Debt Equity Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022The article is constructed regarding the Debt Equity Ratio Calculator, which covers the way it is commuted. Starting with the significance of the ratio, we have also drafted an example, to make you well accustomed with the formula.

Leverage is the borrowings made by a company in order to fund its business and the returns provided to the share holders. It is more than often the company needs to use leverage in order to keep the operations going.

This doesn’t change the fact that great level of leverage is a threat to the companies and so, companies keep track of the ratio, which draws a fine line between the leverage and equity, which determine if or if not there lies sufficient equity against debt.

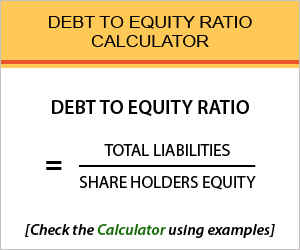

Debt Equity Ratio Calculator

Debt Equity Ratio Calculator Details

The factors to be put into the process of finding the debt to equity ratio are:

- Total liabilities

- Shareholder’s equity

The borrowings made by the company is what referred to as the debt, and it obviously needs to be paid off, in due time. This is what we need to consider for the first factor, which basically lies in the balance sheet of the company where the record of debt lays.

Money raised from shareholders is what we need to consider for the second product and you will find the same in the balance sheet, the same side as the liabilities.

Check out more Financial Calculators here –

Debt Equity Ratio Calculator Product Details

The factors are almost easier to find and the reason for them is because companies have their balance sheets created at the end of the each period. Given access to the factors, the product can be easily founded.

The product here is the ratio – debt to equity ratio, and you need the formula which is total liabilities dividend by shareholder’s equity for commutation of the ratio.

Be assured and follow the rightful commutation process in order to find the correct ratio, a wrong commutation can give a wring debt to equity ideas of the company, and you may as well use the calculator for the commutation process.

How to use Debt Equity Ratio Calculator?

The use of debt to equity ratio is well illustrated further in the formula, whereas the factors and the products have already been discussed. Make sure you have the right digits in factors as for further reference we have added a calculator at the end of the page.

This calculator is embedded with the formula of debt to equity and you are only required to enter in the factors details alongside the mentioned names and you are good to go.

Upon entering the details and hitting the enter button you will be able to find the working of the formula and the answer at the end of the calculator.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Debt Equity Ratio Calculator Usage

A company’s borrowed capital stands out to be Rs.300000, whereas its shareholder’s equity was marked to be Rs.250000. For the company to evaluate the possibilities of payment, it finds the formula.

It would need to use the equation:

Debt to Equity Ratio = Total Liabilities / Shareholders Equity

Here is how to solve it too:

Debt to Equity Ratio = 300000 / 250000

So, the formula when taken into consideration, we will have a debt to equity ratio of 1.2. If this percentage keeps rising, the risk in terms of the ability to pay off the debt will rise as well.

What is the use of Debt Equity Ratio Calculator?

Levered beta, also known as equity beta is calculated using the formula debt equity ratio, being a part of the financial leverage ratio. There is a direct relation between both the formulas and they move the same way, contributing to the company’s decision making process.

The decision of raising capital through debt or finance is what is being referred to. Debt to equity ratio plays a very important role into getting past the decision, as it is used as a variable to commute the levered beta.

A high rate of debt indicates the company has been making ties with the creditors, rather than the shareholders.

Debt Equity Ratio Calculator Formula

Let us consider going through the formula for once.

Business needs to gather as much funds as it can in order to ensure a uniform fashion of operation is on. Businesses decide on gathering funds through leverage or through fully owned shareholders fund.

Debt is always an obligation company has to fulfill, and so, in order to be assured if the equity will be enough to pay off the debt, companies tend to commute this formula. This is also evaluated for the time when the company is in danger of running out of business but it still owes some debt.

Debt Equity Ratio – Conclusion

Companies need to maintain a lot of ratios and formulas, as there is a lot more going in the organization.

In order to ensure each of the aspect of the company is covered the formulas are maintained, and one such formula which ensures the debt is in rightful measures of fulfillment or not, is the debt to equity ratio.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles