Earnings Per Share Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022If you are on a quest to pick up stock on the basis of value of earning, you may use our Earnings Per Share Calculator to commute EPS formula. It also determines the possible future growth prospects of the company and the future likely returns.

Earnings per share is the money a company makes for each of the share it issues. So, the investors can take EPS as a basis to compare how much money market is paying for earnings that the company makes.

Earnings Per Share Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Earnings Per Share Calculator Details

Here are the details you will need in order to calculate the EPS formula.

- Net income

- Preferred income

- Weighted avg. Outstanding shares

As the first factor is net income, you need to take into account the net income of the company for the year, which can be found in the income statement. Preference shares income is to be excluded, as common stocks are to be taken into evaluation. So, any such preferred incomes found are to be subtracted.

The last factor is the weight average outstanding shares for the year, so if the amount of outstanding shares the company issued is not constant for entire one year period, the weight average should be found and used.

Check out more Financial Calculators here –

Earnings Per Share Calculator Product Details

The above mentioned 3 factors are required to be put in order to find the product. The product here is the earning per share. The balance sheet of the company is used to find all the above mentioned factors.

The product here has a greater purpose and significance too, as it is also used to evaluate the price to earning ratio, where earnings is the EPS. EPS is important, but when put together in comparison with share price of the stock, will help invests have a better idea of the share, in many terms such as future growth and returns.

How to use Earnings Per Share Calculator?

Check out your motive of finding EPS for the first thing, and then take a look at the factors which are required in the process of calculation and find them all.

Then take up the formula and use the obtained factor to commute the product. We have made your job easy by adding up the earning per share calculator here, in this article. So, you can scroll up to the calculator and then enter in all the factor details as asked.

Cross check to be sure, you entered in the right details and then press the enter button on your keyboard. You will see the working along with the product below the calculator.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Earnings Per Share Calculator Usage

Suppose, a company XYZ has a net income of Rs.10000000, among which it pays Rs.500000 as preferred dividend. The weighted average outstanding share for the said company is 7500000.

The formula is:

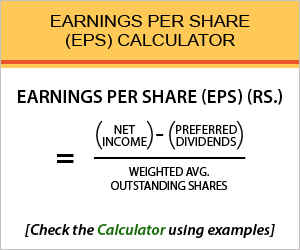

Earnings per Share (EPS) (Rs.) = (Net Income – Preferred Dividends) / Weighted Avg. Outstanding Shares

Apply the numbers to the given formula.

EPS = (10000000 – 500000) / 7500000

So, if the formula is commuted with the use of the earning per share calculator, the product thereby will be Rs.1.27. Therefore, XYZ company makes an amount of Rs.1.27 on each of its share.

What is the use of Earnings Per Share Calculator?

Use of Earning per share is also related to dividend. Most of the companies do not pay all of their earnings to the stockholders, and the percentage of earnings paid will be the dividend payout of the company.

But some of the companies do pay all of their earning to stockholders and that is when earnings will be equal to dividend. In similar manner, earning per share will also be equal to dividend per share.

Apart from the relationship with dividend, EPS is also used to calculate price to earnings ratio, stock valuation and a couple of other formulas as well.

Earnings Per Share Calculator Formula

Here is the reference of earning per share formula.

Here, in this formula, the EPS portrays the earnings of the company for each of its share and hence the product is expressed in rupees.

The reason why any preference share dividend is subtracted is because the EPS is evaluated only on the basis of common stock.

If the average outstanding shares for a period change at some point, then each of the period’s average is to be obtained and then added with each other in order to obtain the exact, entire year’s average outstanding shares.

Earnings Per Share – Conclusion

We assume you already have the stocks sorted, the ones you are willing to buy or invest in but are confused. You need to make a thorough comparison of all the stocks in question including the EPS and then need to make a decision which will best serve you. We hope to have cleared your concept of EPS and if you still face difficulties, let us know in the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles