Geometric Mean Return Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 17, 2022Catch up with the Geometric Mean Return Calculator, and all the information on the formula in this article. Let us get going with the formula and its description in the first place.

Effect of compounding is basically the process of assets put into work to earn incomes from the same, which are then reinvested during the next period for the normal course of operation.

In such a way, earning made from a period is then reinvested and generate a new set of earnings for the next period. The concept of geometric mean return is focused on the understanding of this term, and once understood, we can easily perceive each of the company applies this process.

Geometric Mean Return Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Geometric Mean Return Calculator Details

In order to commute the formula, we will need a couple of factors and they are:

- Rate of return of multiple periods

- Multiple periods or time

Geometric mean return, also referred to as compounded annual growth rate, or time weighted rate of return need the above mentioned factors. The reference is also made with geometric average return.

So, the first factor is the rate of returns of each of the periods and they are to be mentioned in the form of percentage. The second factor is the number of periods for which the concept of compounding has been in trend.

Check out more Financial Calculators here –

Geometric Mean Return Calculator Product Details

Now that we are well versed with all the factors and also have a grasp of what compounding means, we are going on the correct track which will probably lead us to the correct place.

The correct place we need to reach here is the product of the equation, which is the geometric mean return calculator itself.

A strong hold of the information, the formula and the factors will lead you to the desired product here, which is the entire point of commuting the formula in the first place. You can follow up further in the article as we have also given a reference in the form of an example.

How to use Geometric Mean Return Calculator?

It is pretty much easy to use a normal calculator, on the contrary of solving a set of diversified figures and calculation. This is the same for the geometric mean calculator we put up in this article.

The geometric mean calculator is unlike a normal calculator and is the reason why you should refer to. This calculator has the exact geometric mean return formula embedded into it which makes it easy to commute the formula.

All you need to do is, enter in the asked factors, the different rates you have and the number of periods in their place and you will get the result in seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Geometric Mean Return Calculator Usage

Let us assume the rate of return for a number of 7 seven years has been a above, so in order to calculate the average rate of return per period you need to:

The formula is:

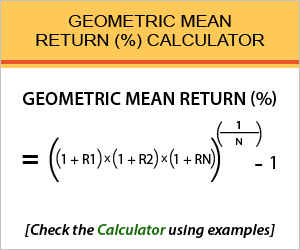

Geometric Mean Return (%) = (((1+R1) * (1+R2) * (1+Rn)) ^ (1/n))) – 1

Here is how to solve it:

Geometric Mean Return (%) = (((1+7)*(1+9)*(1+12)*(1+5)*(1+6)*(1+3)*(1+6))^(1/7))-1

So, taking into consideration all of the above factors and the formula all combined, you will get a result of 6.8%.

What is the use of Geometric Mean Return Calculator?

This formula is used by analysts, who study the investment which fetch a return on the investment as well as the interest of previous years.

This way the returns will be of greater proportion and is why they suggest people to also invest the returns made in the form of dividend and earnings.

This is contrary to simple interest where all the returns are added with the total number of years taken into consideration, which cannot be broken down to a particular rate per period.

Hence, this formula is also used for effective rate per period of the holding period return.

Geometric Mean Return Calculator Formula

Let us discuss the formula precisely for a better understanding.

Where,

R = rate of return of multiple periods

n = number of periods or time

The formula implies to all the investments which are compounded, and hence, in order to know the annual returns for a lot of period in average.

The amount of investment is no where required to be taken into consideration, as the formula evaluates the average just on the basis of return percentages of per year, hence making it easy for comparison in between two or more than two investment options over a course of time more than a year.

Geometric Mean Return – Conclusion

Compounding is always profitable as the returns are greater than in simple interest but, with further comparison among the compounded option, you will be able to create an investment portfolio fetching you the most of returns. For further doubts and queries relating to the geometric mean return, leave a comment below.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles