Free Cashflow to Equity Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 17, 2022Investors have their share of concerns to check for the Free Cashflow to Equity Calculator. If the formula result is proportionate to the dividend the company owes to the shareholders, no debt is used and is an assurance for the investors, therefore favorable.

Analysts consider fair enough ways to figure the worth a company holds. This model has gained a pretty good significance in terms of value commutation, alongside the major Gordon Growth Model.

Analysts also use this formula for varied purposes, including the ways through which dividend is paid of the investors.

Free Cashflow to Equity Calculator

Free Cashflow to Equity (FCFE) Calculator Details

The factors we are in need of for the formula are:

- Net income

- Depreciation & Amortization

- Working Capital

- Capital Expenditure

- Net Borrowings

The term net income implies the income made by the company after deducting the income and tax as well as the other expenses. Companies generally enter the net income in the profit and loss statement or the cash flow statement.

Depreciation is as well an expense, and can be found in the profit and loss statement. As for the working capital it is commuted by subtracting current liabilities from the current assets, which is used for a short period, say a year.

Capital expenditure is to be found in the cash flow statement as well. Net borrowing is extracted from the company’s balance sheet.

Check out more Financial Calculators here –

Free Cashflow to Equity (FCFE) Calculator Product Details

The product of this equation has a well defined purpose for the investors and the analysts. The product in general here is referred to the Free Cashflow to Equity. However, the commuters need to have the exact knowledge of accounting terms in order to get the correct information.

It is because a lot of terms and their significance are not known to everyone, and a company issues the balance sheet, cash flow statement and profit and loss statement in general, but extracting the factors out of it is the tough process.

One such example is the working capital where current assets and liabilities are only taken into account, and all of them combined, are displayed in the balance sheet.

How to use Free Cashflow to Equity Calculator?

The commuters need to make sure the odds are in their favor, while gathering the factors. If they manage to do so, they will easily be able to get their hands on the product.

We assure you this with confidence because we have attached a calculator with the article, which you will find at the end of the article.

Scroll down to it, and enter in all the gathered factors in the places they belong and then you will have the answer at the end of the calculator. The calculator works on the basis of the formula, and correct details will fetch you the appropriate product.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Free Cashflow to Equity (FCFE) Calculator Usage

An analyst wishes to evaluate the money will shall be left with the company, in order to make the retaining decision, for a fresh project. With the above mentioned details, he will follow the following process.

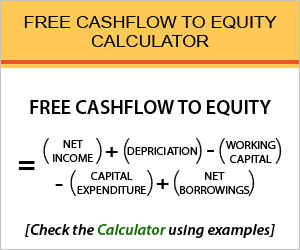

The formula is:

Free Cashflow to Equity = Net Income + Depreciation – Working Capital – Capital Expenditure + Net Borrowings

The way to commute it is:

Free Cashflow to Equity = 168000 + 150000 – 75000 – 300000 + 72000

So, with the 15000 left with the company, the analyst will decide if it is sufficient for shareholders and if reinvestment can be done.

What is the use of Free Cash flow to Equity Calculator?

The major significance of the formula has already been defined above, where the formula comes handy to commute the value of the company.

Apart from this basic valuation, this formula alongside gives an idea of the amount which is available, back to the company as the amount left with the share holders.

Though, the company may not necessarily pay the entire amount to the shareholders in the form of dividend, if it has plans to set aside a portion of it, for further growth and expansion of the company, trying to set the company in a path of progress, which would facilitate extended returns in the form of profits.

Free Cashflow to Equity (FCFE) Calculator Formula

Let us set up the formula in detail for easy further references.

Expenses are to be paid for the first thing after income is earned from operational activities. The money which stays back with the company after paying off all the expenses is use as payment toward the shareholders, and it is exactly what this formula discovers.

Investors have their motive of commuting this in order square the thereby obtained results with the dividend paid to him, or if company is planning on retaining additional earnings.

Free Cashflow to Equity – Conclusion

Purposes to commute this formula are diverse and so is it commuted by investors and analysts. The reason why this formula is used in substitution of DDM is because DDM uses dividend as the basis, as opposed to the FCFE, where cash flow is used. If the readers encounter any doubts from this article, we are open to resolving them through the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles