Free Cashflow to Firm (FCFF) Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 17, 2022Financial health of a company depends upon a number of factors and company constantly keeps calculating a number of profitability ratios to ensure it is not lagging behind in any terms. One such requirements here would be Free Cashflow to Firm (FCFF) Calculator.

This formula is accounted for as the cash flow available with the company after all the expenses are paid and also reinvestments are done.

Depreciation expenses, taxes and working capital are generally paid off first and then the remaining amount left with the company is then available for distribution.

Free Cashflow to Firm Calculator

Free Cashflow to Firm Calculator Details

Factors which you need to put into the formula are:

- Earnings before interest and tax

- Tax rate

- Depreciation and amortization

- Changes in working capital

- Capital expenditure

The list of factors which are required to be included in the formula are as above. The first factor which is the earnings before interest and tax is the income made before tax and interest is paid, and is found in the income statement.

The following factors i.e. the tax rate, depreciate and amortization can be found in the income statement of the company as well. Change in working capital is the difference between the current asset and current liabilities and they are to be extracted from the balance sheet.

Capital expenditure on the other hand will be found in the cash flow statement.

Check out more Financial Calculators here –

Free Cashflow to Firm Calculator Product Details

The factors and they ways to find then has been mentioned in the above paragraph, while we agree the hunt for factors may be difficult. You need the factors in order to commute the product, which in this formula is Free cashflow to firm.

With the personal reason to commute it, anyone can find the answer if the correct procedure is followed.

However, a higher product is likely aspired by the commuter which ensures sufficient cash flow is made by the company, without hampering the payment system where every debt and obligation has to be met, if the company wishes to survive and run for a longer time period.

How to use Free Cashflow to Firm (FCFF) Calculator?

You need to hop onto a lot of place in order to evaluate this formula. You need to have all the information of the company and then shall you be able to complete the factor hunt while trying to figure out how to find the formula.

Calculating the formula may be difficult as well, and so we aim at reducing the challenge for you as we can contribute to it. So, we have added a calculator which works on the formula FCFF, at the end of this article.

The calculator will let you find the answer in a matter of seconds, and you are required to only enter in the factor details.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Free Cashflow to Firm (FCFF) Calculator Usage

A company has an EBIT of Rs.200000, followed by which it it has all the expenses which are given in the above table.

The formula is:

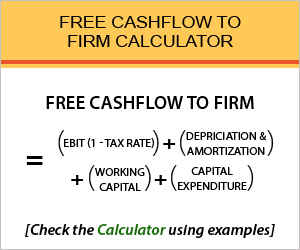

Free Cashflow to Firm = EBIT (1 – Tax Rate) + Depreciation & Amortization – Working Capital – Capital Expenditure)

Let us solve it:

Free Cashflow to Firm = 200000 (1 – 0.3) + 150000 – 75000 – 300000)

The result however here, is in negative, i.e. -85000 which means the company has no additional funds left to pay off the debt and dividend, however it is short on cashflow, even for the expenses.

What is the use of Free Cashflow to Firm Calculator?

The most basic use of this formula is in terms of determining the leftover fund with the company to pay off the debt obligation and also dividend to the shareholders. Apart from this the formula comes handy over stock valuation models which may use the FCFF as a substitute to dividends.

Future cash flow discounting is as well done with the help of the FCFF formula. Analysts and investors use this formula to study how often the company is able to manage a constant and steady cashflow, because the debt obligations and also the shareholders payment is to be done in due time course.

Free Cash flow to Firm Calculator Formula

Where,

EBIT = Earnings before interest and tax.

This formula works as the indicator of stock value, as it is the cash available with the company after it has paid several operating and non operating expenses. The formula is an indicator, also of the operations which take place in the company and how well it is performing.

The basis is a proportionate higher FCFF, which indicates the company has a high proportion of money left with it to pay the debt and shareholder, whereas lesser the cashflow, lesser will be the generated money left.

Free Cashflow to Firm – Conclusion

A company has to be financially capable, also in terms of the distribution, it does to its shareholders and creditors.

The expenses are to be paid off, followed by which a company has to have a sufficient amount of cash flow, and this formula lets us evaluate how capable a company is.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles