Book Value per Share Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022As the formula of Book Value per Share Calculator itself reads, it lets the aspiring investor evaluate the price of each of the share which is sent to common shareholders for subscription.

This article has each and every aspect of the formula covered, including the factors, the out and how the Book value per share is calculated.

You will also find a calculator in the end of the article which would do the process of calculation for you, all you have to do is enter in the factors.

Open Demat Account Now! – Save upto 90% on Brokerage

Book Value per Share Calculator Details

The factors to be needed here are:

- Shareholder’s equity

- Number of common shares

The details are in relation with the company in which one plans to invest. The details are to be obtained from the company’s balance sheet, or the information disclosed by the company.

Even if you have access to the assets and liabilities of the company, you can easily obtain the shareholders equity value. Subtract the liabilities by its assets, and the difference amount is the shareholder’s equity.

If you can evaluate the formula, you will also be able to figure out how profitable the deal is.

Check out more Financial Calculators here –

Book Value per Share Calculator Product Details

If you have access to both the factors which are needed to calculate the book value per share, you will be able to get the product of the formula, or in other words the book value per share.

Having diverse needs of the values, a huge number of investors try commuting book value per share, where the most common need for the commutation is comparison.

Investors also try to compare market prices to know the surge and also, the potential of growth the company possesses in future. This lets the investors predict how profitable the stock would be for them.

How to use Book Value per Share Calculator?

If you have access to the company’s balance sheet, of which you aspire to buy the shares based on the comparison you will make, you will be able to find the difference between the market price and the existing equity of the company.

The above factors are to be obtained, and then is to be entered into the calculator is the fields as describes. Just when you enter the factors and then press enter, you will have the value of the company’s equity in front of you. Use may use the value given as per the benefit it contains for you.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Book Value per Share Calculator Usage

| Factors | Product | |

| Cash Flow of a Period | 2,00,000 | 100

|

| Rate of Return % | 2000 | |

A person wishes to know the price which is offered to

The formula is:

Book Value per share = Total common shareholder’s equity / Number of common shares

Here is the workout:

Book value per share = 200000 / 2000

So, the result here is 100 which means the company actually has the equity of value 100 each. In other words, the company has 2000 equities, each of which is valued at Rs.100. Now, it will be easier for you to compare the actual equity of the company with that of the market price.

What is the use of Book Value per Share Calculator?

An investor can compare the equity which exists in the company, with the prices in which it is being offered to the public for subscription. The offer price here, is the price of the stock.

This evaluates the price basis of the company’s equity, as in the final price at which the company is selling its equity in the market.

The market price can be equal, greater or lesser to the existing equity and each of the phenomenons portrays the growth potential of the company in future terms. Book value per share can also be put into use as a component of the return on equity formula.

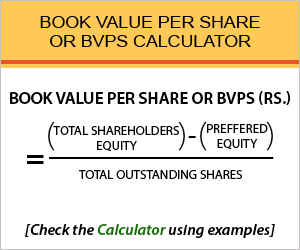

Book Value per Share Calculator Formula

Let us go through the book value per share formula in brief, to help you evaluate the price of share you wish to buy.

The term which is used in the formula, the book value, determine the worth of the company which is obtained after the liabilities of the company are subtracted from its assets.

The book value is basically the stockholder equity which is also referred to, with different names such owner’s equity, etc. The respected equity we have been referring of the company is often found in the balance sheet of the company, in the liability side.

Book Value per Share – Conclusion

Now, that you have been through the article, you will be easily able to calculate and also compare the different values of the company.

As in, the value of equity of the company is derived through this formula, which can be used to compare the price at which it is offered for subscription to the general public in the market. use the calculator to find the book value per share easily.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles