Sushil Finance Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Dec 01, 2022Sushil Finance is India’s top financial services providers which majorly deal in Stock broking services and equity research services. It was founded by Mr. Sushil N Shah in the year 1982 and has made a strong foundation in the Share market with its niche experience.

In this article, we will demonstrate for you the actual worth and credibility of Sushil Finance by doing an intrinsic analysis on its products and services offered, what kind of brokerage rates they charge, are there any other charges that they charge apart from brokerage and how much would they be, their various offers and deals that they launch etc.

Most importantly, we will also give detailed information on the trading platforms that this company uses and is it a user friendly one for use or no.

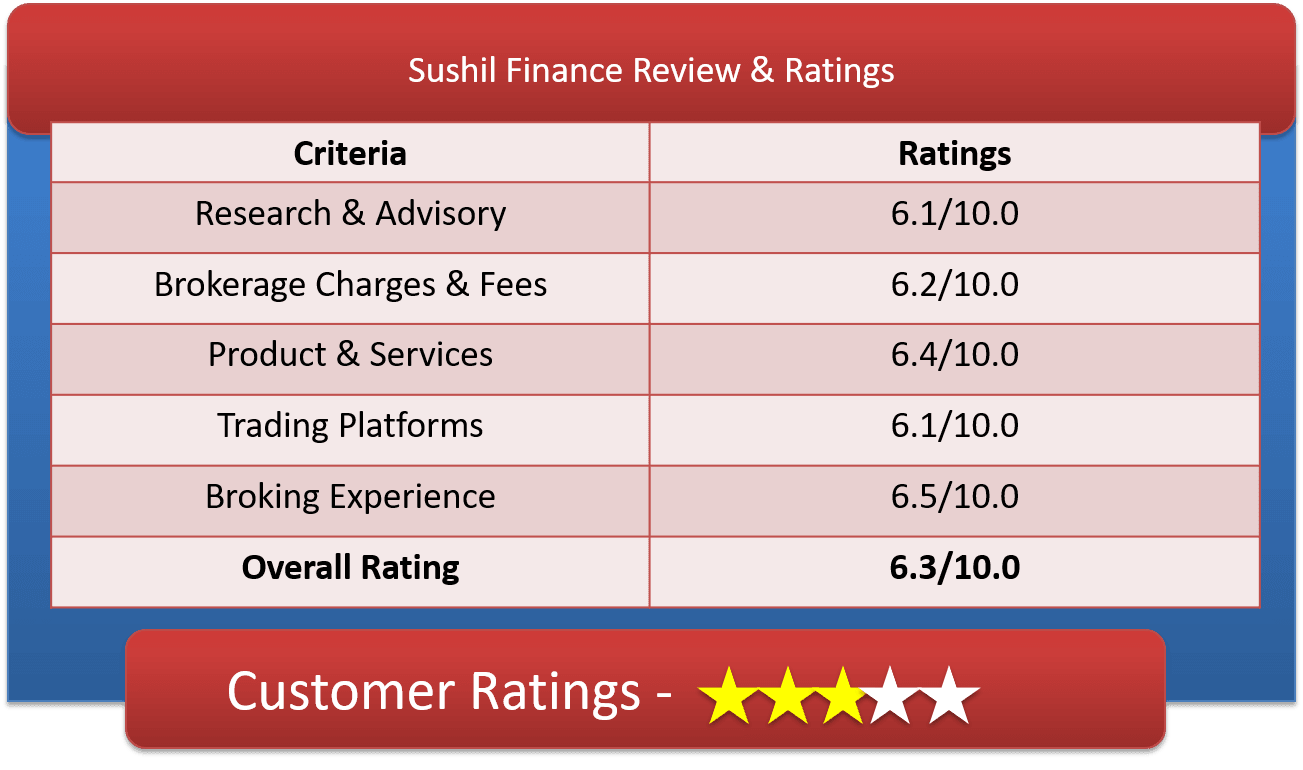

Sushil Finance Ratings & Review by Top10StockBroker

About Sushil Finance

| Overview | |

| Company Type | Private |

| Broker Type | Full Service Broker |

| Headquarters | Mumbai, Maharashtra |

| Founder | Sushil N Shah |

| Established Year | 1982 |

Sushil Finance is a Private Full Service Broker which was established in the year 1982 by Mr. Sushil N Shah in Mumbai, Maharashtra. With over 3 decades of successful progression in the financial industry, they have been able to maintain over 120,000 happy customers with a total asset value of more than 6000 Crore.

They operate from more than 21 States in 148+ cities and have more than 450 Business Partners who grow their business every year. Their product offerings are also diverse and exorbitant ensuring that they have something for every customer that walks into their office.

Sushil Finance deals in Equity, IPO, Currencies, Mutual Fund, Insurances, Online Trading and much more. They are enrolled with BSE, NSE, MCDX and NCDEX and hence you get the flexibility to trade with multiple exchanges under the same roof.

Get a Call Back from Sushil Finance. Fill up this Form.

Sushil Finance Brokerage Charges

| Brokerage Charge & Fees | |

| Equity Delivery | 0.35% |

| Equity Intraday | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | Rs 60 per lot |

| Currency Futures | 0.03% |

| Currency Options | Rs 60 per lot |

| Commodity | N/A |

| Minimum Brokerage | Percentage of Transactions |

| Demat AMC Charges | Rs.300 |

| Trading AMC Charges | Free |

| Margin Money | 75% Margin |

| Brokerage Calculator | |

If you are a trader or an investor, you would surely be keen to know what are the brokerage charges that the company would charge you when you start to trade. The above table depicts very clearly what rates are charged as per each segment and product.

For an Equity Delivery trade, they would charge 0.30% of the transaction amount whereas for an Intraday Equity, they would charge on 0.03% of the total trade value.

Similarly for a Equity Futures trading and a Currency futures trading, they charge 0.03% of the total amount. In a currency options trade, they charge Rs.25 per lot irrespective of the trade amount.

There is an AMC charge for maintaining the Demat Account whereas the trading account maintenance is free of charge. You also need to deposit minimum Margin Money of 75% Margin before starting off as a trader with Sushil Finance

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| Sharekhan | Edelweiss | Indiabulls Ventures | Kotak Securities |

| Angel Broking | HDFC Securities | India Indoline / IIFL | Motilal Oswal |

| Axis Direct | ICICI Direct | Karvy | Upstox |

Sushil Finance Charges

| Other Charges | |

| SEBI Turnover Charges | 0.00005% (Rs.5/Crore) |

| STT | Equity Delivery: 0.1% on both Buy and Sell Equity Intraday: 0.025% on the Sell Side Equity Futures: 0.01% on Sell Side Equity Options: 0.05% on Sell Side(on Premium) Commodity Futures: 0.01% on sell side (Non-Agri) Commodity Options: 0.05% on sell side Currency F&O: No STT On Exercise transaction: 0.125% Right to entitlement: 0.05% on sell side |

| Stamp Duty | (On buy side only) Delivery: 0.015%, Intraday: 0.002%, Equity Futures: 0.002%, Equity Options: 0.002%, and Currency F&O: 0.0001%.Commodity Futures: 0.002%, Commodity Options: 0.002% (MCX) |

| GST | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| Margin Funding Charges | 18% |

| Reactivation Charges | Rs 20 per instruction |

| Account Closure Charges | Rs 20 per instruction |

| Dematerialisation Charges | Rs 5 per certificate + Rs 25 per request |

| Pledge Creation | Rs. 59 per scrip |

| Pledge Invocation | Rs. 59 per scrip |

| Margin Pledge/Unpledge/ Pledge closure | Rs. 59 per scrip |

| Margin Repledge | Rs. 59 per scrip |

Broking houses need to charge some extra amount from the customers apart from the brokerage charge in lieu of some government taxes and other taxes. You should also be aware of these extra charges in case you want to join them as a trader.

They charge a Transaction charge for every transaction that would happen and that would be 0.00310% of the total turnover amount; apart from that, there is a STT charge which computes to around 0.0126% of the total amount of trade.

Apart from this, they also charge a SEBI Turnover charge which will be around 0.00005% of the total turnover done. There are two other components apart from these charges that are Stamp Duty which is charged to the customer as per the State norms and the GST which is a flat 18% of the value of the Brokerage and transaction charge put together.

Don’t worry, although these look like many charges, however when we actually calculate it along with the trade value, they are very nominal amounts which are charged to the trader.

Sushil Finance Demat Account Opening Fees

| Demat Services | |

| Trading Charges [One Time] | NIL |

| Trading AMC [Yearly] | NIL |

| Demat Charges [One Time] | NIL |

| Demat AMC [Yearly] | Rs. 300 per annum |

| Margin Money | 75% Margin |

| Offline to Online | Yes |

Being a Broking House and a Depository participant as well of CDSL & NSDL, Sushil Finance provides both Demat Account facilities as well as Trading Account benefits to its customers. The Trading as well as Demat Account opening is absolutely free of charge with Sushil Finance.

However there is certain Maintenance charges that the customer needs to bare in order to maintain his Demat account with them every year which is Rs. 300 per annum. However, this amount can also be waived off if a certain amount of trade is being carried out by a customer every year.

The Margin money needed to start the Trading account is 75% Margin which is a one-time deposit.

Sushil Finance Offers

| Offers | |

| Free Demat Account | No |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | No |

| Zero Brokerage for Loss Making Trades | No |

As a broking house, they do introduce many special offers time and again for the benefit of their customers and to retain them. To start with they don’t have any Account opening charges which is a great reliever itself, whereas all other competitors do have account opening charges.

They also have very minimal account maintenance charges which can also be waived off if there is enough trade happening in that account.

Moreover, Sushil finance also believes in giving higher benefits to its regular traders, hence if you are a regular trader with them, you might get your account AMC charges waived off as well. So if we look at it as a complete package, the number of offerings that this company gives to its customers is huge.

Find Offers from other Broking Houses

| SBI Smart | Aditya Birla Money | Asit C Mehta Investment | Bonanza Portfolio |

| Narnolia Securities | Alice Blue Online | Astha Trade | Choice Broking |

| Zerodha | Anand Rathi | BMA Wealth Creators | Geojit Finance |

How to open Demat Account with Sushil Finance?

Sushil Finance invites traders from all across the country and abroad to come and join them and start trading with them. That’s the reason why, if you notice, they have a blue tab which says “Open An Account” which pops up prominently on the home screen of their website itself. The account opening procedure is fairly simple and can be explained in simple steps:

- When you click on the “Open an Account” button, a pop-up form will appear.

- You can either enter your basic details there or register online or you can also give a missed call at their customer support number and someone will call you back for the registration process.

- If you choose to call, then you just need to give a missed call on 08045936028 and they will instantly get back to you with their application process

- If you choose to fill up the details, then all you need to enter is your basic details like Full name, email id, contact number, city of residence and Pin code.

- Once you enter all these details and click on the Register button, you will be directed to the Account opening form page. Here you need to further fill up all your details like complete address, bank account details, Adhar and Pan Card numbers etc.

- You will then be prompted to upload your KYC documents there itself; you can upload your Pan Card, Adhar Card, Residence proof and one photograph as well

- Once you’ve uploaded all the documents and click submit, you will get an application ID number for reference.

- Once your registration process is done, you will receive a call from their customer support team for validation of documents and verification purpose as well. On successful completion of verification process, you will be issued you Trading and Demat account details from Sushil Finance company. This if how you can get started.

Get a Call Back from Sushil Finance

Why Open Sushil Finance Trading Account?

Getting a trading account opened is a mandate for all traders as per the Trading regulatory board of India. It’s imperative to have a Trading account as well as a Demat account for anyone who wants to trade in stocks.

And as seen above, it is fairly easy and hassle-free to open up an account with Sushil Finance. Without even the need to visit the branch or completed tons of documentation procedures, one can actually get the account opened and gets started.

If you’re still wondering why only Sushi Finance should be your choice for the Trading account, then here are some of the reasons why you should consider them:

- The sheer experience of over 3 decades in the industry speaks volumes about their sustainability and trust that they have built amongst the people.

- The strong and robust Research focus that the company has keeps them at the edge of the performance always. They have been delivering excellence only due to their strong research and analytics that they provide to the customers

- The arena of products that they offer also goes to show that they care for the customers and want them to not waste their time shopping elsewhere

- Their simplified investment plans also integrates a loyt with the growth prospects as customers can very well connect with what is being offered and hence are more adaptable to enroll for them.

Sushil Finance Products & Services

List of products & services provided to its clients

Sushil Finance Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | No |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

Sushil Finance, like seen above, is one company that offers various product options to its customers to choose from rather than just being unfocused. They offer Equity trading options, Currency trade, Commodities trade, Futures trade and options as well.

They also deal with Mutual Funds, IPO services, SIP plans and Insurances as well. In a nutshell they offer a plethora of products to their customers so that they become a one-sto-shop for all their financial needs

Sushil Finance Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Acount | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 5x |

As a leading broking house, Sushil finance understands that a company becomes great only when their services are of supreme quality and hence they strive to provide better services every time. They have Demat services and Trading account facilities with them, They offer Intraday trade services as well IPO Services as well.

Research and analysis is something that comes as a package deal with their offerings and hence Stock updates, real time markets news, stock recommendations and advisory services is something that they boast about.

As far as they leverage and exposure is concerned, they provide upto 5 times the average exposure than what other service providers do.

Sushil Finance Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | Yes |

| Monthly Reports | No |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

As mentioned earlier as well, this company boasts about its research and analytics capabilities and hence that comes as a great advantage to its customers.

They do provide regular reports to customers in the form of monthly, weekly and daily reports as well on the health of the market, market trends and forecast on what’s going to be beneficial and whats not. Stock tips, IPO reports and other Top picking stocks is also what they provide regularly as recommendations.

They also provide a dedicated Relationship Manager whose core job is to assist you with your financial decisions and help you take better calculated steps in your investments.

Sushil Finance Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | 1x |

| Equity Intraday | Upto 5x |

| Equity Futures | 1x |

| Equity Options | 1x |

| Currency Futures | 1x |

| Currency Options | 1x |

| Commodities Future | 1x |

| Commodities Option | 1x |

| Margin Calculator | Available |

Sushil Finance offers lots of leverage and exposure to its customers to enable smooth trading transactions and complete transparency.

It offers upto 1 times leverage than the average exposure in Equity Delivery & Futures, upto 5 times leverage in Equity Intraday & 1 times in Equity Options; with respect to Currency trading, it offers upto 6 times leverage in Currency Futures & 1 times in Currency Options, whereas in Commodities, it offers upto 1 times the leverage than an average exposure should be.

Check Margin or Exposure of other stock brokers

| IDBI Direct | KIFS Trade Capital | Nirmal Bang | Prabhudas Lilladher |

| Jhaveri Securities | Mastertrust Capital | Groww | Profitmart |

| JM Financial | Monarch Networth Capital | Paytm Money | Reliance Securities |

Sushil Finance Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | No |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi Account Management | No |

Sushil finance provides 3 powerful Online trading platforms for their users’ convenience and flexibility:

Swift Trading – which is a web based platform for online traders

Power trading – which is for their Desktop and laptop users

Savashare App – which is a Mobile Trading App

Lets look at some benefits that each of them are providing:

Sushil Finance Swift Trading: Web Based Trading Platform

This is a web based system designed for people who don’t access the trading portal that regularly but this can give them access to it from anywhere in the country:

- It gives a personalized watch on the market updates

- Live streaming of market quotes

- Single screen view on all reports

- Easy order placing capability

Sushil Finance Power Trading – Trading Terminal

This is a desktop based software which you can access anytime from your laptop or desktop:

- Live streaming of quotes

- Instant market updates

- Personalized screen for orders placed and portfolio summary

- Alert facilities for notifications and alerts

- Top picks of the market on a daily basis and recommendations too

- Interactive charts for analysis purposes

Sushil Finance Savashare Trading Mobile App

- Easy display of all relevant information on yoru mobile screen

- Seamless download and upload capacity

- Easy order placing methodology

- Easy navigation between segments and exchanges

- Convenience to trade on the go.

Sushil Finance Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | 555 |

Sushil Finance has a total of 55 branches across the country to assist the customers in times of need while trading. They also have dedicated dealers who look into day-to-day operations and have direct contact with customers for their training needs.

Apart from Online Trading to enable seamless trading transactions, Sushil finance has also left the window open for Offline trading services as well such that if anyone wants to follow the conventional method of trading, they are still open to that.

You can reach out to Sushil Finance directly via email support & chat support as well wherein the team of advisors will instantly help you deal with your queries.

Sushil Finance Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 22 |

| Resolvd in BSE | 18 |

| Lodged in NSE | 29 |

| Resolved in NSE | 22 |

Every company, no matter how big they are, would have some percentage of customers complaining about their services and products. Similarly, Sushil Finance also had a few complaints in their basket, however they have seemed to resolve most of them.

Sushil Finance Disadvantages

Although the company is doing very good financially and in terms of its customer base as well, however if we look at some of the areas where they need to improve basis customer feedback is:

- The leverage or exposure that they offer is very low as compared to other competitors

- Their brokerage plans need to be a bit more flexible and customer friendly

Sushil Finance Conclusion

Sushil Finance is an overall supreme broking house which provides high quality service and platforms to its customers. All it needs to do is just focus on some customer feedback to enhance its performance

Get a Call Back from Sushil Finance

Find Reviews of other Stock Brokers

| Religare Securities | Shri Parasram Holdings | 5Paisa | Ventura Securities |

| SAMCO | Shriram Insight | Swastika Investmart | Way2Wealth |

| SAS Online | SMC Global | Tradebulls | Yes Securities |

Most Read Articles