SBICap Securities Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Jan 05, 2024SBI Capital Markets Ltd or SBICap Securities is a 100 % subsidiary of India’s oldest players, influential on Indian capital markets. In Indian primary capital markets, they have a leading position in stock Markets.

The secondary demands of financial institutions, FIIs, mutual funds, banks, corporations, high net worth SBICap Securities deals, non – residential shareholders, and domestic retail investors have been covered in brokerage operations launched in 2006.

SBICap Securities Ltd. (SSL) is a corporation established to take over the SBI Capital Markets Ltd. brokerage operations.

The services presently available include Depository Participant services, Institution Equity, Retail Equity, Derivatives, Broking, E – Broking.

This article mentions all detailed information about brokerage, products, and services.

Table of Contents

- Rating & Review

- Overview

- Brokerage Charges

- Other Charges

- Account Opening Charges

- Offers

- Account Opening Process

- Products & Services

- Research & Tips

- Exposure

- Trading Platforms & Apps

- Customer Care

- Complaints

- FAQs

- Open an Account with SBI Securities Now!

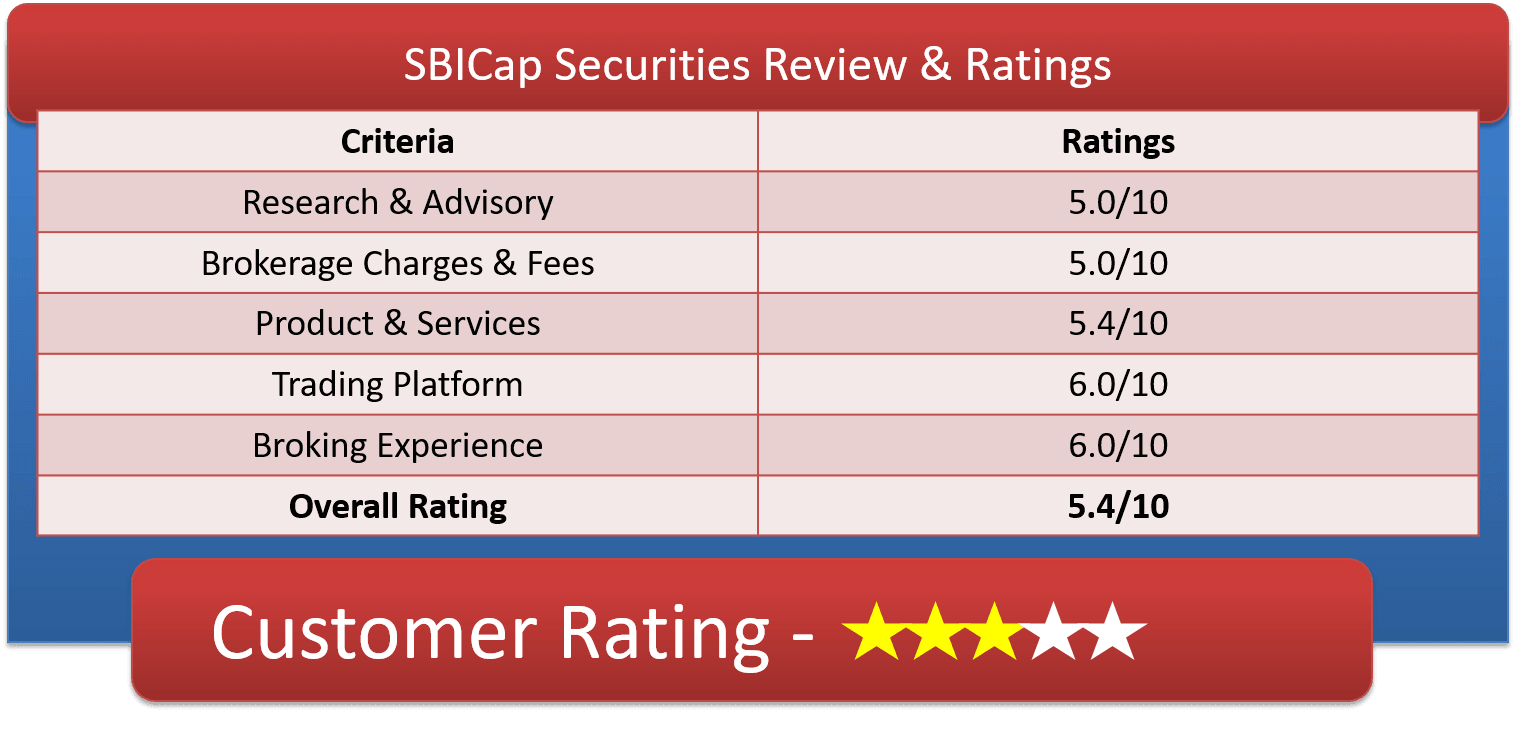

SBI Securities Ratings & Review by Top10StockBroker

About SBI Securities

| Overview | |

| Company Type | Public |

| Broker Type | Full-Service Broker |

| Headquarters | Mumbai, India |

| Founder | Arun Mehta |

| Established Year | 2006 |

SBI Cap Securities need no introduction. The company was established by Arun Mehta in the year 2006. SBICap Securities Ltd (SSL) is part of the State Bank of India’s SBI group.

SBI is India’s largest bank and has now legitimately earned every Indian a banker’s title for many hundreds of years. SBI Cap securities deliver a 3-in-1 account, including banking, Demat, and trading services, because of its payment services from the parent brand.

Open your 3-in-1 account with SBI Cap Securities and ignite your trading journey with the preferred and Best broker for trading.

They are a full–service broker with a presence in PAN India because many of their customers tend to require offline assistance.

So if you want to have conversations or regular communication with local sub-brokers face-to-face, these are always available.

Only stockbroking firms with the leverage of a financial service parent company are offered this feature.

The benefit of a 3-in-1 account is that you have the supposedly best business experience as your bank account is integrated specifically into your trading account, helping you to transfer cash immediately.

SBICap Securities Limited (SSL) offers a comprehensive series of services to meet NRI investment needs worldwide.

They offer their client to deal and invest in the following segments equity, currency Trading, mutual funds, IPO, ETFs, bonds, fixed deposits, and insurance.

Open Demat Account with SBICap Securities – Fill up the Form Now!

SBIcap Securities Brokerage Charges

| Brokerage Charges & Fees | |

| Equity Delivery | 0.50% |

| Equity Intraday | 0.05% |

| Equity Futures | 0.05% |

| Equity Options | Rs 100 per lot |

| Currency Futures | 0.03% |

| Currency Options | Rs 30 per lot |

| Commodity | NA |

| Minimum Brokerage | Rs.10 per Transaction |

| Demat AMC Charges | Rs.350 per annum |

| Trading AMC Charges | Free |

| Margin Money | Rs.25,000 |

The brokerage charges are comparatively higher relative to discount brokers for all trading services provided by Full-Service brokers.

This cost generally represents a certain percentage of the value of the commercial transaction and varies based on the trade segment.

- SBICap Securities has flexible brokerage plans.

- They charge 0.50%for trading in equity delivery.

- SBICap Securities sub-broker charges 0.08% for the equity’s intraday trading and equal trading in cash futures and currency.

- Trading in derivative options, the charge of brokerage is flat Rs.100 per lot

- Brokerage charge for trading in currency options is flat Rs. 30 per lot and for currency future is 0.02%.

- The minimum brokerage charged for trading is Rs.10 per Transaction.

- The maintenance charge for the Demat account is Rs 350, and the free trading account needs to pay once a year.

- To trade with SBICap Securities minimum of Rs 25,000 needs to maintain a security amount in the Demat account.

For a detailed calculation of brokerage & other charges, check out our SBICap Securities Brokerage Calculator.

Similar Stock Brokers, you may also Like

SBIcap Securities Charges

| Other Charges | |

| SEBI Turnover Charges | 0.00005% (₹5/Crore) |

| STT | Equity Delivery: 0.1% on both Buy and Sell Equity Intraday: 0.025% on the Sell Side *Equity Futures: 0.01% on Sell Side Equity Options: 0.05% on Sell Side(on Premium) Commodity Futures: 0.01% on sell-side (Non-Agri) Commodity Options: 0.05% on sell-side Currency F&O: No STT On Exercise transaction: 0.125% Right to entitlement: 0.05% on sell-side |

| Stamp Duty | (On buy side only) Delivery: 0.015%, Intraday: 0.003%, Equity Futures: 0.002%, Equity Options: 0.003%, and Currency F&O: 0.0001%.Commodity Futures: 0.002%, Commodity Options: 0.003% (MCX) |

| GST | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| Margin Funding Charges | |

| Reactivation Charges | Rs 20 per instruction |

| Account Closure Charges | Rs 30 per instruction |

| Dematerialisation Charges | Rs 5 per certificate + Rs 35 per request |

| Pledge Creation | If SSL/SBI is the counter party, 0.02% of Value or Min Rs 25 whichever is higher (Plus CDSL Charges) |

| Pledge Invocation | If SSL is not the counter party, 0.04% of Value or Min Rs 50 whichever is higher (Plus CDSL Charges) |

| Margin Pledge/Unpledge/ Pledge closure | Rs. 12.5 per scrip |

| Margin Repledge | Rs. 15.5 + Rs. 15.5 (Rs. 31 per scrip) |

SBICap Securities Charges

Other charges with brokerage on trading are charged on performing trading. These charges are the tax imposed for conducting trade.

- Transaction costs are expenses incurred when placing the order and squaring off any trade. Transaction Charges are 0.00384% of total turnover.

- Securities transaction tax or STT is a tax imposed on equity gains. This mostly involves stocks, futures, and options. For various types of securities, the rate of tax is different. Each future trade is the amount at the real traded value; each option trade is priced at a premium.

- Securities applicable to STT are Stocks, bonds, debentures, or any such cash equivalents traded in stock traded Derivatives of any mutual investment scheme obtained from custodians. Government securities of a kind similar to capital rights or securities interests.

- Stamp duties on stock–market transactions were levied by state governments. The rates and practices varied between states. Some countries have reduced the stamping obligation to attract their state.

SBICap Securities Other Charges

- Dematerialization – Any dematerialization request placed by investors would cost Rs 5 per certificate + Rs 35 per request.

- Rematerialization – Orders related to changing certificates to physical form would cost you Rs 35 per request + Rs 10 for every hundred securities or part thereof, or a flat fee of 10 per certificate, whichever is higher.

- Pledge – 0.02% of Value or Min Rs 25, whichever is higher (Plus CDSL Charges) is taken if SSL/SBI is the counterparty. Contrarily, 0.04% of Value or Min Rs 50, whichever is higher (Plus CDSL Charges), is taken if SSL is not the counterparty.

- On-Market (Sell Market) – For on-market transactions, SBIcap securities charge 0.01%, which can vary within the bracket of Rs 21 to Rs 300.

- Off-Market – It charges no sum from investors for buy-market and off-market. But it charges Rs. 10 for rejected or failed transactions.

- Additional Accounts Statements – Where the investor avails the service of requesting additional accounts statements, no sum will be charged if the information is required through email, and Rs. 10 shall be charged if the request is for courier.

- SBICAP Securities Transaction Charges – Brokers in India charge for the transaction and the brokerages as applicable on executed orders.

The transaction charges in equity delivery or intraday are 0.00386% for NSE and 0.00384% for BSE. For futures, they charge 0.002206% or Rs 221/Crore and 0.05515% or Rs 5515/Crore for options.

To know in detail, just click on this link SBICap Securities Brokerage & Other Charges.

Compare SBICap Securities with Other Brokers

Compare Stock Brokers

SBIcap Securities Demat Account Opening Fees

| Demat Services | |

| Trading Charges [One Time] | Rs 850 |

| Trading AMC [Yearly] | Rs 0 |

| Demat Charges [One Time] | Rs 0 |

| Demat AMC [Yearly] | Rs 350 |

| Margin Money | Rs.25,000 |

| Offline to Online | No |

Depository source interacts via its agents with its customers, and investors are CDSL & NSDL. They intend to assist their clients and derive them to the greatest extent with insight into equity / financial markets.

CDSL & NSDL facilities are securities services, as the bank retains all your funds and offers all of the benefits associated with a cash transaction. They also assist you in conducting the service through a Demat account.

- Account opening charges are on the higher end, and they are Rs.850. On the contrary, the company also rolls out the offer of a Free account opening charge. This offer is presently ongoing.

- Yearly, upholding Rs 350 needs to be paid every year for the Demat account.

- Charges maintenance of trading account charges is free.

- The amount of Rs.25,000 required as a deposit margin is determined by the derivative used and the market traded. Higher volatility or larger markets may require a higher margin for deposits. A marginal deposit is one of the two main margin types necessary for an open leverage position.

To know more, just click on this link SBICap Securities Demat Account.

SBIcap Securities Offers

| Offers | |

| Free Demat Account | No |

| Free Trading Account | No |

| Discount on Brokerage | No |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | No |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | No |

| Zero Brokerage for Loss-Making Trades | No |

The elaborated services and distinguished features of SBI Cap Securities make it unique among other. SBICap Securities is a well-established, one of the oldest and most trusted players in the share market.

As SBI Cap Securities holds strong customer reliance and is one of the Top 10 Full-Service Brokers. It does not require making an offer to the customer to trade with them. Some offers given by SBI Cap are:

0% interest on E-Margin – Margin Trading is trading where the investor pays just a portion of the value, and the broker meets the rest obligation.

With SBICap, an investor can go as low as 25% and carry forward the position for 30 days. No interest is charged on this facility.

Refer & Earn – Investors can win rewards by referring SBICap to their family and friends. The rewards are credited after the referral code is used and the person successfully installs and creates an account.

SBI Multicap Fund – SBI Mutual Fund has introduced its SBI Multicap Fund. This open-end scheme will invest across large, mid, and small-cap companies.

Corporate FD – SBICap securities also offers Corporate FD to its customers. This expands the variety of products of SBICap. The interest rates are also attractive.

How to open a Demat Account with SBIcap Securities?

You can open a Demat account with SBICap Securities with the following step.

- Click on the ‘open Demat account button & fill up the lead form.

- One of the SBICap Securities representatives will speak to you for the meeting.

- The spokesperson will meet you to complete other opening formalities by collecting the required document.

- Once all process is completed, your Demat account will be open in a few days.

Open Demat Account with SBICap Securities – Fill up the Form Now!

Why Open SBIcap Securities Trading Account?

Here are a few reasons to open an SBICap trading account –

- They are one of the prominent financial brokers with a diverse customer base that offers a wide range of products and state–of–the–art service and implementation.

- It gives you the ability to listen to your voice and control your financial life. They provide you with finance data with intelligent investment tools, deep education resources, sophisticated analysis, and various investment choices that help you achieve your goals.

- SSL has a partnership with SBI Cap to offer an online trading resolution to NRIs, So while they take trading decisions, they can feel at home.

- SBICAP Securities expresses high stock exchange expertise and offers a variety of savings and investment solutions to its customers. The range of value-added services offered includes equities and derivatives, reciprocal funds, NCDs, IPOs, etc. Take a look at our appeal and feel-good TV advertising, and learn all about sbismart.com.

- They have high excellence in Compliance.

- The systems outline is good.

- The management of market risk is controlled.

- External Interface

- They maintain a high credit profile of customers for high returns.

SBIcap Securities Products & Services

List of products & services provided to its clients

SBIcap Securities Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | No |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | Yes |

| Banking | Yes |

| SIP | Yes |

| Insurance | Yes |

- SBI Cap provides trading products to the segment to trade retail, institutional, and NRI customers.

- They serve intraday trading in which roles can be purchased or sold and closed on the same day. Such purchases and then sales are made to take benefit of daily movement in terms of share value. Intraday enables attaining on the same day without taking delivery of shares in your Demat account.

- They offer delivery-based trading for traders seeking to hold their positions longer. The greatest benefit of holding-based trading is that you are not forced to sell your shares. These shares can be held as long as you want.

- They offer you the opportunity to buy and sell NSE exchange securities in the future. You may purchase or sell an agreement for a stock in the Futures Index, BANK NIFTY, and Stock Futures.

- You can trade currency derivatives through SBISMART. These are future and option contracts for which a certain amount of a certain currency pair may be bought or sold on a future date.

Such a currency pair (i.e., USDINR, EURINR, JPYINR, or GBPINR) is comparable to the stock futures and stocks, but it is a currency pair rather than stocks.

They give you a chance to purchase and sell currency pairs via NSE Exchange in Futures.

Additional Products

- SBICAP Securities delivers an easy and smooth way of buying and selling units of mutual funds. You can purchase both physically and in Demat mode. You can also trade transactions in MFs.

- Knowing your background, investment behaviour, etc., and risk appetite before investing. Their risk analyzer calculator will help you understand the ability to take your risk that will help you determine your investment.

- You can plan the portfolio allocation based on your risk analyzer. The calculator for the allocation of assets in different asset classes is available.

- Equity – Equity is the divided unit of a company commonly known as shares. These are freely transferrable, and the holder of shares is called a shareholder or stakeholder.

- Derivatives – The security which derives its value from some other asset is called a derivative. Their value changes according to the underlying asset.

- Mutual Funds – Mutual Funds are units issued by an entity under a scheme of Mutual Funds.

- ETF– – ETF its expanded name is called Exchange Traded Fund. It is a pooled investment security. Its nature is very much like Mutual funds only.

- Insurance – Insurance is an arrangement where a contract is undertaken between an individual and an entity called a policy. In this arrangement, the entity ensures the individual makes the loss good regarding any asset for which the policy has been taken.

- IPO – IPO is a process where a company’s securities are offered for the first time in the capital market.

SBIcap Securities Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | Yes |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | Yes |

| Trading Institution | No |

| Trading Exposure | Upto 5x |

- They provide Demat Services by this customer can handle a physical certificate and DRF (Demat Request forms) in any branch; customers can transform their physical certificate to electronic form.

- The refurbishment allows you to transform the dematerialized shares physically.

- An Initial Public Offer (IPO) is the initial offer for the public to sell private shares to a private enterprise.

- In accordance with the new SEBI guidelines, you can perform investment in the IPO via the ASBA account. By visiting one of our branches, you can invest in an IPO.

- SBICap Securities provides an easy and transparent way of buying and reselling units of mutual funds. You can buy both physically and in Demat mode. The exchange also allows you to transact in MFs. In addition, through a Systematic Investment Plan (SIP), they offer you the facilities to buy and sell mutual fund units in which you can regularly invest, as required.

- They provide buying and selling on exchange ETFs (S&P CNX Nifty, BSE Sensex, CNX Bank Index, CNX PSU Bank Index, etc.). It offers broad exposure to investment companies, on an easy and real-time basis, at a lower cost, both to the stock market and certain sectors.

Other Services

- Provide simplified investor education with this tool; you can quickly identify the topic and information you need from our website for your convenience in website browsing. They provide trading through smart edutainment videos, smart insight, and webinars.

- They offer you a unique chance to ask our experts your questions directly. You can ask your questions and see other investors ‘ questions.

- For trading, exposure up to 5 times of investment is provided.

- Loans – SBI securities offers various loan offers for its customers on easy terms. They can provide you with loans for cars and homes.

- Fixed Income – Everyone has their distinct goals with investment; some want rapid growth, some want high margin, and others have regular income and SBI securities cater for all of the requirements. Invest in fixed-income investments and receive a steady income with the right balance.

SBIcap Securities Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | Yes |

| Annual Reports | Yes |

| Company Stock Review | Yes |

| Free Stock Tips | No |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | No |

| Monthly Reports | Yes |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

They provide relatively good Research & Advisory for traders

- Based on the market situation, stock–associated headlines, and significant global events, SBICap Securities offers comprehensive research reports with a basket of market data and a worldview of intended stock and index movements.

- The reports are submitted to SBICap Securities by researchers and experts after thorough market instances, important events, and trends have been analyzed and researched.

- SBICap Securities provides a basic view of stocks that can help analyze a particular company’s future opportunities.

- The basic factors of the company/share are the basis for these fundamental views. Our research analysts analyze different parameters such as EPS, profit margin, P / E ratio, and more to define basic opinions and stock valuation.

- They offer derivative reports covering views and investment strategies for the future and options. The report’s opinions are based on industry trends, analytical and fundamental analysis factors, important events, and news related to stocks in local and international markets.

- SBICap Securities provides technical information on stock levels. These technical perspectives are presented on the grounds for a certain stock or index over technical factors and trends.

- SBICap Securities offers several many other reports as well as the above. BTST, Intraday Calls and Weekly Recommendations, Basket of Golden Eggs (selective basket view), and many more are regularly updated.

SBIcap Securities Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | 1x |

| Equity Intraday | Upto 5x |

| Equity Futures | 1x |

| Equity Options | 1x |

| Currency Futures | 1x |

| Currency Options | 1x |

| Commodities Future | 1x |

| Commodities Option | 1x |

- SBICap Securities offer maximum exposure of 5 times for trading in equity intraday.

- If trading inequity is not settled on the same day, traders get a maximum of 1 time of exposure with interest.

- For trading in commodities and derivatives, no exposure is provided for trading.

SBICap Securities Margin Calculator will help you to calculate how much margin you will get if you invest or trade with SBICap Securities.

How to transfer shares in SBIcap Securities from other Stock Brokers?

Investors can easily transfer shares from one stock broker to another:

- Place a request through the DIS form with the current stockbroker.

- Submit it to the current broker, and the same shall be submitted to the Depository.

- The Depository will transfer the shares to the new account.

- After completion, the shares will be reflected in the new Demat account.

- Also, when you transfer shares from an earlier stock broker to SBICAP securities, the price will be shown as on the date of the transfer, but the same can be changed too.

SBIcap Securities Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | Yes |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platforms | No |

| Real-time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | No |

| Research Reports | Yes |

| Easy Installation | Yes |

| Global Indices | No |

| Stock Tips | Yes |

| Personalized Advisory | Yes |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | Yes |

| Email Alerts | Yes |

| Multi-Account Management | Yes |

SBICap Securities is a full-service security dealer that offers a range of mobile, web, smart-watch, and desktop platforms.

So customers of this full-service stockbroker need not worry much about the range of trading applications available to them. Their application has the following features:

- The high-speed performance of the trading application.

- Trading skill

- No interruption in the feeds

- simplicity of navigation

- numerous tools for technical and fundamental analysis

- Robustness experience for trading.

- Heat maps help you manage rapidly the time it takes to know and manage records in real-time using much more precise financial information.

You can consolidate data from a sector perspective with Heat Maps, merge information about holding companies, and access real-time data that speeds up decision-making.

SBICap Securities Web Trading Platform

Here are some of the main characteristics of the web application:

- If you log over for the first time, the home screen will show you basic widgets like market information, current index snapshot, market winners, portfolio, and more. Moreover, you can customize the dashboard with the widgets to be kept.

- You can put the trade from the ‘Trade Now’ menu by providing values such as Buy/Sell, Exchange e. NSE, BSE, etc., Products like Intraday trading, Delivery trading, ValuePlus, Name of the Scrip, Quantity, Order Type like Limit Order, Market Order, Stop-loss, Price, etc. Post entering the details, you can click on the Buy or Sell button depending on your trade type.

- You can quickly approach the market analysis by clicking on Markets,’ then clicking on the Overview’ sub-menu item and checking the current stock traction across the indices and segments, equity, derivatives, commodities, or currency. You can also change the index with this feature.

- As a full-service stockbroker, you will receive regular technical and basic tips, reports of Research, recommendations, and analysis. You can find these recommendations in the Our Recommendations ‘ section, along with information on market prices, exit prices, target prices, stop-loss, etc.

To know more, check out SBICap Trading Terminal.

SBI Smart Trading App – SBICap Securities Mobile Trading App

The compact design and improved visual interface of the trading app, advanced tools/widgets, and extensive research into investment facilitate auto–directed business as ever. Tablets, iPads, or Smart Mobile.

Phones ensure that everything you can do is on the go. Customers can download Play or App Store “SBISMART.” You can connect your account with the same login information as your online trading portal SBISMART.

The following super-wealthy characteristics powered by SBISMART Mobile / iPad Trading App:

- Customers can access live quotes and messages

- Able to place orders for trading taking no time.

- A Trader can easily modify, Square off or cancel pending orders on a single application.

- Customers can create personalized market watches.

- Able to confirm Order Status and Positions of traded stock.

- Track the live markets of NSE and BSE on one application.

- Right of access to live trading calls from research technical and fundamental teams, media, and another basis.

- Acquire stock recommendations and tips in depth.

- Outlook stock rankings and admittance are inclusive research tools to analyze stocks.

The various platforms of SBICap securities are:

SBISmart Portal – This is a web platform to watch various stocks and other marketable securities. This can be operated through desktops, laptops, tablets, and mobile phones.

SBISmart Xpress – Another platform offered by SBI securities is SBISmart Xpress, a software used for trading securities. This platform provides all services in one single place.

SBISmart Lite – Investors can also take benefit from the website provided. You get all the information about the dealings, offers, opportunities, a place for resolving queries, and all other requirements.

SBISmart Mobile App – To access all the services from your mobile phone, download the SBISmart Mobile App and search, buy, sell, and watch all the stocks, commodities, derivatives, mutual funds, etc.

SBIcap Securities Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | Yes |

| Email Support | Yes |

| Chat Support | No |

| Toll-Free Number | 1800 209 9345 |

| Branches | 225 |

The resolution quality is average, and any communication is well recognized for the delay in responding to its customers.

So you need to understand this particular aspect when you decide to open a brokerage account with the Bank.

- SBICap Securities provides its customers with various communication channels like email and chat support.

- They provide 24*7 Support to customers.

- They solve resolutions for online and offline trading.

- You can contact 1800 209 9345 toll-free number anytime.

- You can visit your nearest branch office; there are about 225 branches.

SBIcap Securities Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 196 |

| Resolved in BSE | 153 |

| Lodged in NSE | 218 |

| Resolved in NSE | 200 |

The number of claims lodged against a broker and how many are resolved must always be known to customers.

- In the BSE board Last year a total of 196 complaints were lodged, and 153 were resolved.

- On the NSE board, A total of 218 complaints were lodged last year, and 200 were resolved.

SBIcap Securities Disadvantages

There are a few drawbacks to trading with SBICAP Securities Ltd.

- Their customers are not satisfied with customer care service.

- They do not propose any offer as other brokers provide.

- Do not provide exposure for trading in commodity trading.

- Brokerage is compromisable high than others in the security market.

SBIcap Securities Conclusion

Trading with SBICap Securities Ltd will be a decent decision. More than one million customers have the same trust as SBICap Securities Ltd (SSL).

It is the brokerage of SBI Capital Markets Ltd., a prominent investment company in India and the project adviser, and is a fully–registered subsidiary of the State Bank Group.

They help respected NRI clients through a special NRI desk, in which they may also transact on offline channels (as required by the rules of the country in question).

The performance of SSL’s services is demonstrated by NRI’s clientele located across different countries.

Stock analyses are essential for your trade proposal because they offer you an overview of the company plan, its economic advantages, competitors, and market situation. 3-in-1 account for convenient transactions between your bank and your trading account.

SBI Smart Review FAQs

Check out the FAQs on SBI Smart Securities

Is SBI Smart safe for trading?

Yes, the brand worth is denoted by the name itself, where many people trust the brand SBI and wish to be associated with it.

You can trust them and be assured your wealth is in safe hands, as they have been a part of the banking industry for a long time.

What is the brokerage of SBI Smart?

Brokerage, this stock broker charge, varies from one segment to another.

The brokerage for Intraday is 0.05%, Futures is 0.05%, currency Futures is 0.03%, delivery is 0.50% Equity Options and for Currency Options, it is Rs.100 per lot

How to open SBI Smart Demat online?

The process starts when you click on the “Open Demat Account” button from this page. You will instantly see a pop-up form, fill it up, and this will redirect you to the next step.

When the KYC process is done, you will receive your account. For a detailed process, check out the article.

Can I invest in an IPO via SBI Smart?

Yes, SBI Smart provides you with the feasibility of investing in IPO via online and offline mediums.

So, according to the process, you can fill out the offline or online form; however, make yourself familiar with the terms and conditions of the investment.

What Leverage does SBI Smart provide?

Leverage or exposure is a part of all the segment investments this stockbroker provides. It is 5x for the intraday segment, starting with the highest exposure level.

The next rate is 1x, which is provided for the segment’s delivery, futures and option. 1x is provided for currency futures and 1x for currency options.

Does SBI Smart have a trading App?

Yes, being a client of this stock broker, you will be able to use a mobile app and trade on the go. They have put together a great application for both iOS and Android users to enjoy uninterrupted stock market investment services.

How to contact SBI Smart customer care?

There are online as well as offline mediums since this stock broker is a full-service broker and has 225 branches.

So, according on the issue you face or otherwise, you can connect with the company’s representative via email and their toll-free number as well.

Does SBI Smart provide Research?

Yes, you are provided with the assistance of enjoying Research, advisory, and stock tips by the company.

They are a full-service stock broker, and they have specific divisions for all kinds of stock broking services, including a research and advisory division of stock market experts.

Is SBI Smart good for Beginners?

Yes, this brand is one of the most trusted networks, and hence, you can be assured your funds are in safe hands.

Also, the stock market tips and recommendation service is the best way to understand the market and make an investment instantly.

Who Founded SBI Smart?

This stock broking is the broking arm of State Bank Group. It is a wholly-owned subsidiary of SBI Capital Markets Ltd.

They are one of the oldest market players and have been running strong and tall since they were established. Naresh Yadav holds the present designation of MD and CEO.

Open Demat Account with SBICap Securities – Fill up the Form Now!