Current Yield Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Taking into account the current market price, you can calculate the percentage current yield, using the Current Yield Calculator below. Here, the face value of the stocks are not taken into account, rather the return on investment for the present year is determined, based on the current price of the bond.

It is also used as a measure to determine the annual return, i.e. the interest or dividends on an investment or security, but is majorly used for the evaluation of bond investments.

Current Yield Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Current Yield Calculator Details

The factor details required on the process of calculating the current yield are:

- Annual coupons

- Current bond price

As stated, the first factor required is the annual coupon price expressed in rupees and the second factor is the current bond price, also expressed in rupees.

The annual coupon is the coupon which the company provides to you every year on the bond purchased and the current bond price is the price at which the bond is valued in the market.

These two factors together will determine the results of the current yield formula, if used as directed.

Check out more Financial Calculators here –

Current Yield Calculator Product Details

The result obtained after all the factors are taken into consideration is the current yield. Make sure you have the factors as directed and then you shall be able to find what you are in search of. Make sure to follow up with the instructions as given, and know what the result indicates.

It is very import to have the understanding of the formula and why it is commuted. You will find different formulas which help you compare bond prices or know the return you are making, and this is the reason to know how current yield stands out of the other formulas.

How to use Current Yield Calculator?

We want you to gather in the details of the factor, which are must in order to successfully commute the annual gains or returns you made on the bond.

You do not need to worry about the calculation of the figure, as you will find a calculator at the end of page which will do your job perfectly. Once you have the factors, go to the calculator and enter them all in the following fields or blanks as instructed.

Once you are done, we want you to cross check if you entered in the right factors in the correct places and then click on enter. You will have the current yield percentage in front of you immediately.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Current Yield Calculator Usage

| Factors | Product | |

| Annual Coupons (Rs.) | 100 | 10.0%

|

| Current Bond Price (Rs.) | 1000 | |

Suppose, a bond was issued for the price of ₹1000, and it bears an annual yield of ₹100, and you wish to calculate the current yield of the bond.

The formula is:

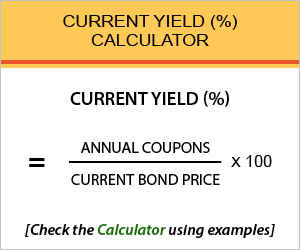

Current Yield (%) = (Annual Coupons / Current Bond Price) * 100

Let us go by the figures mentioned and check the current yield:

Current yield = (100 / 1000) * 100

So, summing up the formula, you will be have a result of 10%, i.e. the current yield of the bond will be 10%.

What is the use of Current Yield Calculator?

There are various types of uses associated with the current yield formula, other than determining the current returns i.e. yield on the basis of present market price.

This formula also goes into use while determining the bond yield formula, yield to maturity, yield to call and many more, all of which lets the investor compare returns obtained from a number of bonds.

This formula also supports the calculation of risk associated with a bond, in order to determine where the bond stands in terms of risk and the return it is likely to fetch. Investors calculate risk to know what return shall be expected from a bond.

Current Yield Calculator Formula

Going through the formula again, for a better understanding:

You will encounter a lot of formulas which let you calculate or compare similar bonds and their coupons. But here is the catch in this formula, you will be able to know of the current, as in the present annual yield on contrary to bond yield where the face value of the bond is taken into account.

Also, you will not be able to determine the entire holding period yield, rather the yield of the current year coupons.

Current Yield – Conclusion

Summing up the article, we have provided how the formula is calculated and the factors required to calculate the formula. You also are provided with the additional information of various uses this formula can be put to, which may come handy anytime in future.

If you can follow up with the instructions of this article, you will have the exact annual returns made on the bond.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles