Return on Equity (ROE) Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 12, 2022Commute the formula with the enclosed Return on Equity (ROE) Calculator in this article. Know how the formula works and also places where the formula can be put to use, as well.

Profit is literally the source of power, which regulates the company and its on-going activities. Profit needs to be made in very constant interval, failure of which will lead to the company falling off on debts and we know the obvious here, bankruptcy and winding up of business.

This is where the return on equity comes to play, where it determines the constructive efforts of the company in making out profits from the assets of the company.

Return on Equity Calculator

Return on Equity Calculator Details

Factor details required are the:

- Net income

- Stockholder’s equity

Factors as we see are the net income and the stockholder’s equity. As for the first and the foremost factor requirement, the net income, it is to be obtained from the income statement of the company.

For the stockholder’s equity, you will find it in the balance sheet of the company, and if you do not locate it, and you have access to the debt and assets of the company, you need to take the debt off the assets to find the equity. This shall do the trick.

Check out more Financial Calculators here –

Return on Equity (ROE) Calculator Product Details

Studying formulas by breaking them up as in the factors and the products makes the entire process easy to understand and remember. So, is it our aim to educate whosoever reads this article or ties to find the way of solving the formula.

The factors have been scattered in the above paragraph, which are important to takes notes of. As for the product, this formula has only one product and it is the Return on Equity.

The product, or in other words the return on Equity is to be always expressed in percentage and so, it is lie a regular end requirement of the formula, where the amount after division of the formula is to be converted into percentage in order to find the correct product.

How to use Return on Equity (ROE) Calculator?

Calculator on Return on Equity has been provided to our readers from our end, which is provided to use as per your convenience and ease. Search for the calculator at the end of the article and by that time you will have absorbed quality information of the prospects of the formula and its working.

The calculator will have all the factors and a blank against them already, which you are responsible to fill up with the figures of the company you have in consideration.

You got to do as you are directed to, putting in the factor information followed by which, the calculator will show up with the product, and the process will take just a couple of seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Return on Equity (ROE) Calculator Usage

| Factors | Product | |

| Net Income (Rs.) | 100000 | 22.22% |

| Stockholder’s Equity (Rs.) | 450000 | |

Analyst of the company ABC, as usual depicts the yearly Return on Equity based on the statistics of the year, which stood out to be Rs.100000 for the net income and Rs.450000 for the stockholder’s equity.

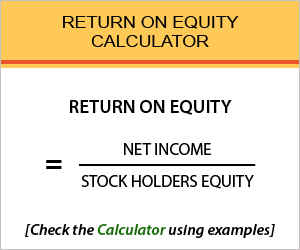

The formula is:

Return on Equity = Net Income / Stockholders Equity

He would solve the formula as, or we can use the calculator to solve it:

Return on Equity = 100000 / 450000

He will discover that the company has 22.22% of return on equity for the current fiscal year, and then proceed on to evaluate if it is as per the goal if any further redo has to be done.

What is the use of Return on Equity (ROE) Calculator?

Management is responsible for each and every face of the company, where a lot of activities take place. The assurance of the company’s life falls at the hands of the management, and management as usual has a lot of formulas to commute and keep every aspect of the company balanced.

One such formula used by them is the return on equity where the valuation of profit made out from the assets is valuated to check if the present strategies are going on or then need to be terminated.

Investors for the second thing commute this formula to weigh in the company and its performance before investment.

Return on Equity (ROE) Calculator Formula

Return on net assets would be yet another compatible term for the formula, where a percentage determines the effectiveness of the management in putting the assets to use in order to turn them into profits of greater proportion.

Industry standards are different for each and so does the average ROE range. This is where the investors need to target, the average ROE of the industry, where the best catch would be to go for the company which has been maintaining a constant pace of investment over a few year, and has a ROE greater than the average.

Return on Equity (ROE) – Conclusion

Proportionate profit margins are to be set by the analysts, upon which lies the mere survival of the company and the target has to be met over the assets.

We have the reason why the formula is to be commuted and maintained by the analyst and how good would it do to the investors. Call out for our help, if you shall need, through the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles