Return on Assets (ROA) Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 12, 2022We have included the Return on Assets (ROA) Calculator in this article, to make it easy for you. Beginning with the insights on how the calculator and the formula works.

Generating income is the prime motive of assets, and the actual frequencies of returns made from assets range distinctively and it purely depends upon the company and the way it manages its assets.

The higher efficiency a company can portray the higher income will it be able to make on the assets. Investors who weigh in the performance of companies also use the formula return on assets to identify which company has been matching the pace of better efficiency in the industry and is likely to raise its worth.

Return on Assets (ROA) Calculator

Return on Assets (ROA) Calculator Details

Factors you need to put into the formula are:

- Net income

- Total assets

We wish to walk you through the factors for the first things and the product is further explained in the next paragraph. So, the prior factor needed is the Net income which can be spotted in the income statement of the company in question, and needs to be extracted from there.

The preceding factor is the total assets, where the entire asset has to be accounted for. We surely do know the location of this factor, which is presented at the balance sheet of the company.

Check out more Financial Calculators here –

Return on Assets (ROA) Calculator Product Details

Product is actually the main motive of commutation and we believe the formula would be more seamless and simpler to understand if we assume its constituents as factors and products.

The factors are the items which are fit into the formula, or in order words the contents of the formula, while the end product derived is the product, which for this formula will be the Return on Assets.

The product of this formula is expressed in as percentage so the commuter needs to take notes, that the product at the end has to be converted into percentage after the division is done.

How to use Return on Assets (ROA) Calculator?

As explained, if the factors are put together with the formula form the product. We want our readers to perceive the way of commuting so as to be clear about the process, which includes gaining up on the insightful information correlated to the formula.

Clearing each and every issue relating to the formula shall be the priority, and when fulfilled the path which lies further becomes seamless, where we have added a calculator to give you a kick start, directly to the product.

The calculator will be found at the end of the article which needs the user to enter the factors in the right places, which will lead them to the product.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Return on Assets (ROA) Calculator Usage

A company which has been insistent on expansion, finds the return on assets ratio every now and then, and as for the present scenario the analyst noted down the net income as Rs.100000 and total assets as Rs.500000

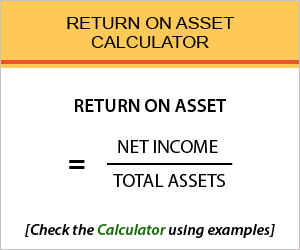

The formula is:

Return on Asset = Net Income / Total Assets

Let us consider how the commutation is done:

Return on Asset = 100000 / 500000

This particular company which has been firm about its assets efficiency finds out that the return to asset for this fiscal year amounted to 20.0%, when expressed in percentage form.

What is the use of Return on Assets (ROA) Calculator?

Efficiency endorses performance, and both of them are endorsed by assets, the wealth of the company. Companies try keeping the use of assets as minimal as possible, eventually increasing the returns which are made.

This ratio shall be put into use by the company themselves and also by the investors who aspire to study the company and its performance in dept.

As for the company, they aim to prosper by trying to increase the ratio ever counting year, transforming the strategies which mold the returns. This is a major process analysts attempt to execute so, as to help company reach height it has forever been trying to reach.

Return on Assets (ROA) Calculator Formula

Let us sneak peek into the formula for once

The formula cannot be used as the measure where companies from different industries are measured, as the industries differ on high measures.

Conversion rate needs to be high, the conversion of assets which are put into the business into the profits or earnings the company secures.

The most a company can make, the higher it is in demand by the investors. The best bet the investors got with the formula is while they form a comparison from the company’s previous ROA with the present ROA.

Return on Assets (ROA) – Conclusion

Being an investor we hope your motive of studying about your investment option has be fulfilled. Efficiency is the key, for it leads to effective management and better return on assets.

If you experience any misunderstanding relating to any of the content of this article feel free to keep up with the comment section. We keep it open to interactive with our esteemed customers.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles