Quick Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 11, 2022Know everything about the Quick Ratio Calculator in this article, but let us get familiar with the concept in the first place. Irrespective of the fixed assets and capital, a company is in dire need of maintaining a good liquidity position, in terms of short term fund, to fuel its operations and obligations, which are short lived.

So, a company always has assets, precisely referred to current assets, in fixed proportional to fulfill the liabilities which are due in short term.

Current assets can generally be turned into cash, to immediately meet the deadlines and due dates, ensuring the daily activities are not hampered.

Quick Ratio Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Quick Ratio Calculator Details

Having factors in store is necessary in order commute the formula and the factors required here are:

- Current assets

- Inventory

- Current liabilities

Companies always account for its current assets and current liabilities and enter them for full and final in the balance sheet at either side they belong.

So, in order to commute the formula you need to go to the balance and fetch out all the current assets and liabilities, and they include every such item which can be converted into cash in a period lesser than one. Inventories, in the form of raw materials, finished goods, etc are as well to be extracted.

Check out more Financial Calculators here –

Quick Ratio Calculator Product Details

You will find the importance of the product which is discussed in brief further in the article. Before we move on to that, you need to know what the product is, it is the formula – the quick ratio.

In order to find the formula you need assistance of factors so make sure you do as directed above. Also make sure you know which items are to be extracted if the balance sheet does not specifically mention the current items.

Easing up your further job, we have added up a calculator to this article which will take you one step closer to the product.

How to use Quick Ratio Calculator?

Following up on the calculator of quick ratio is definitely simple and easy. The calculator has been attached at the end of the article and that is where you will locate it, so scroll down to the bottom if you need its assistance.

It makes your commutation job easy just like a regular and basic calculator, however the catch is this calculator is embedded with the formula and so you need not commute the formula individually all by yourself, being prone to making mistakes.

Just when you find the calculator, click on the factors area and then enter in the respective factors. You will immediately find the products.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Quick Ratio Calculator Usage

Checking out for its liquid position, the company tries commuting its quick ratio based on the factors, where it has current assets worth of Rs.100000, inventory worth of Rs.20000, and current liabilities worth Rs.60000.

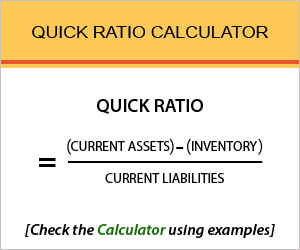

The formula is:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Here is the workout:

Quick Ratio = (100000 – 20000) / 60000

Upon reducing the inventory value from the current asset and then dividing the result with the liabilities, the company finds out that it has 1.33 quick ratio, which is also referred to as acid test ratio.

What is the use of Quick Ratio Calculator?

Operational activities of a company earn sufficient debtors and also creditor along the course of time. Some of the liabilities though, are due within a period lesser than a year, and so, a company has to maintain a significant proportion of asset to payback the liabilities.

This is the liquidity position of the company we are referring to, and the quick ration is used to keep a check on it. It safeguards a company from making defaults in payment, which would pull the company and its performance down.

In order to avoid it, a company manages to keep assets in liquidity form, and also that each penny of the liability is replicated in current assets.

Quick Ratio Calculator Formula

Let us study the point of finding the formula and what the formula is:

Simply put, a quick ratio determines if the company has enough secured current assets against the current liabilities, for the company is obligated to pay its debt by the due time.

Companies prefer managing current assets greater than the current liabilities, and any company which successfully pulls it together has a quick ratio of 1 or greater.

Less than one ratio indicates the company failed. However, it is to be noted that inventories are not to be included with the current assets.

Quick Ratio – Conclusion

Performance of a company highly relies over the operational activities and funds are the fuel to keep operations going smoothly and steadily. So, quick ratio lets a company know how well it is managing the liquid funds, and if it is in need of more, as there is a chance of default taking place.

For any additional help with the formula and its solution, we may seek out helps. We are available via the comment section.

Open Demat Account Now! – Save up to 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles