Three Line Strike Candlestick Pattern – Meaning, Trading, Trend Identification & more

Last Updated Date: Nov 17, 2022Know everything about Three Line Strike Candlestick Pattern here. Find details like its Formation, Identification, Trading Tips using this pattern & more.

Lets get Started.

About Three Line Strike Candlestick Pattern

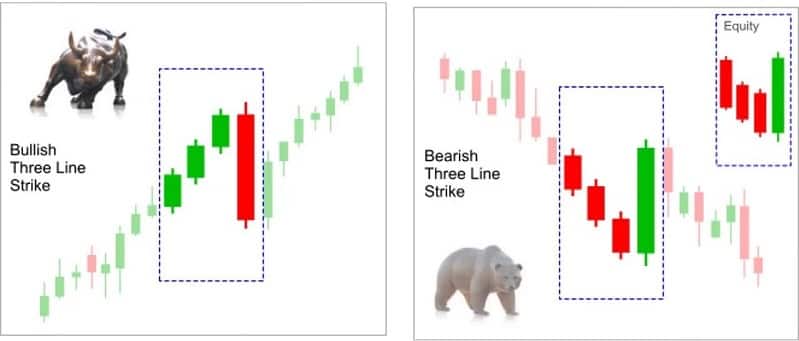

The Three Line Strike Candlestick Pattern consists of four candlesticks and can be found during both upward or downward trend.

As mentioned, the pattern can be observed after the formation of three candles during a trend and the fourth candle of opposite nature.

In most cases, the pattern is an indication of a trend reversal. However, this should not be taken as a confirmation for the same. The two types of three-line strike patterns are bullish and bearish.

In the bullish pattern, the first three candles are formed during a bull trend, while a bearish pattern leads to the formation of three bearish candles during a bear trend.

No matter what type of three-line strike candlestick pattern is formed, you must keep in mind the next pointers for identifying the pattern.

Open Demat Account in 10 Min & Start Trading Now!

Identification of Three Line Strike Candlestick Formation

The first three candles should be a part of the trend and should be similar, i.e., either bullish or bearish.

In the first three candles, the close price should be higher than the previous closing if the trend is bullish. However, if the trend is bearish, the closing price should be lower than the previous closing price.

The low should be higher than the previous day’s low for a bullish trend. On the other hand, a bearish trend will depict lower lows.

The high should be higher than the previous day for a bullish trend. On the other hand, the high should be lower than the previous day’s high.

The fourth candle is highly crucial for the formation of a three-line strike pattern. The candle will have the highest high and lowest low among all the four candles in both types of trends, i.e., bullish and bearish.

Note: The fourth candle is formed during a trend after the formation of three candles that are either bullish or bearish.

The fourth candle’s nature is different from the previous three, i.e., a bearish candle is formed after a bull trend and vice versa.

This is an indication of a trend reversal. However, a trader needs more confirmation to be sure if the trend reversal is going to take place or not.

Let us now look at the ways to trade a three-line strike pattern.

Know about other major Candlestick Patterns

How to trade using Three Line Strike Candlestick Chart?

If you are an experienced day trade, you would already know the golden rule of trading.

However, for those of you who don’t know, we would love to tell you that capital preservation and risk management is one of the most important things while trading.

Trading on the basis of simply observing a pattern and not confirming it with other factors can lead to risks in the market. One of the best ways to trade using a pattern is through the formulation of strategies.

Once you form a habit of developing strategies and back testing them, you will be able to apply them in the live market. With this, you will be able to improve your accuracy in the market.

That said, let us now try to look at a few pointers that you should keep in mind while trading a three-line strike pattern.

These points are not sure-shot strategies. However, keeping these points in mind will help you formulating strategies for both a bullish three-line strike pattern and a bearish three-line strike pattern.

Identify the Trend:

Since the pattern is formed during a trend, it becomes crucial to identify a trend and trace the three candles that are either bearish or bullish depending upon the type of pattern formed.

Also, apart from the identification of patterns, the candles must fulfill other conditions too.

The closing price should be greater than the previous close in a bullish pattern while it should be lesser in case of a bearish pattern.

A bullish pattern must also have higher highs and higher lows in the three candles. Simultaneously, a bearish pattern must have lower lows and lower highs in the first three candles.

Identify Big Candles after Three Consecutive Candles in a trend

The red candle in a bullish pattern and the green candle in a bearish pattern plays the most crucial role in a three-line strike pattern.

If the trend is bullish, the candle formed should be a red one that has an opening price that is higher or equal to that of the previous candle.

However, this candle does not follow the trend. As a result, this candle’s closing price should be lesser than the opening price for the first candle.

On the other hand, if the trend is bearish, the candle formed should be a green one, which has an opening price lesser than that of the previous candle.

However, this candle does not follow the trend. As a result, this candle’s closing price should be more than the opening price of the first candle.

In simple words, the length of the fourth candle in both types should be bigger than that of the previous three candles.

Patience is the Key

Earlier traders believed that the fourth candle in a three-line strike pattern does not lead to a trend reversal. Rather it leads to a continuation of the trend only.

However, after they started back testing their strategies, it was found that the fourth candle can lead to a trend reversal in most cases.

Since there is no surety about what might happen, it is always advisable to wait for the perfect entry point.

If you see a three-line strike pattern forming up, don’t hurry into a trade. Instead, make sure other factors are favorable and then wait for the perfect entry point.

Find other important Candlestick Patterns here

Conclusion – Three Line Strike Candlestick Pattern

So these were the pointers that you must keep in mind whenever you see a three-line strike pattern forming up.

While analyzing the charts, make sure that the four candles fulfill all the conditions as mentioned above.

Apart from that, patience is the key to success in the market. So make sure you wait for the perfect entry point before taking a trade and back-test your strategies before applying them in the market.

Open Demat Account in 10 Min & Start Trading Now!

Learn everything about Technical Analysis here

| Technical Analysis – Know Everything |

| How to Start Technical Analysis? |

| Best Intraday Indicators |

| Types of Technical Charts |

| Know about Resistance & Support |

| Dow Theory |

| Fibonacci Retracement |