Simple Interest Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 19, 2022Simple interest has the easiest formula one can remember and so is it seamless to calculate. It is the contrast of compounding which is used fairly as is simple interest. Find out our Simple Interest Calculator below which would make your commutation job easier.

Loans offered and saving account interest paid have some of the agreements based on simple interest and is when the simple interest formula is used to calculate the interest and resulting end amount.

Simple interest is either paid or obtained for each period, unlike compounding when interest as well bears interest for the holder.

Simple Interest Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Simple Interest Calculator Variable Details

The details you will need are:

- Principal

- Rate

- Time

The requirements are as simple as they can be and are easy to consider or remember. Here, the principal amount stays common throughout the period of time with no changes in rate as well.

Taking the period into consideration, the interest rate as well stays common which is then added onto the principal. In order words, interest earned at the end of each interval is same in simple interest.

Whereas in compounding, the interest is added up to the principal at the end of one period then, further commuting is done based on the new principal.

Check out more Financial Calculators here –

Simple Interest Calculator Details

The items stated above have to be taken into consideration and differ as per the investing or lending interest of the holder.

All the mentioned variables when put together in formula will deliver you the product, or the simple interest. Here, the result is the interest which is required to be paid in case of a lending is done, or received when a principal amount is invested.

The plans will, in advance state on which basis the interest calculation is done. If simple interest basis is mentioned, the formula followed by the variable requirements is to be put into use.

How to use Simple Interest Calculator?

We agree the formula is pretty easy to calculate the product by yourself. But investment or lending cannot be done based on one figure, for the options are vast.

A wise investor will always weigh in all the necessary options available in the market and will then select the one which would grant him the highest of return. So will the lender choose an option which requires him to pay a significant lesser amount of interest for money lent.

So, precision and quick results are necessary which can be granted by the simple interest calculator. Enter in different variable items and press the enter button. This is all you are required of and the end product will be in front of you in seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Simple Interest Calculator Usage

A person wants to lend Rs.2500 for a period of 2 year, which requires him to pay a rate of interest at the rate of 6%, and wishes to know how much interest he will be paying for the same. Here is the commutation.

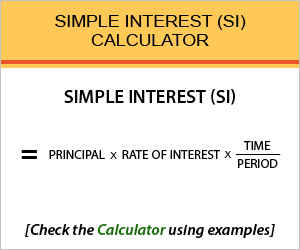

The formula is:

Simple interest = Principal*rate*time

Check out the working of the variable:

SI = 2500 * 0.06 *2

The same person if calculates the interest based on the formula will find, he or she needs to pay an amount of Rs.300 as interest. Total money he/she needs to pay at the end of period will be Rs.2500 plus Rs.300, which will be Rs.2800.

What is the use of Simple Interest Calculator?

The calculator which is embedded with the SI formula can be used for varied purposes. People having the intention of lending money or borrowing money from financial institutions based on the SI commutation, can use this calculator to determine the amount of interest.

Simple interest is also a used as a basis, on which other major formulas depend. It is based on simple interest and compound interest that major and complex formulas rely and the interest rates differ simultaneously.

The interest rates based on compound interest and simple interest differ greatly and so, it is necessary to search for the basis of interest calculation.

Simple Interest Calculator Formula

Follow up once again with the formula of Simple Interest.

The significance of each of the variable is put up clearly above and an example is given to illustrate how the formula works. Now, coming back to how there is alteration in formula, in purely depends on the time period.

The above formula is based on annual interest, and is subject to changes if the interest is to be paid on the basis of monthly. In case you want to know the total amount in additional with the interest, the SI is to be added to the principal amount.

Simple Interest – Conclusion

The sole motive of this article and the inbuilt calculator is to make our readers well versed with the formula, variables and product.

Also, the ease of commutation is provided through the calculator which does the tough part of calculating, all in a matter of seconds. Likewise, we suggest the use of calculator as per your will and let us know if you face any difficulties in the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles