Debt Coverage Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Debt Coverage Ratio Calculator is used by the lenders who wish to be assured that the borrower has the capability of paying off the money which he borrows without the need to seek help for similar external sources of debt.

Companies have their own share of debt percentage, an obligation which is required to be fulfilled in a course of time, say a year. A company needs to keep paying off the debt, ensuring the obligations are met and minimized for a fulfilled and on-going operational procedure.

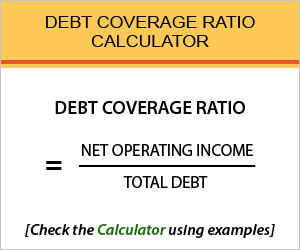

Debt Coverage Ratio Calculator

Debt Coverage Ratio Calculator Details

The factors which are used in the process of the debt coverage formula are:

- Net operating income

- Total debt

So, we are not here with the factor requirement for the formula. As referred, there are two factors requirements for the formula and the first one is the net operating income which can be commuted by subtracting the operating expenses from the revenues.

This net operating income can be found in the income statement of the company. The total debt factor of the formula can be derived from the balance sheet where the short term debt and the present dated parts of the long terms debts are considered.

Check out more Financial Calculators here –

Debt Coverage Ratio Calculator Product Details

The factors and the need for them being clear, you can move on to trying to commute the product. If you wonder what would be the result here, in this equation, the product would be the formula itself, the debt coverage ratio.

The objective of commuting the formula will be fulfilled if you can successfully extract the product with the help of the factor.

This product is commuted by the companies itself, for self benefit, in order to ensure the income they are making is enough to fulfill each and every debt obligation the companies have towards them, during the course of one year.

How to use Debt Coverage Ratio Calculator?

We aim at making your ob easy, firstly by educating you about the ratio and its various other needs, followed by the factors which are required in order to calculate the formula followed by the sources from where you can find them.

If you have obtained thorough information of all of them, we are here to offer even more, in the form of a calculator which is embedded with the debt coverage ratio.

Gather all the factors and stuff them up the calculator, in the places they need to be, and press enter. This is where you will have the answer in a matter of seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Debt Coverage Ratio Calculator Usage

A company disclosed an operating income of Rs.100000 from its income statement and the debt payments to be made for the same year are of Rs.30000. The debt coverage ratio is

The formula is:

Debt Coverage Ratio = Net Operating Income / Total Debt

Here is how to commute the figures:

Debt Coverage Ratio = 100000 / 30000

If the division is done and the answer is evaluated, the company will be having a ratio of 3.33 which is a favorable ratio in connection with the company’s capacity of paying off debts.

What is the use of Debt Coverage Ratio Calculator?

The most common use this formula is put to, is for determining a company’s self ability to pay off the debts. Company use this formula to study its capability of writing off the borrowings made.

Banks and other financial institutions which carry on the lending business also commute the debt coverage ratio of the companies which seek out to borrow from them.

The financial institutions use this ratio to evaluate the firms as well as individual consumer’s debt paying power. Though, there is a slight variance in the formula used for an individual loan seeker, as compared to the firms in common.

Debt Coverage Ratio Calculator Formula

Here is the brief explanation of the formula for better help.

In order to meet its debt obligation a company need to ensure, sufficient amounts in the form of income and profit keeps flowing in. It is because the cash which comes into the business pays off the obligations of debt.

For this formula, 1 is taken as the measure, where if the company has a debt coverage ratio around 1 or less than 1, it can be concluded the company cannot pay off its debts. A ratio, greater than 1 is considered favorable.

Debt Coverage Ratio Calculator – Conclusion

This formula can be used by anyone for the analysis of a project, individual borrower or even of the company.

Use the formula as per you need and if you encounter any major issues while trying to commute the formula, let us know via the comment section and we would respond back to you as soon as possible.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles