Price to Book Value Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 19, 2022Keep a check on the Price to Book Value Calculator, embedded in this article. This formula would come handy to all the investors out there.

Investors who have the motive of value investing may find this formula beneficial. It is because the real value of a stock is determined this way, where the market is expected to be inefficient and there exist some firms which are trading for a value which is lesser than what they deserve.

So, some investors are always in constant search for the stocks which have higher potential yet lower traded values. Hence, this formula will lead them to those particular stocks.

Price to Book Value Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Price to Book Value Calculator Details

The factors you will need here are simultaneously 2 items

- Market Price per Share

- Book price per share

The first factor can be found in the stock exchanges in the secondary market, where they are traded and offered to public.

The book values of the share, i.e. the second required product can be derived by taking into account the total equity for common stockholders, and is found in the balance sheet of the company.

The relativity between both the shares is to find the value of the stock in order to make a conclusion on the company worthy of investing in or not.

Check out more Financial Calculators here –

Price to Book Value Calculator Product Details

So, we have precisely discussed the factors of the formula, which leaves us with the discussion on the product. Product is the price to book ration which would be derived at the end of the formula solution and is measured on the basis of 1, the reason is further explained.

The motive behind the product is to identify the stocks which have a low book value, but the market thinks they are worthy enough of more; and for stocks which have a higher book value but market states the asset value of the company is overstated or if it is performing bad making lower return than normal.

How to use Price to Book Value Calculator?

You do not need to worry about the calculation of the formula, as we got your back in this case. You simply need to work hard on searching for a group of valued companies and of course the means to gather the factors of the formula.

There it is, you hard work will be done if you reach this page. The factors you need and how you will find them is discussed, so you simply need to pick them up and enter them in the calculator given, exactly in the blanks they belong. Just when you press enter, you will see the results in a matter of seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Price to Book Value Calculator Usage

The book value of a company, derived from its balance sheet stand to be Rs.40, whereas the shares are being sold in the market for a value of Rs.100, then the price to book value ratio will be:

The formula is:

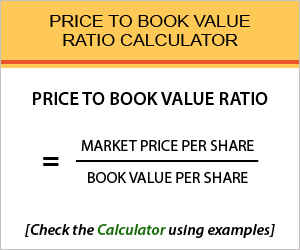

Price to Book Value – P/B Ratio = Market Price per Share / Book Value per Share

So we need to calculate the ratio in this manner:

Price to Book Value – P/B Ratio = 100 / 40

So, the price to book value of the company’s share in question would be 2.5.

What is the use of Price to Book Value Calculator?

The best use of this formula is where investors use it to determine the price at which the market thinks it is of value. So, the basis of evaluation is of 1 when any stocks above the value of 1 have a tendency to be paid more by the market than the equity per share.

On the contrary, below the ratio of 1 implies the market not willing to pay the price of the equity.

So, the performance of the company can as well be determined by the formula, as any formula below the ratio of 1 are have a stagnant performance rate, below the par level.

Price to Book Value Calculator Formula

So, the formula which you need to commute here is the:

Other reference with this formula is of market to book ratio. So, here we take into consideration, the book value of the stock with the price for which the share is available in the market.

Here, 1 is taken as a measure of valuation and any stock which goes with the price to book ratio below one, is considered to be undervalued. But, tit is also a matter of fact that this formula has pretty much shortcomings.

Price to Book Value – Conclusion

There are reasons for the formula to not stand up to its potential, and so, we must know that this formula has a set of shortcomings.

But, the one use it can be put to is that this formula is an easy way of determining which companies are undervalued and which of them are overvalued.

For further help with this formula, or to clarify your doubts, if any, you may leave the explanation of same through the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles