Equity Multiplier Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Investments in the form of assets are basically done through borrowing, or issuing equity. Equity multiplier is the formula which lets one evaluate the how much of such finance is done through equity, and how must is done through debt. Use the Equity Multiplier Calculator in this article, to commute the formula.

This way, the risk factor is studied, in regards of the leverage it owes to the creditor and the investors of the company. So, a company’s productivity in terms of operations and survival is showcased through the Equity multiplier ratio.

Equity Multiplier Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Equity Multiplier Calculator Details

The process of calculating equity multiplier requires a couple of factors and they are:

- Total assets

- Stockholders equity

It is a financial leverage ratio, and in order to find of the equity multiplier, you will need the total assets of the company which can be found in the balance sheet of the company.

The second factor required is the stockholders equity, as the formula is about equity multiplier. This factor will as well be found in the company’s balance sheet.

On the contrary, you may as well subtract the total assets of the company from the total liabilities in order to find the stockholders equity, given such relatable circumstances.

Check out more Financial Calculators here –

Equity Multiplier Calculator Product Details

Taking into account the factors of the formula, you need to have access to them. This will let you figure out how the solve the formula which will derive the product.

The result here is the equity multiplier, obtained after the end of formula solution. You may as well refer to the calculator at the end of the page, which will make your job of calculating the product easy.

Debt will not be mentioned in the formula specifically, but is a factor obtained through the product. The relationship between the product here and the debt is explained further, which would help you have a clear idea.

How to use Equity Multiplier Calculator?

Figure out why you need to calculate the equity multiplier and for what further use can it be put into. Once you are well comprehended of the factor, product and the use of the formula, we suggest you to move on to the end of the page where you will find the equity multiplier calculator.

The calculator is embedded with the formula of equity multiplier. Users need to enter in the details of factor in places where they are asked. All the instructions will be given and you have to follow it, and press enter button at the end. The product will be displayed in front of you.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Equity Multiplier Calculator Usage

You can find the leverage ratio, Equity Multiples of a company if it has a total asset worth of Rs.1000000, among which Rs.200000 worth of money is leveraged to stockholders Equity.

The formula is:

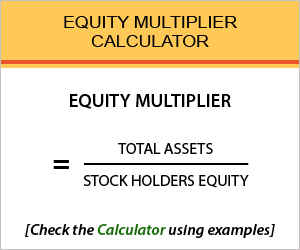

Equity Multiplier = Total Assets / Stockholders Equity

Let us check the working of the above mentioned company.

Equity Multiplier = 1000000 / 500000

Calculating the equity multiplier of the company in question, we will obtain the product of 5. Here you may assume that a greater portion of the company’s assets come from debt, rather than its investors.

What is the use of Equity Multiplier Calculator?

Debt servicing costs of the company can be obtained if you find the Equity multiplier, because if the company takes up a lot of debt, then it is entitled to high payment of debt servicing costs.

Being a leverage ratio, it is also put to use into finding a number of financial ratios of the company such as return on equity DuPont and others.

So, the equity multiplier formula can be put to use for finding the debt of the company and also the equity of the company, as they are both included in the total assets part of the formula.

Equity Multiplier Calculator Formula

Take into account the equity multiplier calculator and the formula used.

Equity multiplier is a leverage ratio which determines how much a company is leveraged to the investor and creditors of the company. So, in the equity multiplier formula the stockholders’ equity and total assets of the company are taken into account, which also features the debt part of the company.

So, if the equity multiplier of the company goes up, it means fewer assets are leveraged to the investors; thereby indication the company has heavy debt. This way, if the company does not secure sufficient cash flow to match up to the debt, it is exposed to being shut down.

Equity Multiplier – Conclusion

Investors can in turn try predicting the stability of the company they wish to invest in. The debt and equity issued by the company plays a special role, and the earnings on the other hand determine the stability.

So, if the cash flow is constant for companies which have huge debt, they will be able to suffice the operational activities. If you face issues while calculating the formula, mentioned where you got stuck, in the comment section below.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles