Payback Period Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 17, 2022Investments and projects related to operations differ vastly and the analyst tries measuring them, in order to pick up the best one. One of the contributor formula is Payback Period, and we have enclosed the Payback Period Calculator in this article for better understanding.

Everything is related to profit and so an analyst picks up the most profitable one based on a lot of criteria’s. One such measure he uses is the payback period, which is further explained in this article in a better way. We have also attached a calculator, in case you wish to evaluate the formula yourself.

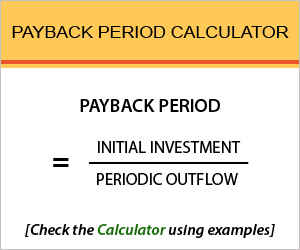

Payback Period Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Payback Period Calculator Details

First things first, an analyst gathers the factors which are:

- Initial investment

- Periodic outflow

While valuating the formula the first thing needed is the initial investment, as in the money required to be put up by the company.

In other words, the cost of investment is taking into account here, for the first factor. As for the next factor requirement, the analyst takes the amount which the investment contributes in total for one fiscal year, i.e. annually.

Both of the factors will lead the analyst into determining the period around which the investment will entirely pay off.

Check out more Financial Calculators here –

Payback Period Calculator Product Details

Leads are to be followed everywhere, and in order to commute this formula, both the factors act as the lead. We gave you a heads up on what they will be, and for further process, the commuter needs to extract the same in figures.

This is how product can be found, i.e. the payback period. All you need to know is that, if the payback period is shorter, the investment has high probability of being chosen, whereas an extended payback period is never considered to be favorable, and the commuters will override the option, selecting the competitor option, for the benefits are huge.

How to use Payback Period Calculator?

If you are pretty well associated with all the factors, the product, the point for calculating this formula and further follow up action, you may get on with solving the formula for the investment or project option you aspire.

Making you commutation process easy, we have added a calculator which works on the basis of the formula payback period. Instead of solving it yourself, for precision, you can opt to use the calculator whenever you need it.

Scroll down to find the calculator and then fill up the details of the factors as the calculator directs you to, and then wait for it to display the result. It will take only a couple of seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Payback Period Calculator Usage

XYZ Company got an offer of a new project, which demands the company to invest Rs.500000, where the project will pay back Rs.200000 per year.

The formula helps in finding the period:

Payback Period = Initial Investment / Periodic Outflow

Time to commute it:

Payback Period = 500000 / 200000

The time which the investment will cater to payback entirely is 2 and a half years. If the company has a better option, it would not consider the option from the example, taking into account the time value of money.

What is the use of Payback Period Calculator?

Time value of money is one great consideration when investment is made, though this concept of payback period definitely ignore the fact that time value of money portrayed, as opposed to capital budgeting formulas which have their prime focus on time value of money.

Payback period rather directly display the number of years associated with the payback of investment. Analysts who are into this easy method, consider this whereas others use is as a variable in capital budgeting decision making.

This formula also happens to ignore the profit outcome of the investment, as its prime focus is the initial payment and the time catered to recover it.

Payback Period Calculator Formula

Formula which lets you keep up with investment benefits:

Simplicity lies in this formula as in unlike the other formulas, this formula directly convey the number of years which would provide back the investment initials.

Isn’t it better to get returns sooner than later? This is exactly what analysts consider and so they are determined into evaluating all of the alternative projects, in order to choose the one project which has a proportionately lesser payback time.

Winding up is done sooner and so are the returns provided sooner in projects which has lesser payback period.

Payback Period – Conclusion

Time is money and so, companies consider this formula which is based on directly on the years which will earn company its money back.

So, having money sooner is better than having the invested money back after an exceeding period of time. If you meet with any issues along the article, let us know in the comment section below.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles