What is Resistance & Support in Technical Analysis? – Know Everything

Last Updated Date: Nov 16, 2022Lets understand in detail about Resistance & Support in technical analysis here.

From the perspective of technical analysis, a technical analyst has to only look at the price of a stock derived as a result of supply-demand interaction.

For technical analysts price is supreme and the person sees the price as a manifestation of every fundamental reality.

Basically it is a trading discipline we use to assess investments and to find out trading possibilities in price trends and patterns seen on charts.

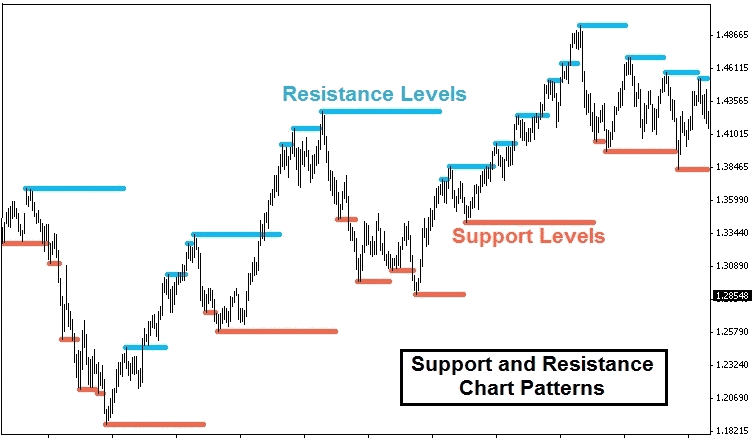

Technical analysis generally comprises two crucial levels or points in it. Namely:

- Support

- Resistance

Both are important under the discipline of technical analysis. But here in this article, we will talk about the support and resistance level used in technical analysis.

This was the basic definition of technical analysis now let’s come to the part of the RESISTANCE level in technical analysis.

Resistance in Technical Analysis

Resistance is more of a value level in which the selling power is capable of keeping the cost from improving.

The basic idea behind this is the cost can draw closer to obstruction. It can turn out to be costly and the vendors will be bound to sell.

Likewise, the buyers will be less inclined to make a purchase. In this situation, the sellers will beat the buyers which will bring the cost within the resistance.

In that situation, vendors will defeat request purchasers and that will forbid cost from going above resistance.

Resistance is an amazing column in exchanging and most techniques have some sort of opposition strategies incorporated with them.

Also, Resistance will in general create around key zones that cost has consistently drawn closer and bounced back from that point.

Resistance is one of the most generally followed specialized methods in the budgetary business sectors.

It is a straightforward strategy to dissect a graph rapidly to decide three focal points to a trader

- The heading of the market

- Timing a passage in the market

- Establishing focuses to leave the market at either a benefit of misfortune

Open a Demat Account Now! – Start Trading in Futures

Purpose of a Resistance Line

The fundamental reason for the resistance is to let investigators make sense of the transient pattern of stock, however, it can fill a similar need for a more drawn out time period.

Distinguishing resistance areas enables an investigator to settle on track costs for both purchasing and selling.

Whatever the trend is, drawing resistance lines on an outline empowers an investigator to plot a pattern chart.

Importance of Resistance in Technical Analysis of Trading

When making a decision about entry and leave venture timing using the resistance levels, it is essential to pick a diagram dependent on a value stretch period that lines up with your exchanging procedure time span.

Short term ventures will in general use outlines dependent on stretch periods. Long term traders usually use-value graphs dependent on hourly, every day, week by week, or month to month stretch periods.

Normally dealers utilize shorter-term stretch outlines when settling on an official choice on when to contribute and invest.

Learn everything about Technical Analysis & make for money in stock market

What does the term Support in Technical Analysis mean?

Support is the level at which demand for a stock is much strong to stop the stock from falling any further.

The support level of stock can happen only on the demand of the stock entering the market getting to a lower price.

When it comes to technical analysis, the simple support level is shown by a line present in the bottom for the time period under consideration.

The support line is either inclined or flat with respect to the overall price trend.

Example of Support Line in Technical Analysis

The trader might try to find out the best time to enter a long procession and over the past year, the company could have traded INR 8 and INR 15 per share.

When the second month happens, the stock might climbed to INR 15 but when the fourth month happens, it could fall to INR 8.

During the seventh month, it might reach INR 15 before it falls to INR 10 during the 9th month. As for the 11th month, the price reaches to INR 15 over the next one month and it falls to at least 13 before it stands up to 15.

At this point, you have an established support level of INR 8 and a resistance at INR 15. There are no disturbing factors in technical or basic strategies.

If the order is set right, the support level would be INR 7 and the risk will be higher.

Limitations of the Support level

Up to the above section, we learned that the support level is useful and preferred in technical analysis. But as everything has its own bad effects, support too has its limitations.

Support is the market concept that could act as a complete technical indicator and with so many indicators in place; incorporation of these concerts in the right manner becomes vital.

Also, it is evident that there are actionable insights only with simpler visualizations. The traders would like to view the support instead of a particular line that can connect the lower region.

It is in consideration of the fact that there will always be chance support for the movement and it might remain unexecuted.

Final Thoughts on Resistance & Support in Technical Analysis

It is possible to conclude that the identification of Basic support levels can become an essential ingredient to become a successful technical analyst.

If the security approach becomes vital then awareness has to be created within the traders in order to improve the Purchase pressure and focus on potential reversal.

Technology has stepped into every sector of business. It is important for the traders to keep abreast with the latest technological updates.

Online trading can be a boon as well as a curse if we do not use it properly. If we use online trading properly, it can significantly help in reducing the cost price of the goods that the trader sells.

This is because, if the company is small, the manpower will be reduced. Only one man can do the job of data entry instead of employing more people. This will help the trader to earn more profit.

Open a Demat Account Now! – Start Trading in Futures

Most Read Articles