Profitability Index Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 19, 2022Know everything you need to, here, about the Profitability Index Calculator. We managed to include all the major aspects of the formula, and the added calculator, just makes the commutation easy.

Investments, to be precise the assets of the company are not provided in abundance. It only implies that company is responsible for its use, and each and every company has this prime motive of making the most out of it.

The first jump a company will make would be the project which requires less investment and comparatively equal or even higher returns, as compared to projects which requires high amount of investment. This relationship is portrayed, when the formula of profitability index is found.

Profitability Index Calculator

Profitability Index Calculator Details

In order to proceed with the product, you need to get some of factors:

- Future outflows

- Initial investments

- Discount rate

- Time

These are the information you need to gather. The details will be provided by the investment option and you can use them alongside the formula.

Some factors though, i.e. the future outflows, discount rate and the time are collectively used to get the numerator of the formula, which is further discussed in dept. The initial investment i.e. the money which will have to be put up by the company goes by the denominator place.

Check out more Financial Calculators here –

Profitability Index Calculator Product Details

A thorough evaluation first of the Present value of the future outflow will get you to the verge of discovering the numerator of the formula, profitability index which is the product we need to find.

Make sure you do the calculation precisely and then use the remaining factor – initial investment into the formula in order to find the product, as mentioned.

This will help you draw of conclusion of which option is better to be chosen, where a basis of 1 is taken into account, and any value which falls below it, is considered to be the least profitable investment option.

How to use Profitability Index Calculator?

We figured this article is the best way to educate everyone over the profits and loss criteria of various project options. We have accorded for the formula in this article along with the explanation.

But in order to find the formula, i.e. the product you need the assistance of the factors which have already been mentioned. Look over them and then proceed to the end of the article, where we have placed the profitability index calculator, which might come handy while calculating the formula. go to the calculator, enter in all the factors in the place they belong and then press enter to find the product.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Profitability Index Calculator Usage

A proposed investment option showed the above mentioned data, and a company was determined to find out the profitability index it contains in order to learn if it was worth consideration.

The formula is:

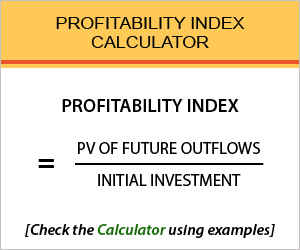

Profitability Index = PV of Future Outflows / Initial Investment

Let us find out the product:

Profitability Index = 97823.24 / 100000

Using the present value formula, we found out that the numerator shall be 97823.24 followed by which if you enter the denominator, we will find the result as 0.97823.

What is the use of Profitability Index Calculator?

When an investment is made, companies experience capital outflow in order to get a better capital inflow. The margin which is made in between the investment amount and the return is the profit earned, which a company aspire to make at the maximum.

So, profitability ratio is one such measure of profit, and is used to evaluate heavy returns with lesser investment. After valuation of a number of projects, companies tend to go for the project which has the highest profitability index. This ratio doesn’t take into account how huge or how greater the periodic cash inflows are, rather valuates the benefit made from the project in total.

Profitability Index Calculator Formula

Let us see how the formula works out:

Where,

PV = Present value

This ratio comes handy when a company wishes to know the costs associated with a project or investment and the benefits which it would yield.

Companies generally prefer avoiding projects which have the index of 1 or lesser, the reason being, any investment with the value of 1 or lesser states the company will get returns equal to or lesser than the investment amount used. Making lesser or equal returns makes no sense in investing, for the first thing.

Profitability Index – Conclusion

Companies need the best option when they have multiple projects and investment options in store, where they use multiple finance formulas including the profitability index.

So, it doesn’t matter if investment options produce higher returns of all the other options, but companies would go for one which has the greatest of profitability index. We are here to help you out with the formula, and in case you encounter any issues getting to the product, reach out for us via comments.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles