Bonanza Portfolio Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Mar 27, 2023My Etrade powered by Bonanza Portfolio Ltd is a name that needs no introduction in the stock market.

About Bonanza Portfolio, most pro traders know about this huge financial services and brokerage house which has a pan-India presence.

The article below will describe the different aspects of the company ranging from its brokerage plans and how it offers various facilities to the customers.

It will also talk about the pros and cons of the company and will guide you through the trading platforms it offers.

The article can be referred to as My Etrade Review or Bonanza Portfolio brokerage review which can enlighten your knowledge about the company and guide you to take a wiser decision about investment.

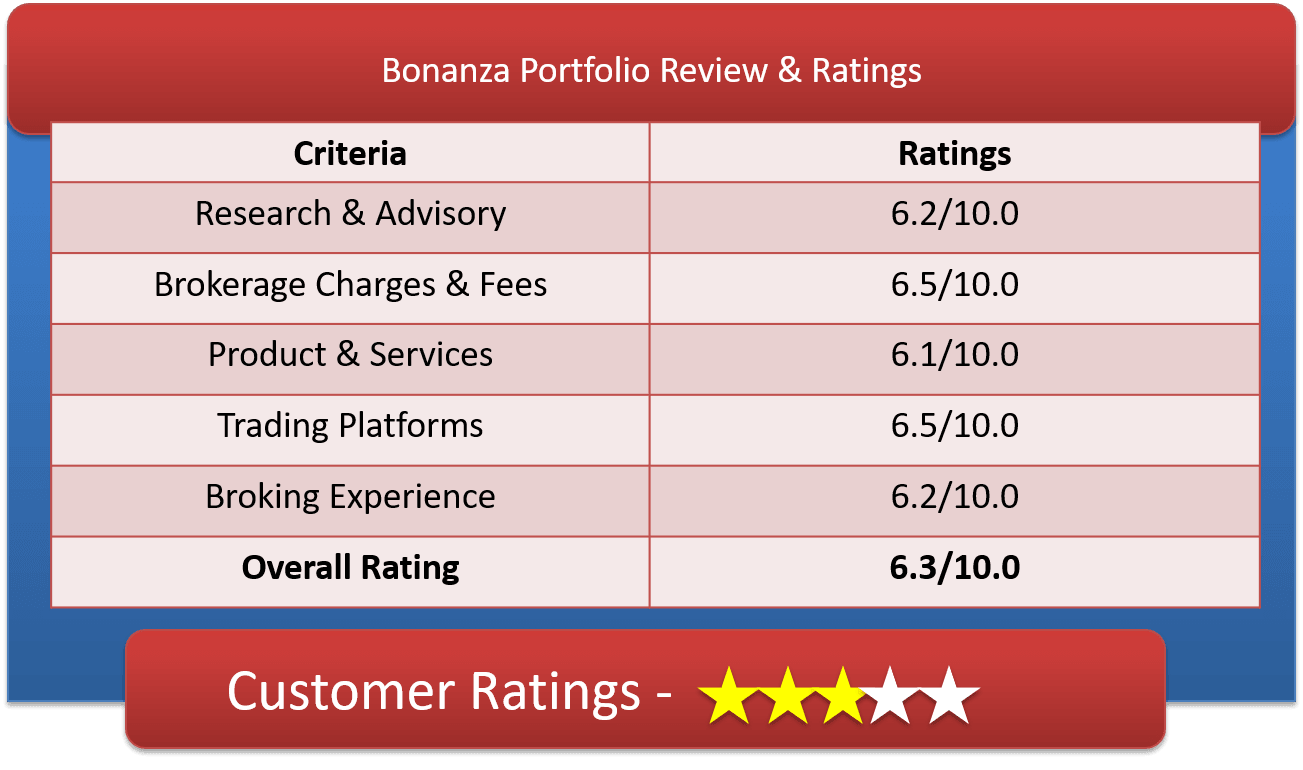

Bonanza Portfolio – My Etrade Ratings & Review by Top10StockBroker

About Bonanza Portfolio – My Etrade

| Overview | |

| Company Type | Public |

| Broker Type | Full-Service Broker |

| Headquarters | New Delhi |

| Founder | Shiv Kumar Goel, Satya Prakash Goel, Anand Prakash Goel, Vishnu Kumar Agarwal and Surendra Kumar Goel |

| Established Year | 1994 |

With a rich experience of more than 25 years, this company is utmost popular as a discount broker in the country. It falls under one of the top five rapidly growing financial services companies in the country. Its dedicated efforts along with its services and products make it easier for them to be on the list.

The company was established in the year 1994 with its head office in the city of Mumbai.

It is registered as a private firm with more than 1784 outlets in the country and all these outlets are spread across the country in more than 560 cities. It is one of the biggest chains of financial service companies and can be termed a giant in itself looking at its scale of operation.

The company has been working in various verticals of financial services including equity broking, PMS, mutual funds and many other services provided by the company.

More About Bonanza Portfolio

The company has its membership with the major exchanges in the country and most of them fall under the list as it seems. It is a member of NSE, MCX, BSE, MESI, NCDEX, ICEX, and NMCE. The depository source of the Bonanza Portfolio is CDSL.

The firm has been awarded and recognized many times because of its outstanding performance in various segments. It has been awarded for the trading platform – web-based in the year 2013 and many other times for its trading platforms.

For its exceptional financial advisory services, it was awarded and recognized as “India’s NO. 1 Valuable Financial Advisory & Stock Broking Company”. There is a lot of other recognition in its kitty and a lot more to come its way as can be depicted by its overwhelming services.

Get a Call Back from My Etrade Bonanza Portfolio.

Bonanza Portfolio Brokerage Charges – My ETrade

| Brokerage Charges & Fees | |

| Equity Delivery | Rs 18 per executed order |

| Equity Intraday | Rs 18 per executed order |

| Equity Futures | Rs 18 per executed order |

| Equity Options | Rs 18 per executed order |

| Currency Futures | Rs 18 per executed order |

| Currency Options | Rs 18 per executed order |

| Commodity | Rs 18 per executed order |

| Minimum Brokerage | As per Transaction |

| Demat AMC Charges | NIL |

| Trading AMC Charges | NIL |

| Margin Money | 75% Margin |

| Brokerage Calculator | Bonanza Brokerage Calculator |

The brokerage plans of My Etrade plan by Bonanza Portfolio includes three different structure which are –

- Percentage-based brokerage plans

- Flat brokerage charge; and

- Monthly plans

Under the My Etrade plan, the brokerage you have to pay for the equity delivery segment is Flat Rs. 18 per Trade for the equity intraday, futures, and commodities.

In that case, the flat fee brokerage will be applicable and the trader will be paying only Rs. 18 per trade. In the case of options – currency and equity options (both), the charges are fixed at Rs. 18 per lot.

For the other plan which is the monthly plan, there are four different segments according to the number of plans you choose. The monthly plan starts from Rs. 1000 and goes up to Rs. 27000 plan including the Rs. 3000 and Rs. 7500 plans in between.

So under these four plans, the brokerage is charged on a percentage of the transaction however, the more expensive plan you opt for the lower the brokerage charges you have to pay. For instance, the intraday brokerage charges under Rs. 3000 plan is 0.00375% of the trade whereas it is 0.00281% under the Rs. 27000 plan.

There is a call & trade option available for the customers and the charges are Rs. 18 for each of the executed orders.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| Sharekhan | Edelweiss | Indiabulls Ventures | Kotak Securities |

| Angel Broking | HDFC Securities | India Indoline / IIFL | Motilal Oswal |

| Axis Direct | ICICI Direct | Karvy | Upstox |

Bonanza Portfolio Charges / My ETrade Charges

| Other Charges | |

| SEBI Turnover Charges | 0.00005% (Rs.5/Crore) |

| STT | Equity Delivery: 0.1% on both Buy and Sell Equity Intraday: 0.025% on the Sell Side *Equity Futures: 0.01% on Sell Side Equity Options: 0.05% on Sell Side(on Premium) Commodity Futures: 0.01% on sell-side (Non-Agri) Commodity Options: 0.05% on sell-side Currency F&O: No STT On Exercise transaction: 0.125% Right to entitlement: 0.05% on sell-side |

| Stamp Duty | (On buy-side only) Delivery: 0.015%, Intraday: 0.002%, Equity Futures: 0.002%, Equity Options: 0.002%, and Currency F&O: 0.0001%. Commodity Futures: 0.002%, Commodity Options: 0.002% (MCX) |

| GST | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| Margin Funding Charges | NA |

| Reactivation Charges | Rs 20 per instruction |

| Account Closure Charges | Rs 20 per instruction |

| Dematerialisation Charges | Rs 5 per certificate + Rs 25 per request |

| Pledge Creation |

If SSL/SBI is the counter party, 0.02% of Value or Min Rs 25 whichever is higher (Plus CDSL Charges)

|

| Pledge Invocation |

If SSL is not the counter party, 0.04% of Value or Min Rs 50 whichever is higher (Plus CDSL Charges)

|

| Margin Pledge/Unpledge/ Pledge closure | Rs. 12.5 per scrip |

| Margin Repledge | Rs. 12.5 per scrip |

The other charges of the broker include the statutory charges like STT at 0.0126% on the total turnover and the SEBI charges at 0.00005% on the same.

The transaction charges are at 0.00275% of the particular transaction and the GST is levied on the same including the amount of brokerage for the transaction.

The percentage of GST is 18% which is levied on the brokerage and the transaction charges of the trade. The stamp duty is also there which the trader has to pay however that is a very nominal amount and differs from one state to the other.

Bonanza Portfolio Demat Account Opening Fees

| Demat Services | |

| Trading Charges [One Time] | Rs 999 |

| Trading AMC [Yearly] | NIL |

| Demat Charges [One Time] | NIL |

| Demat AMC [Yearly] | NIL |

| Margin Money | 75% Margin |

| Offline to Online | No |

Bonanza Portfolio Demat AMC charges are nil as the firm offers Lifetime account opening to the customers. The charge for opening the demat account is Rs. 999. However, for the trading account, there is no such AMC applicable. The brokerage house also charges 75% margin money from the customers on a mandatory basis.

Bonanza Portfolio Offers

| Offers | |

| Free Demat Account | Yes |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | No |

| Zero Brokerage for Loss-Making Trades | No |

The firm comes up with a wide range of offers for the customers and the prospective customers and some of the offers are –

- Flexible Brokerage charges and plans for the customers. It helps different types of customers to trade without watching their pockets.

- There are ample discounts available on the brokerage charges of the firm for the customers. One can avail of them by meeting the set criteria.

- The trading account offers absolutely free

- The Demat opening is free as well.

Find Offers from other Broking Houses

| SBI Smart | Aditya Birla Money | Asit C Mehta Investment | 5Paisa |

| Narnolia Securities | Alice Blue Online | Astha Trade | Choice Broking |

| Zerodha | Anand Rathi | BMA Wealth Creators | Geojit Finance |

How to open Demat Account with Bonanza Portfolio?

If you want to open an account with Bonanza Portfolio then you can do it either online or you can do it manually.

For opening a Demat account manually with this firm, you can –

- Visit any of its branches or outlets of the 1784 outlets in 560 cities. There you will get the application form which you have to fill in with the required details.

- You have to submit the necessary documents for the verification process and KYC.

- Then they will evaluate your application and verify your documents and once found all right, they will approve your application.

- Your account will be opened and you will be provided with the login credentials.

- You can also call them on this number +91 22-68363904-760 / +91 22-62735568 for any kind of assistance required in making an application.

For applying through the online mode you have to –

- Open their site and you will find the Demat account opening form on the site itself. Register yourself and provide all the details they ask for theirs.

- Upload the scan copies of the documents asked for along with the form. The most important documents here are PAN, AADHAAR, Voter ID, Address proof and bank statements.

- Once you complete the process, it takes a few hours to a day or so to verify the documents and application at their end.

- You will receive the login details once your account is approved and opened.

Get a Call Back from Bonanza Portfolio

Why Open Bonanza Portfolio Trading Account?

If you are looking for reasons to start trading with bonanza, the firm has abundant reasons to give you and the primary ones are –

Biggest Network

The firm as mentioned above in the first two sections of the article has 1784 outlets at present which are operating across 560 cities in the country. This apart from having a pan-India presence, it has one of the largest and widest networks. This helps customers from different cities, places, and backgrounds to join and trade using its services even if they are in the remotest areas. You do not have to go and look for an outlet for many days as there must be one at least near to your house.

Exceptional Research Support

The brokerage house understand the need for dedicated and experienced research support and thus it provides all kind of important financial advice, research reports to its customers. It has been rated as the best in providing financial advisory and research support as mentioned above.

Wide variety of services and products

You name it and they have it – this is the motto of the Bonanza Portfolio as it seems. They have all kinds of products and services listed under them and they work in all the segments. It has equities as well as mutual funds. They have options as well as PMS services. To put it simply, they can be termed as a complete financial service company and not just a stockbroker.

Excellent technical team

The trading platforms of Bonanza Portfolio have been recognized various times to be the best in the industry and the credit goes to its technical team who are working day and night to make the trading easier and smooth for the customers. Not only are the people in the technical team but also the marketing experts and the customer care experts knowledgeable and dedicated towards the customers.

Two-in-one account

The firm offers a 2-in-1 account which means the trading and the Demat account come together as a package and the company also charges no fee for opening them.

Recognized and experienced

The firm provides safety and assurance to the customers because of its huge recognition in the market and the amount of experience it has in the market. This ensures that the customers are not going to be fooled or defrauded.

Bonanza Portfolio Products & Services

List of products & services provided to its clients

Bonanza Portfolio Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

- Equities of maximum companies working in the country. With its membership with BSE and NSE, the traders get to trade all the shares listed on these two exchanges.

- Commodities trading is done with a membership in the NCDEX and MCX.

- The firm also offers currency trading and futures and options trading and for that, it also has membership in other exchanges mentioned above apart from NSE, and BSE.

- It has one of the largest distributorships of mutual funds in the country and it deals in various mutual funds and SIPS.

Bonanza Portfolio Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | No |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 5x |

The Bonanza Portfolio services include Demat and trading services. It also allows the customers to take part in the IPOs and they update about IPOs on a daily basis through its online portal.

The trading service also includes daily trading services or intraday services.

Bonanza Portfolio Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | Yes |

| Annual Reports | No |

| Company Stock Review | Yes |

| Free Stock Tips | No |

| IPO Reports | Yes |

| Top Picks | No |

| Daily Market Review | No |

| Monthly Reports | Yes |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

The firm mentioned above has already been recognized and referred to have the most excellent research and advisory team and the reason behind the same is –

- Fundamental reports: The firm provides fundamental reports of the companies with in-depth analysis of the company. This helps in understanding the fair value of the share price of the company and in turn, helps the traders in taking investment decisions that is whether to buy or sell the shares of the particular company.

- Research Reports: The research team dedicates itself to generating research reports on the stocks and other financial instruments on a periodic

- The company reports: The firm circulates the company reports amongst its customers.

- IPO Report: If any new company is going to list its shares and there is a new IPO coming in the market, Bonanza Portfolio is going to update its customers about the same so that interested traders can buy the shares at the lowest price possible to gain more.

- It also provides company stock review reports, daily and weekly as well as monthly reports of the shares.

- The company has relationship manager services as well as offline advisory facilities.

Bonanza Portfolio Exposure or My ETrade Leverage

| Exposure / Leverage | |

| Equity Delivery | 1x |

| Equity Intraday | Upto 5x |

| Equity Futures | 1x |

| Equity Options | 1x |

| Currency Futures | 1x |

| Currency Options | 1x |

| Commodities Future | 1x |

| Commodities Option | 1x |

| Margin Calculator | Bonanza Portfolio Margin Calculator |

The exposure or the leverage provided by My ETrade Bonanza Portfolio to its customers is up to a maximum of 5 times the amount they have in their trading account and this is for the intraday trades.

For the others like equity delivery, the maximum leverage you can get is up to 1 time and it is 1 time for the equity futures. The maximum exposure for the equity options and commodities is the same at 1 time and it is 1 time for the currency futures and options segment.

Check the Margin or Exposure of other stock brokers

| IDBI Direct | KIFS Trade Capital | Nirmal Bang | Prabhudas Lilladher |

| Jhaveri Securities | Mastertrust Capital | Groww | Profitmart |

| JM Financial | Monarch Networth Capital | Paytm Money | Reliance Securities |

Bonanza Portfolio Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platforms | No |

| Real-time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | No |

| Research Reports | Yes |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | No |

| Personalized Advisory | Yes |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | Yes |

| Email Alerts | Yes |

| Multi-Account Management | Yes |

The trading platforms of Bonanza Portfolio are referred to as one of the most advanced and upgraded and easy-to-use platform in the market and the industry at present. There are three types of platforms that are offered by Bonanza Portfolio which are –

Bonanza ODIN Diet Trading Platform:

This is the trading terminal which is accessible through the desktop or laptop as any other software. This is also downloadable and you can easily install it on your system. The platform has certain features which need to be highlighted as they make the platform one of its kind and they are –

- It is a single-screen terminal for trading all your financial instruments.

- The abundance of research reports, fundamental calls, intraday calls, and many other facilities are accessible using this platform with just a few

- The platform has technical indicators, charts, and historical data to assist you in your daily trading and help in assessing the market well in advance and in the right direction.

- Market watch is customizable to an infinite extent that is you can accommodate any number of the scrip on your market watch and alter them anytime you want.

Bonanza My ETrade

This is the online platform which you can use to trade your stocks from anywhere and at any time during market hours.

it is an advanced web-based trading platform which has been built in-house by the firm for its customers. It has the lowest cost and highest flexibility and offers one of the fastest and smooth trading experiences in any part of the world. The features which make it extraordinary are –

- You have access to any of the exchanges that Bonanza is a member of via this platform. This, in turn, means that you are being able to trade across all the segments using this online platform.

- The platform provides one of the most accurate technical analysis charts and historical data

- There is a helpdesk to assist you in your trading

- There are educational videos to understand the trading process and how to use the platform.

- It is accessible from any of the devices whether it is a laptop or a desktop or a mobile or a tablet.

Bonanza Touch

This is a mobile application trading platform offered by Bonanza Portfolio to its customers. The mobile trading application is one of the latest applications with all the advanced features and technology intact.

The application offers a variety of features that are there on the trading terminal and online platform. You can trade from your mobile screen whenever you want with just one single application. The features include –

- Market watch – real-time data and updates are available

- News updates are available

- Trading facility across every segment is possible with the mobile application

- It is accessible on android mobile or tablet.

- There are email alerts, and SMS alerts facilities.

Bonanza Portfolio Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll-Free Number | No |

| Branches | No |

The customer care of Bonanza Portfolio is renowned for its exceptional management of the customers and they are prudent in handling the customers when they face any difficulty.

They are friendly and understanding. They provide offline and online customer services. You can mail them to contact@bonanzaonline.com.

Bonanza Portfolio Complaints & Feedback

Find the list of total complaints lodged & resolved at both exchanges.

| Complaints (Current Year) | |

| Lodged in BSE | 135 |

| Resolved in BSE | 106 |

| Lodged in NSE | 114 |

| Resolved in NSE | 89 |

The number of complaints received against Bonanza Portfolio is 114 on NSE and 135 on BSE as per the records of last year. The firm resolved 89 and 106 complaints out of the respective numbers mentioned on both exchanges.

Bonanza Portfolio Disadvantages

- There is no 3-in-1 account that is a bank account together with Demat and trading account.

- There is no support or services for the NRIs.

- They do not have any referral program

- The brokerage charges are quite confusing and not very transparent.

Bonanza Portfolio Conclusion

Being one of the most reputed and recognized stockbroking and financial services in the country, the firm has been trying to make it bigger and better every day.

They put dedicated efforts to reach the customers with its widest network and range of services. There are very few loopholes which the firm can fix in the upcoming days to make it beneficial for the customers.

Get a Call Back from Bonanza Portfolio

Find Reviews of other Stock Brokers

| Religare Securities | Shri Parasram Holdings | Sushil Finance | Ventura Securities |

| SAMCO | Shriram Insight | Swastika Investmart | Way2Wealth |

| SAS Online | SMC Global | Tradebulls | Yes Securities |

Most Read Articles