PV is great, it means the stock is undervalued and a good option to invest in.

Stock – PV with Constant Growth Calculator Formula

Let us go through the formula precisely so you can solve a lot of digits by yourself.

Using this Gordon Growth model, the investors can determine the present value of the stock, taking into account the internal factors of the company and not the market effect, which is often referred to as the intrinsic value of stock.

In fact,the future possible dividend payouts are considered in the formula where the growth of the company is assumed to be constant. This formula is basically used to evaluate the price of established companies.

Stock – PV with Constant Growth – Conclusion

Let us sum up this article with the limitations where the formula may not hold of any value. Basically established companies have a constant growth rate but this is merely not applicable to a lot of companies in actual world.

The second consequent limitation is when the denominator fetches a negation amount, and the formula becomes void.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles