Average Collection Period Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Discussing in this article about Average Collection Period Calculator in detail and formula to give you the exact ratio.

A company can be well judged for investments, if an investor knows about the Average Collection Period of a company, then it will be easier to know the time between the credit sales and payment received by clients.

The high and the low ratio helps investors to know the frequency of payments, organization is able to collect.

Average Collection Period Calculator

Average Collection Period Calculator Details

To calculate the Average Collection Period, following are the required details:

- Sales Revenue

- Average Account Receivables

With these two factors we can generate the ratio with a simple formula discussed further. Sales Revenue indicates the income a company generates in a business after the sale of goods and services.

For Average accounts receivable we can say, it is the average amount of trade receivables on hand during a fixed period.

Average Collection Period Calculator Details

In calculating process, if you have these two details mentioned above, you can directly get the result through the formula discussed further.

Investors need to have the factors, followed by placing these number in right place in the formula and final product received is the Average Collection Period.

Finding out these ratios is sometimes not easy to get, but for our investors we have come up with the Average Collection Period Calculator, with required details to make it simple.

Enter the details in the right place and press the enter button to get the correct product.

Check out more Financial Calculators here –

How to use Average Collection Period Calculator?

The Average Collection Period Calculator is very handy to use. If the objective is known then investor can input the details in the formula to get the Average Collection Period of a company, which is also the number of days within which a company receives its payment through clients.

For your convenience we have illustrated an example in next section. You can choose the company in which you want to invest in.

Example of Average Collection Period Calculator Usage

Here giving you an example of calculating Average Collection Period for a company you wish to invest in.

Coming on to the calculation part, suppose there is company ABC and we need to find its Average Collection Period

What required first is:

Sales Revenue (Rs.) = 400000

Avg. Account Receivables (Rs.) = 100000 Now, when we know these two details, the next is placing the details in formula of Average Collection Period.

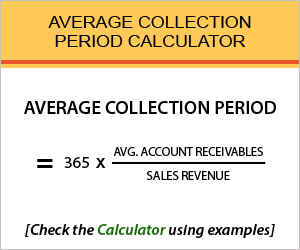

Average Collection Period = 365 * (Avg. Account Receivables / Sales Revenue)

Placing the above numbers in the formula, we get:

Average Collection Period = 365* (10000/100000) = 36.5 days

Hence, Average Collection Period of the ABC is 36.5 days.

Find out other Financial Ratios & Technical Analysis Calculators here

What is the use of Average Collection Period Calculator?

The income of the company is known by the Average Collection Period. This is the important part to know before investing in a company. Basically, this calculator tells you about company’s efficiency in extending credits and collecting debts

Also, if the high and low Average Collection Period helps the investors to take the right decision. A company holds a good rapport, if there is smooth credit and payment done between client and company.

Average Collection Period Calculator Formula

The example is enough to know the basis of Average Collection Period Calculator. For more details here we will discuss Average Collection Period Calculator Formula.

This formula:

Gives us number of days in which a firm is able to collect payment from its clients. This shows the rapport of the company in the business.

Sales revenue and Average Account Receivables are the variables required to know the Average Collection Period; these can be gathered easily.

Average Collection Period – Conclusion

With the simple calculation, one can easily know about company’s performance and can decide how profitable a company would be in future.

Above discussed process is less time taking and easy to understand. If you still have any query contact us by leaving your comments in the comment section below.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles