Receivables Turnover Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 12, 2022Customers or client of the company owe money i.e. the receivable to the company, which may or may not be paid by due time. Not receiving money in due time has a lot of reasons, as a company has to possess the ability of collecting what it owes. Follow up on the ratio using the Receivables Turnover Ratio Calculator.

A reason developed for the lack of payment is deemed to repeat, and so, if a company continues to calculate this ratio over a period of time, it likely find the trend upon which, necessary measures can be taken.

Receivables Turnover Ratio Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Receivables Turnover Ratio Calculator Details

On account of the formula, you need to search for some of the factors.

- Sales receivables

- Average account receivables

The commutation process will start with the search for the factors as mentioned above. The first factor is sales receivables which consists of the sales which are made on the credit basis, but excludes the return of goods from the clients.

The second factor is to be commuted, and in order to do so, the figures of accounts receivables at the beginning of the period and the end of the period are to be taken which has to be divided by 2 at the end.

Check out more Financial Calculators here –

Receivables Turnover Ratio Calculator Product Details

If you want to find the formula and the benefits of the formula, it is further explained in the article, but then you also need to have an idea of the factors which are required to find the product, which in this formula is the receivables turnover ratio.

The factors are given in the above paragraph in brief and also the ways you can get hold of them. Make sure you hit up to the places and retrieve the factors which will make the commutation simple. For your reference we have also added up a calculator which will take care of the product.

How to use Receivables Turnover Ratio Calculator?

We tried to make this article as easy as possible so you can understand the basics of the formula, which will open the door to correct commutation.

You will find the information extremely valuable if you are in search of this formula, and on this plus side, we have the calculator to this formula attached with the article.

Move to the end of the page, because it is where you will find the calculator and you may use it as many time as you please. Use it by entering in the factor credits and the calculator will find the product for you.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Receivables Turnover Ratio Calculator Usage

As usual, a company wants to commute the receivable turnover ratio and for that it manages to gather the present data on sales revenue which amounted to Rs.500000 and the average account receivables amounted to Rs.125000.

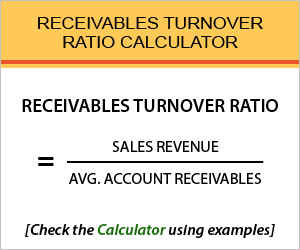

The formula is:

Receivables Turnover Ratio = Sales Revenue / Avg. Account Receivables

Let us find out how the formula is to be worked:

Receivables Turnover Ratio = 500000 / 125000

Upon solving the formula as given, using the calculator, the company will find out that it has a receivables turnover of 4.00.

What is the use of Receivables Turnover Ratio Calculator?

Effectiveness of sales is basically the criteria here, where a high receive ratio or a low receivable ratio is derived.

For the record, a high receivables indicates, the company has on point credit policies and that credit facilities are extended to the worthy customers, which the company has managed to earn, all by its goodwill.

On the contrary, a low ratio is an indication of the ways in what the company is failing, and they can be anything ranging from poor policies, bad collection procedure to customers who aren’t worthy. On the end note, the receivables turnover is used in regards with sales and their payments.

Receivables Turnover Ratio Calculator Formula

Here is what you need in context with the formula.

Starting with the account receivables formula, there is no interest to be by the clients upon maintaining this account. The credit policies of the company are framed previously and have the effectiveness of receiving the payments.

If they are not up to the mark, company may face a backlash on payments and so, this formula lets them figure out how likely they have been receiving the payments. High receivable turnover basically features how fruitful the company is and the quality customers it has managed to retain.

Receivables Turnover Ratio – Conclusion

Sales do not account to if the payment for them is not received. Hence, the company has to develop a thorough study on the creditworthiness of the clients which starts from this formula, and also improves the credit policies it framed if the need arises.

We are open to queries and questions relating to this article, which can be sent to us through comments.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles