Future Value Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 17, 2022This article is all about Future Value And the Future Value Calculator. We assure, you will have a thorough understanding of the formula by the end of this article.

Investors take into consideration, the benefited returns before actually making the investors. The excess of returns an amount will bear, as compared to its present value is one such phenomenon from various others, while taking a decision.

Futures value holds a pretty important position in finance, and the formula used helps one know to aggregate future value of a sum invested today. The belief is placed upon the time value of money, and it says a fixed amount of money today being invested is better than having the same amount of money after a year or so.

Future Value Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Future Value Calculator Details

The factors you need, to obtain its future value using a calculator is given below.

- Cash flow of a period

- Rate of return

- Number of periods

The factors which go into the formula, thereby resulting into an obtained future value are cash flow of a period, rate of return and number of periods. Not much of factor details are required here, making it easier to obtain FV of a product.

Specifying the factors, cash flow of period should be the amount you wish to calculate the FV on. Rate of return is a particular digit in percentage, and is the interest which will be added up to the cash flow in fixed intervals. Lastly, number of periods being the time for which the cash flow is intended to be held.

Check out more Financial Calculators here –

Future Value Calculator Product Details

The formula is based on the approach that, it needs specific factors (ones stated above) to be filled up, following by which the calculation is to be made, thereby obtaining the product.

The FV amount which we receive at the end of worked formula is the product we are referring to here. So, if you plan on investing an amount presently, and wish to know how well it will be appreciated, the FV and its product would come handy.

This is where lies the essence of investment decision, for the investors will be in the merit of taking in account a number of investment options, then calculating and selecting the one which bears the maximum return.

How to use Future Value Calculator?

Working out the formulas yourself might come up with a clause of being incorrect, and this is why choosing a calculator will prove to be the appropriate choice.

We have enclosed a calculator in this article which would let you determine the FV just by entering in the desired factor. Figure out the money you wish to invest and the time period, along with the rate of return, and enter them all in the respective blanks provided.

Pressing the enter button after entering the factors will display the result in an instance. Therefore, it save your time, letting you try a different combination of figures in order to reach a specified goal.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Future Value Calculator Usage

Mr. X wants to invest Rs.500 for a year in which he will be enjoying a rate of interest at the rate of 6% per month. This is because the formula is based on compound interest, and here is what he will have at the end of a year.

The formula is:

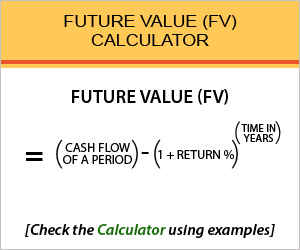

Future value = cash flow of a period * (1+r)n

Here is the workout:

FV = 500 * (1+0.06)12

The solution, after solving the above formula by himself or by using the calculator will be Rs.537.21, based on compound interest. It is the money he will be having at the end of a year, if the investments are done as planned.

What is the use of Future Value Calculator?

Future Value is mostly used in the banking sector, where annuities are calculated on the basis of FV. Ordinary annuities or annuities due are the series of monthly interest payments thereby, taking FV as a component of monthly payments which are then added up to determine the final value of annuity.

Banking sector being briefly mentioned doesn’t make the use of FV calculator limited to it. It is important and used in almost all the arenas of finance industry, and referring to a few, banking, investment and corporate finance use FV the most.

In other words, the FV has got an individual identity but is as well included in other formulas as a component.

Future Value Calculator Formula

Here is the formula of future value we have been speaking of:

Mentioning each of the factor, we have prior discussed which the role of each of the factor is and how a result can be obtained. The formula is worked on the basis of compound interest, probably compounded monthly.

Being compounded on a monthly basis, n will be 1*12=12 and r will be 0.6%=0.06. This formula is used by the calculator, whereas, you may as well personally solve and check the answers to tally how appropriate the calculator is.

Future Value – Conclusion

The investment decision needs consist of weighing in a lot of figures and time period, and solving them all by yourself is much of a hassle job. Hence, we decided on making your task easy and convenient by preparing a table to help you evaluate your decision based on quick results.

You may cross check the product and if you find an issue regarding it, you may leave a comment in the section given below.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles