Inverted Hammer Candlestick Pattern – Meaning, Important Checks, Example & more

Last Updated Date: Nov 17, 2022An Inverted Hammer Candlestick Formation is very helpful in technical analysis. know everything about this pattern here, how it can be used in trading for more gains, benefits & more.

Lets Get Started.

About Invested Hammer Candlestick

To gain insights into the momentum of a market, an Inverted Hammer Candlestick can prove to be effective. Owing to its nature, an inverted hammer candle stick helps to locate reversals in the price of a security.

Usually, the body of an inverted hammer pattern is a small one. As for the shadow, it is common to observe an extended upper wick over the candle and next to no lower wick.

A subsequent price action in the market will be able to validate whether the move of the bulls is confirmed or rejected.

A shooting star candle is commonly mistaken for an inverted hammer candle stick since they have a similar appearance.

However, they differ in meaning and purpose. The inverted hammer formation produces strong signals when it makes an appearance closer to the key support levels.

The occurrence of an inverted hammer candlestick indicates a strong bullish reversal and rejection of lower prices by the market.

Open Demat Account in 10 Min & Start Trading Now!

How does an Inverted Hammer Candlestick Form?

The gain in confidence by bullish traders is one reason why an inverted hammer candlestick may occur.

When bulls in the market push the price of a security up, the upper shadow of the inverted hammer candle stick is formed. Short sellers, on the other hand, contribute to the small lower shadow.

Due to the weight of the bullish traders, the market settles at a higher price and the inverted hammer pattern shows the pattern as discussed above.

The inverted hammer candle stick is an indication for the sellers to take an exit from the market due to an incoming bullish reversal.

It also informs the buyers that they may take a buying position since a bullish trend may be about to begin.

More importantly, an inverted hammer formation tells a trader that there is a buying pressure in the market. At the same time, it is a warning sign for a trend reversal.

Due to its nature, an inverted hammer alone cannot provide enough insights into the price movement in the market.

It makes sense to study it in conjunction with additional technical indicators as well. Some traders like to wait for the next trading day to make an assessment about the position which they must take.

It will then make sense to take a buy position if the opening price of the security is higher than the closing price of the security.

Know about other major Candlestick Patterns

Few checks before using Inverted Hammer Candlestick

There are several aspects of an inverted hammer candlestick which you must check before you base your decision to trade in a security. Some of these points are as follows:

Length of the Upper Shadow

The length of the upper shadow must be more than twice the size of the real body of the candle.

The signs of a trend reversal become stronger if there is a gap down between the candlestick from the previous day.

Only if the price opens higher on the next day, does it make sense to enter the position.

Downtrend in Security

Before the formation of the inverted hammer candle stick, there should be a downtrend in the security. It should clearly indicate a selling pressure from the sellers in the market.

It is vital to study and understand this psychology behind the trading pattern.

Don’t confuse with other Patterns

There are many other types of trading patterns which are easy to confuse with an inverted hammer pattern.

If you are intent on using inverted hammer formation, make sure that you are also using other technical scans to understand the right candlestick pattern.

Example of Inverted Hammer Candlestick

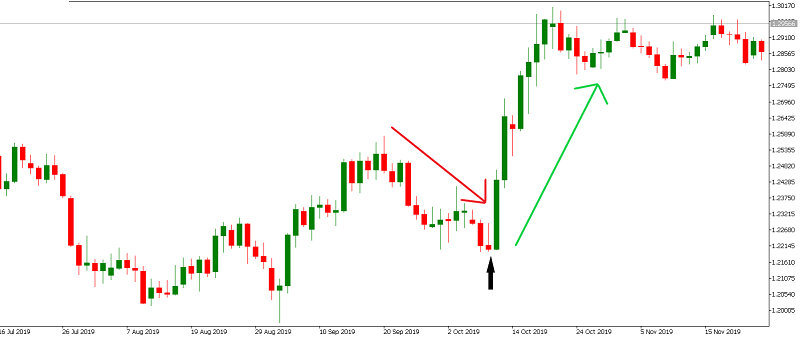

As can be seen in the image above, there is a clear indication that an inverted hammer candlestick is forming.

There is a significant downtrend before the occurrence of the candle. Also, the upper shadow is far greater in size than the real candle itself.

The next day, a trend reversal is taking place as the green candle suggests. The occurrence of inverted hammer candle stick is not as frequent as those of regular hammer candlesticks.

This is one reason why the inverted hammer pattern tends to form mixed and confusing insights.

A potential buy signal occurs only when an inverted hammer chart is complimented by a trend line break or any other candle signals.

Find other important Candlestick Patterns here

Advantages and Disadvantages of an Inverted Hammer Candlestick

Like any other candlestick pattern, there are several pros and cons of an inverted hammer candlestick as well. Let us take a look at them.

Advantages of Inverted Hammer Formation

Multiple entry points – Inverted hammer candle stick offers a chance for traders to enter the security when an uptrend is just beginning to occur.

This means that they can benefit from the complete scope which it will come to offer as long as the uptrend continues.

Easily identifiable – It is not at all difficult to spot an inverted hammer pattern on a graph or trading chart. So even a beginner can easily spot it.

Disadvantages of Inverted Hammer Pattern

Insufficient alone – On its own, the inverted hammer formation can be insufficient. It may fail to provide a clear indication about the direction in which price action may occur.

If a trader completely relies on this candle alone to make a decision about his trades, the resulting decision may not be an optimum one.

Short lived – It is highly possible that an inverted hammer chart depicts a temporary movement in the bullish direction of the market.

The trend reversal may fail to materialize for a long term span. This is likely to happen if the buyers are unable to sustain the buying pressure due to an oncoming downward trend.

Conclusion – Inverted Hammer Candlestick Pattern

Indeed, investors can wait for a confirmation candle to occur. Then, they can be at an advantage to take the first mover advantage with an inverted hammer candlestick.

The purpose of an inverted hammer pattern is to indicate a bullish trend in the price of a security.

As long as the features of an inverted hammer candle stick are followed, an investor can benefit from the study of the pattern.

The shooting star is a bearish version of the inverted hammer formation.

Open Demat Account in 10 Min & Start Trading Now!

Learn everything about Technical Analysis

| Learn Technical Analysis |

| How to Start Technical Analysis? |

| Best Intraday Indicators |

| Types of Technical Charts |

| Know about Resistance & Support |

| Dow Theory |

| Fibonacci Retracement |