Net Working Capital Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 18, 2022This read-up contains all the information about the Net Working Capital Calculator. Before getting onto the commutation part, let us start with the discussion of the formula and what it signifies.

A company does not entirely rely upon capital investments in the form capital funds and assets. The operational activities which are carried on a daily basis need a separate fund deposit, which exists for a short period and in more liquid in nature, for facilitation of daily transactions.

It is the working capital we are referring to here, which is proportionately catered by the company in liquid form and used for a period which is a year or shorter than a year.

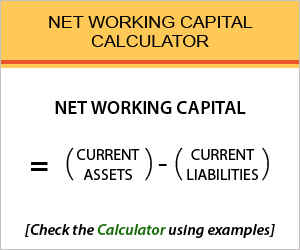

Net Working Capital Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Net Working Capital Calculator Details

Commutation of net working capital is easy if you have the factors:

- Current assets

- Current liability

The Current assets are the assets of the company and their general differentiation from other assets is that, they are short term assets, with the highest liquidity, as in, they can be converted into cash in a period less than a year.

As for the current liabilities, they are all the debt obligations which are to be paid within a year. Current assets and current liabilities are generally found in the company’s balance sheet along with all the other long term assets and liabilities.

Check out more Financial Calculators here –

Net Working Capital Calculator Product Details

Speaking of the product, commutation of it is pretty simple. The catch lies in the identification of the current assets and current liabilities from all the other assets and liabilities.

Make sure you are well versed with the items of the balance sheet which fall along the category of current assets and liabilities. If not, they are mentioned further in the article.

The product will be easy to find, which the net working capital is. The significance of the net working capital tagged along with the company and also its operations is briefly mentioned further. You may use our calculator for the commutation process.

How to use Net Working Capital Calculator?

Calculator we put along with this article is pretty easy to use and it definitely would come handy for you if you want the product of the formula in correct figures.

Yes, you are free to do the calculation by yourself, but the calculator way will save up some time for you. Irrespective of the needs, anyone who finds this article will have the right to use the calculator.

The factor requirement is however to be sorted by the commuters themselves. It is great to use, as it has blanks for the factors and when you fill them up, the calculator will display the result.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Net Working Capital Calculator Usage

A company has prepared a balance sheet and the current assets amounted to Rs.1000000, whereas the current liabilities amounted to Rs.800000.

The formula is:

Net Working Capital = Current Assets – Current Liabilities

Working of the same is:

Net Working Capital = 1000000 – 800000

This makes the networking capital of the company amount to a total of Rs.200000. This amount can be used by the company for any of the operational purposes, as a source assesses to instant funds. The amount which is left with the company as net working capital can also be put to use for other fruitful sources.

What is the use of Net Working Capital Calculator?

Apart from some of the fixed investment which include shareholders fund, properties, furniture in the company, a company needs to maintain a good proportion of working capital.

This capital is used against the expenses which occur on a regular basis, as a result of daily operational activities. Companies need to have an additional amount, apart from current assets, to ensure immediate strategic actions as well can be taken, such as investment decisions which helps the company grow.

Companies prefer keeping track of the net working capital, to keep a part of the funds liquid and also in order to protect the company from major uncertain risks.

Net Working Capital Calculator Formula

Let us discuss the items that belong to the working capital formula.

The balance sheet of the company is just what you need in order to compute the working capital formula. But, all the assets and the liabilities do not belong to the current types, so the commuter had to fetch out the ones.

Some of the examples of current assets are cash, account receivables, inventory, etc whereas the example of liabilities are creditors, taxes payable, wages, monthly instalment payments of long term debts, etc.

The assets need to be over the liabilities, and it indicates the company is doing a pretty good job at maintaining the net working capital.

Net Working Capital – Conclusion

The company needs to be financially strong, in undertake any long terms activities and also short term activities. Sufficient long term funds are must, but so are the short term funds necessary, and they contribute to the operating procedures ensuring all the operating of the company goes on without facing any kind of shortcomings.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles