Yield to Maturity Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Bonds which are held by the investors till the time they mature yield returns in full and final. Is such a case this formula, Yield to Maturity comes into play where investors have had the bond for a real long term. Find the Yield to Maturity Calculator in this article, and all the information regarding its commutation.

Yield to Maturity Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Yield to Maturity Calculator Variable Details

The variable details to be referred are:

- Interest or Coupon Payment

- Face Value of Bond

- Price of Bond

- Time / Period of Maturity

Details required for the YTM formula are pretty simple as above. The first variable being the interest or coupon payment is the amount which is paid to the investors for investing in the bond.

Face value of the bond is the amount for which the bond was purchased in the first place. Price of bond on the contrary is the value the coupon holds presently as the market price. Besides, the last item is the time period for which the bond is available for investment.

Check out more Financial Calculators here –

Yield to Maturity Calculator Details

Consequently, you need to use the above mentioned equally important variables, all of them to cautiously solve the formula which will thereby lead you to the result of the formula.

The result obtained from the formula is Yield to maturity.

So the percentage value you obtain in the form of product for the YTM formula is the return you will be enjoying if you hold the bond for the entire time period. With the compounding effect this formula contains, it is not like the simple yield which is found using the dividend yield formula.

How to use Yield to Maturity Calculator?

It is pretty easy to operate a calculator, a normal calculator for instance and it always adds on to quick commutation. Here is what we got to offer you for this article in the second place, as we have put up a calculator for you to solve the formula quickly.

The Yield to Maturity calculator is unlike a normal calculator, as we have built up the calculator based on the YTM formula.

Moreover, it is easy to use, as you have to enter in all the variables as described in the above paragraph to know the final result. Make sure to enter the items in their right places and then press enter.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Yield to Maturity Calculator Usage

A bond is available for investment in the market which carries a Face value of Rs.1000 but has a price of Rs.920. The coupon payment of the bond stands out to be Rs.100 and the bond will expire after 10 year. Here is what can be done to find the total expected return.

The formula is:

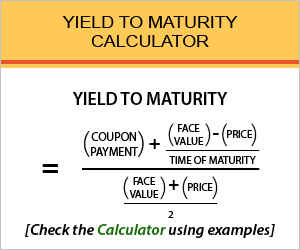

Yield to Maturity = (Coupon Payment + ((Face Value – Price) / Time of Maturity)) / ((Face Value + Price)/2)

Here is the workout:

Yield to Maturity = (100 + ((1000 – 920) / 10)) / ((1000 + 920)/2)

So, if the calculator from bottom is used and the return is evaluated, the result would be 11.25%

What is the use of Yield to Maturity Calculator?

The first use is to know if the concerned bond would make a good investment. For the same, the investor has to find a required yield and then he needs to take the YTM of the bond and then compare if both of them are equal and if the yield stands up to the potential of a good investment option.

The second is how the investors can use the YTM to know how much he has earned annually for the entire held period. As a result, the phenomenon of YTM showing the results in an annual basis is great for comparison between bonds having different maturity rate and even coupons.

Yield to Maturity Calculator Formula

Let us go through the formula for good understanding.

This formula is based on compounding where each coupon of the bond will bear interest for the next period too. It is also important to know that the yield hence obtained is of annual basis and determine the yield of one year.

If the investor wants to know the entire period’s yield for which the bond was held, he or she has to go through the trial and error process. In such a case, P has to be changed until the last one is equal to the present value of the bond.

Yield to Maturity – Conclusion

Comparing a bond based on the yield is now simple with the formula, given the comparison medium can be established on all the bonds, irrespective of the maturity period and the coupon rate. If there are any issues in the process of calculating the YTM let us know via the comment section and we will look out for you.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles