Capital Gains Yield Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Dividends being excluded, the Capital Gains Yield Calculator indicates the increase or appreciation in a stock price. Calculating the dividend received from the stock has a different formula, and both of these formulas, i.e. the dividing yield and the capital gains yield combined together helps an investor determine the total stock return.

The appreciated price is therefore expressed in the form of percentage. This helps the investors learn if they are subject to capital gain or capital loss.

Capital Gains Yield Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Capital Gains Yield Calculator Details

In order to calculate the capital gains, yield you will need these two factors.

- Initial stock price

- Ending stock price

These two factors are must in order to know the percentage of capitals gains you managed to acquire along or if you suffered any kind of loss.

Describing the factors, the initial stock price is the amount at which the purchase of share was made, and the ending stock price is the money at which the stock is sold, and if held, the end of first period. As referred, you may also evaluate the profits or loss made over a particular period or time interval.

Check out more Financial Calculators here –

Capital Gains Yield Calculator Product Details

You need to enter in the factors given above into the formula of capital gains yield. As described, note down the price at which you bought the stock and the price at which you sold it, and then use the formula which is discussed later on, or simply the calculator we put together in the article.

When calculated, you will be able to get the product which is thee capital gains yield percentage, and it will showcase if you made capital gains or on the contrary, capital loss. The percentage determines how much gain or loss you made over the course of time the stock was held.

How to use Capital Gains Yield Calculator?

As we have put up together both the factors needed, you need to refer to them both in order to obtain the capital gains yield. Scroll down to the bottom of the page and you will be able to find the calculator, wherein you will find the factor details with adjacent blanks.

You need to fill out the blanks as per the instructions given, i.e. fill the factors in the right places and then click on the button enter. This will probably direct you to the answer, i.e. the product in a matter of seconds. The answer here is the capital gains yield.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Capital Gains Yield Calculator Usage

| Factors | Product | |

| Initial Stock Price (Rs.) | 100 | 10.0% |

| Ending Stock Price (Rs.) | 110 | |

An investor has bought a share of xyz company for Rs.100, which she later on sells at the rate of Rs.100. Here is how you calculate the % capital gains yield.

The formula is:

Capital Gains Yield = ((Ending Stock Price – Initial Stock Price) / Initial Stock Price) * 100

Let us get to the solution.

Capital Gains Yield = ((110 – 100) / 100) * 100

After solving the above formula and with the mentioned numbers, the product will be 10%, as in, the investor is likely to make 10% of capital gains over the sold stock.

What is the use of Capital Gains Yield Calculator?

This formula is basically used in the context of capital gains made from the bought stock. The thereby obtained percentage can either be positive or even negative, indicating the percentage loss or gain made in the course of time.

If the stock price is greater at the end, higher will be the percentage obtained and simultaneous increase will be witnessed in capital. Another use of this formula is, as a variable in the Gordon growth variable.

You may as well refer to the capital gains yield formula as a rate of change formula, so if the stock has a greater percentage CGY, the stock has higher performance.

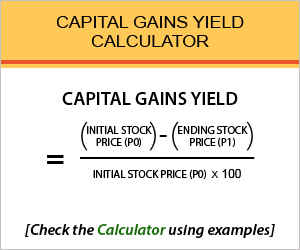

Capital Gains Yield Calculator Formula

We want you to go through the formula once again, so you will be able to do any further research yourself.

Here,

P1 = ending stock price

P0 = initial stock price

This formula is embedded below in the article in order help you calculate the amount sooner than you would be yourself. The resulted percentage is also expressed in terms of company’s total stock return, if it doesn’t roll out dividends to the stockholders.

Also, you can only calculate the start and end gains or a periodic gain through this formula. You may not be able to get an appropriate percentage if you add up different period gains to determine the capital gains.

Capital Gains Yield – Conclusion

We have disclosed every minute detail we could to help you solve the formula in a better way and also have put up the calculator embedded with the said formula.

It would do justice to you if you follow up with everything which is written in this article. In case of issues, feel free to leave a comment, by the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles