Debt Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Some strong decisions can be made using the Debt ratio formula, and it can be ascertained using the Debt Ratio Calculator, enclosed in this article.

There is always a risk of making default associated with the borrowing made by the company. The type of decisions taken by the company for funding its operations often determines its capability of not making defaults.

So, a company is required to take some strong and well thought decision, in the context of expanding assets while reducing liabilities, to maintain a strong financial background and also ensure the debts can be paid off in the stipulated time frame.

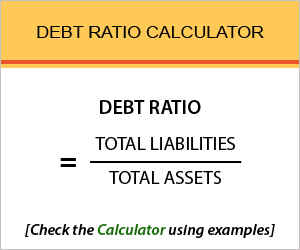

Debt Ratio Calculator

Debt Ratio Calculator Details

Factors are the necessity and you need to keep up with it.

- Total liabilities

- Total assets

Starting with the first factor, the commuter needs the total liabilities of the company which are mentioned in the balance sheet of the company. All the liabilities need to be taken into account for the formula.

The second factor is the total assets of the company which is considered from the balance sheet of the company as well. These two factor combined, play a vital role in examining the debt a company raised in order to grow the company, and if it has the means to fulfill the debt obligation.

Check out more Financial Calculators here –

Debt Ratio Calculator Product Details

The result of the formula is pretty much easy to understand if you go through this article. We assure you are in need of the formula while examining the performance of a company. In order to do so, you firstly need to find the factors and then use them properly in the place they go, for the formula.

If you do so, you will be fine with the process and will be able to find the result, which in this formula is the debt ratio. The measure of evaluating the leverage of a company is further discussed below, go through it in order to know which percentage is reliable.

How to use Debt Ratio Calculator?

Both the factors belong to the balance sheet and the formula heavily relies upon the same. Once the commuter has the factors, the right figures, the formula can be commuted easily. To help you get the right percentage result, we have complied along a calculator which works on the debt ratio formula.

You need to scroll down to the end of this article to find the calculator and do as it directs. It will ask you to enter in the details followed by which it will display the working and the resulted result, in the form of percentage clearly, below the calculator.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Debt Ratio Calculator Usage

A company has managed to secure up assets which result to be worth Rs.250000, whereas it also gathered up liabilities along the process, and the liabilities amount to be Rs.220000.

The formula is:

Debt Ratio = Total Liabilities / Total Assets

Here is what goes to working it out:

Debt Ratio = 220000 / 250000

Along the course of time, when company tries to evaluate the debt ratio, it will find out the product, i.e. the ratio to be 0.88. since, it is below 1, we can safely assume the company has this tendency to pay off its debt using the assets.

What is the use of Debt Ratio Calculator?

The debt ratio necessarily translates the liabilities to debt case scenario, but it does not portray the overall case scenario. The financial wall of the company is held up by many formulas and one such formula is the debt ratio, covering a small part of the finance.

A dept analysis need to be formed in order for evaluating the entire financial threshold, and this formula helps to take the study to a different level, using which the future of the company can be molded, in favor of the company. Various other implications are to be found, and the debt ratio adds on to it.

Debt Ratio Calculator Formula

Let us evaluate the terms of the formula and how it works.

The expression of this formula is made in terms of decimal or percentage. If the company manages to keep a low profile of liabilities and in turns manages a good proportion of assets, it is likely to fulfill the survival criteria.

The basic measure is taken to be 1, where 1 or greater ratio is referred to be risky, where the company has greater level of liabilities, as compared to the assets. Whereas, ratio below 1 is favorable as in such a case, company has greater assets over liabilities.

Debt Ratio – Conclusion

Maintaining a pleasant ratio of liabilities to asset is essential for a company to survive in the short as well as the long run, as it helps the company avoid the dangers of being shut down.

Hence, all the companies prefer maintaining this ratio every now and then for pleasant functioning of the business.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles