Three White Soldiers Candlestick Pattern – Meaning, Illustration, Trading Procedure & more

Last Updated Date: Nov 17, 2022Know everything about Three White Soldiers Candlestick Pattern here. Find information like its meaning, features, how can it be used in trading, how it works & more.

Lets Get Started.

About Three White Soldiers Candlestick Pattern

One of the most popular technical analysis charting methods is candlesticks. The majority of the traders tend to use this method for seeking an edge in the market.

Bullish three white soldiers are one such pattern. The charting method is mainly used to determine the price during a downtrend.

You need to know that the technical analysis charting method is not the usual one because it depends mostly on the context. But you don’t need to get stressed as the pattern is relatively easy to recognize.

The formation features three consecutive days with a white candle in simple terms, each one higher than the previous.

It is mainly termed as three white soldiers, as three white soldiers appear in a row. It is easy to guess the bullish importance of the formation.

In the majority of the situations, the indicator is actually quite potent to guess, and above all, it is highly reliable.

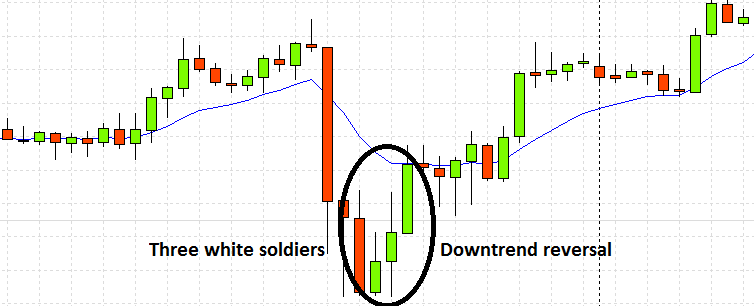

At the end of a downtrend, a bullish three white soldiers reversal pattern takes place, and it also indicates an optimistic trend reversal.

Ideally, the pattern features three consecutive tall bullish candles.

Open Demat Account in 10 Min & Start Trading Now!

Features of Three White Soldiers Candlestick Pattern

The three white soldiers is instead an eye-catching pattern as it forms with significant bar alterations often.

Some of the criteria for the pattern are, there are three bullish candles, all of them are closed in the upper quarter range, and mostly, they also have tiny wicks to the downside.

The common interpretation of the three white soldiers is that it indicates a reversion of the bearish trends under which it is formed. The pattern features three candles, which are in green color.

Typically, traders believe that this formation indicates a prevailing price due to the immense buying pressure. The three black crows are termed as the reversal of the three white soldiers.

The reversal pattern is depicted by three consecutive red candlesticks that tend to be formed at the top of an uptrend.

The long-bodied candlesticks tend to open within the last candle’s real body and close that is more than the last’s candle high.

Ideally, these candles shouldn’t have very long shadows and open with the real body of the last candle in the same pattern.

Know about other major Candlestick Patterns

What does Three White Soldiers Candlestick tell you?

Following a downtrend, the three white soldiers mean there is a stable advance of buying pressure. Often, bullish patterns like these offer a reversal movement with regards to price.

Few traders consider opening an extended position to profit from any upward trajectory while they see the three white soldiers pattern.

Basically, the three white soldiers tell that there is a massive change in the market sentiments with regards to securities or commodities.

It also suggests that bulls have pertained to keep the price on the peak of the range of the session when the candle is either closing with small or no shadows at all.

All over the session, bulls take over the rally, and for three continuous sessions, it closes near the high.

Additionally, the pattern is most likely to be preceded by some other candlestick patterns, including the Doji.

Further illustration on Three White Soldiers Pattern

With Three White Soldiers Candlesticks, you can understand a lot about market data and what the market has been up to. Now, you might be wondering that what is the accurate meaning behind a particular move.

If you want to enhance your understanding with regards to the market moves, then experts suggest that scrutinizing and analyzing the market will help to a great extent.

Soon, by doing this exercise, you will notice some recurrent patterns that will surely grab your attention that have the potential to become your new trading strategy.

Negative market sentiment prevails, featuring the bearish trend. The majority of the people, as such, are confused about entering this market, so they either tend to remain in a cash position or in a short term position.

The market then tends to become oversold when there is a prevailing downtrend in the market for some time now.

When traders discover this, they are willing to enter the market or at least cover the position. It enhances the wave for buy orders, which mainly makes it perform a substantial bullish candle.

As it is one of the earliest signs of the bullish reversal, several people attempt to grab the new trend quickly.

Trend reversal is most likely to stand out a bit and becomes challenging to ignore, provided the three white soldiers candles have been formed.

Due to this, the market turns to be positive gradually, and the market is then fueled with a new bullish trajectory.

Find other important Candlestick Patterns here

How to trade using Three White Soldier Pattern?

The majority of the new traders assume that this is a powerful signal, so it is majorly safe to enter the market once these three white soldiers pattern is seen.

However, in reality, it isn’t as simple as you think, as there will be a plethora of faux signals, and there is no exception to even these patterns.

You need to add some extra filters or conditions if you want to minimize the number of false signals.

Thus, you can be assured that those trades will have the maximum number of odds regarding success.

Hence, the filter that works completely is based on the market and the timeframe you choose to trade-in.

Some of the filters that are mainly used are:

Volatility Filters

One of the most universal and versatile filters used by the majority of the traders is volatility filters.

Different markets feature different volatility that often has a significant impact on the pattern’s reliability.

Under these filters, bar ranges are used to evaluate whether the volatility is more or less. The market is said to be volatile if the ranges are higher as compared to ATR and vice versa.

Besides ranges, ADX is also used to determine volatility in the market. When the ADX is less than 25, the market is considered to be volatile, and the market tends to be relatively calm when the ADX is less than 20.

Market Regime Filters

These are broader filters that help us look at the market in a general state. Under these moving averages they are used, which help in gauging the market on a long term basis.

Limitations of the Three White Soldier Candlestick Pattern

During the periods of consolidation also, the three white soldiers pattern appears. This efficiently traps the traders in the continuation of the current trade instead of reversal.

You can combat this limitation by using the three white soldiers with other technical indicators. Including the trendlines and bands.

Conclusion: Three White Soldiers Candlestick Pattern

Ideally, the three white soldier pattern features a bullish candlestick formation. It includes green or white candles that each close relatively higher than the previous one.

At the bottom of the downtrend, you are most likely to see the pattern. Ideally, the pattern means there is a static advance of buying pressure that can be translated as the potential buying reversal.

You can trade using the derivatives, including CFDs or spread bets when you see the three white soldiers’ candlestick pattern.

Thus before trading yourself, you should test everything. It is mainly essential, so you don’t lose money on trading systems that won’t work.

Open Demat Account in 10 Min & Start Trading Now!

Learn everything about Technical Analysis

| Learn Technical Analysis |

| How to Start Technical Analysis? |

| Best Intraday Indicators |

| Types of Technical Charts |

| Know about Resistance & Support |

| Dow Theory |

| Fibonacci Retracement |