Diluted EPS Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Earnings per share is used for a lot of formulas but you never know when a particular change takes place and the company decides to convert the convertible securities into share. This is where the need of Diluted EPS Calculator used to calculate the Diluted EPS formula kicks in.

This is where a gap arises in the real value of share and the commuted share, hence we suggest the investors to use this Diluted EPS formula in the place of the EPS. Diluted EPS covers almost all the aspects, thereby declaring the performance of each of company’s share in aggregate.

Diluted EPS Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Diluted EPS Calculator Details

The factors which will help you determine the diluted earnings per share are:

- Net income

- Dividend on preferred stocks

- Outstanding shares

- Diluted shares

The first factor you need is the net income which can be obtained from the company’s balance sheet. You then need to find the dividend which is promised to the respective preference shareholders.

The outstanding shares are the ones which are left with the company and not subscribed for by the public. Diluted share are the convertible securities which can be converted into shares of the company and then further adds on to the outstanding shares, thereby playing a backward role on the EPS.

Check out more Financial Calculators here –

Diluted EPS Calculator Product Details

You now are aware of the factors which are to be put in the process of determining the Diluted EPS. We also explained what each of them signifies and how they can be obtained.

While you gather them all, make sure they are appropriate. All the factors are to be put in the formula in their respective places and this will let the investor find the EPS.

This will give him an idea of the future possible effect on the EPS, if by chance the diluted securities are converted and add up to the outstanding securities, which may happen any time.

How to use Diluted EPS Calculator?

You will actually need a number of 4 factors for this simple formula which will determine you the possible future earning capacity of your owned shares.

It tells us how the present shares will be affected if the diluted securities are added on to the outstanding shares of the company.

So, if you are keen to know it, you need to enter in the details of factor after you find then, in the calculator beside the names. Follow up on the factor details to check you entered them correct and then press enter. You will then find the working and the answer, i.e. the earning you will make from each of the share.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Diluted EPS Calculator Usage

Assume a company has a net income of Rs.50000000, while providing a dividend of Rs.200000 to all the preference shareholders. The outstanding shares left with the company are worth of 15000000 and Rs.300000 worth of convertible dilute share. In order to find out the EPS, you need:

The formula is:

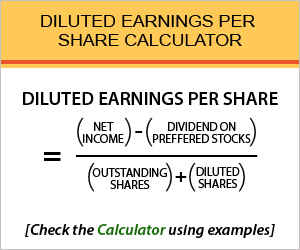

Diluted EPS = (Net Income – Dividend on Preferred Stocks) / (Outstanding Shares + Diluted Shares)

Here is the workout:

Diluted EPS = (50000000 – 200000) / (15000000 + 300000)

So, when you use the calculator or solve the formula yourself, you will know the EPS is 3.25. Now, you can compare if the EPS has become stagnant or is fair enough.

What is the use of Diluted EPS Calculator?

The major use of the formula is, to use it on behalf of the EPS, in order to consider the fact and possibility of convertible securities (diluted securities) being converted into share.

The EPS formula and this diluted EPS share formula are interchangeable, where one determines the actual earning, whereas other determine the earning after diluted securities are as well accounted for.

The change is based on the very fact that, the diluted securities can be converted anytime, based upon the will or need of the company. Investors use this formula to know the possibilities in advance. Well, this formula can as well be used in the place of EPS while calculating other major formulas which use EPS.

Diluted EPS Calculator Formula

We know we have already stated the formula, but let us go through it again to help you exercise the same as per your requirement, seamlessly.

You need all the information as stated in order to solve the formula. Well, the diluted securities comprises of securities such as Convertible preferred stock, stock options, and convertible bonds, where all of them are convertible into shares.

If this does happen and the dilutive securities are converted, this will simultaneously decrease the money made from each of the share, by the shareholders.

Diluted EPS – Conclusion

You can now determine if you will be able to make the same returns on the shares you own where the returns are standard, or if the convertible securities will in some way or the other decrease your earning out of the shares.

Use the calculator and compare the diluted EPS from the future estimates, and if you encounter any difficulty which using the calculator, let us know the same in the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles