Net Asset Value Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 18, 2022Let us put this in straight forward terms, as this formula comes handy for Mutual fund companies and exchange traded fund. We have enclosed the Net Asset Value Calculator in this article.

The mutual fund shares are not traded in real time basis but rather once in a day, basically towards to end of the day. So, since a fund is launched and its share goes out for public, this formula is used to determine the prices of each of the share of the particular fund.

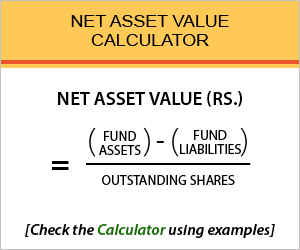

Net Asset Value Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Net Asset Value Calculator Details

The factor details you will have to sort out in order to calculate the formula are:

- Fund assets

- Fund liabilities

- Outstanding shares

As for the first and the second factor, all the items of the balance sheet are to be included. Make sure you take into consideration each asset of the company and also each liability of the company and include them in specific terms.

You will also have to gather the information of the shares which are issued and held by various parties, as they are the outstanding shares of the company and also to be included in the formula.

Check out more Financial Calculators here –

Net Asset Value Calculator Product Details

Well we know the exact reason why this formula is worked upon and if you think it is necessary for you to understand or you simply have interest to explore this arena, it is important you know the result.

So now that you know what the factors are, fetch them out if you want to calculate one and keep them handy. All the factors after put in the formula and then worked out using our calculator will determine the product of the equation.

The product here is the formula net asset value itself. So at the end of the formula, you will have the product, i.e. the net asset value.

How to use Net Asset Value Calculator?

So, are you familiar with the factors of the equation and the product already, as we tried to be as brief and precise as we could? Now if you did understand it, you have overcome the tough part because we make the further process easy for you. Here you are more likely to enjoy the results in a fraction of second, in this article.

It is because we put up a calculator for you which is embedded with the formula of net asset value. As your part, you simply have to enter in the factor details in the correct field and you will have the product commuted by the calculator.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Net Asset Value Calculator Usage

A mutual fund company wants to issue shares for offer to investors and so, it wishes to determine the Net Asset Value, so as to figure out the pricing of share. It has fund assets of Rs.1000000, fund liabilities of Rs.100000, while the outstanding shares of the company are Rs.100000 respectively. Here is what it would do-

The formula is:

Net Asset Value – NAV (Rs.) = (Fund Assets – Fund Liabilities) / Outstanding Shares

Here is the workout:

Net Asset Value – NAV (Rs.) = (1000000 – 100000) / 100000

So, the end of the formula would be a product of Rs.9, which can also be commuted using the calculator.

What is the use of Net Asset Value Calculator?

Speaking in terms of an investor, the formula net asset value might be of no use for him, other than the motive of increasing knowing of how the prices are determined.

Speaking in terms of a mutual fund company, they may find it extremely pleasing and useful, as it is used in the process of evaluating the price of a particular mutual fund.

This formula can only be evaluated in terms of the value a share holds, and not used as a measure of determining the future outcome and neither are the future estimates included in the formula. It is merely based on the present holding of the company.

Net Asset Value Calculator Formula

Let us determine the value of the net asset value by proper understanding of the formula

As we all know mutual funds pool money from investors and then are offered to be bought as shares by investors, thereby diversifying the money as well as the risk associated with it.

So, the company use this formula by taking into account their asset and liabilities and then price the stock based on the result derived.

Also, the mutual funds do not use the basic valuation method like the public companies do, because the share offered to investors are done through the origins rather than a stock exchange.

Net Asset Value – Conclusion

Increase your knowledge and widen the arena you are well versed with in relation with mutual funds and their pricing criteria.

Follow up with the article in order to know how the mutual fund prices work and test some of the figure through the calculator we provided. If you see some issues while calculating the same, let us know in the comment section below.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles