Religare Online Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Jan 05, 2024Religare Online is an open conciliator of Religare Broking ltd that has been a leading name in the Indian stock broking industry for more than two decades.

They boast to offer valuable research insights and multiple advanced analytical tools like Tech Scan for effective online stock trading through many of their remote trading platforms.

In short, we will review Religare Securities on every aspect of their performance to give you a clear description of the firm that is worth registering yourselves as traders or as investors.

Table of Contents

- Rating & Review

- Overview

- Brokerage Charges

- Other Charges

- Account Opening Charges

- Offers

- Account Opening Process

- Products & Services

- Research & Tips

- Exposure

- Trading Platforms & Apps

- Customer Care

- Complaints

- FAQs

- Open an Account with Religare Online Now!

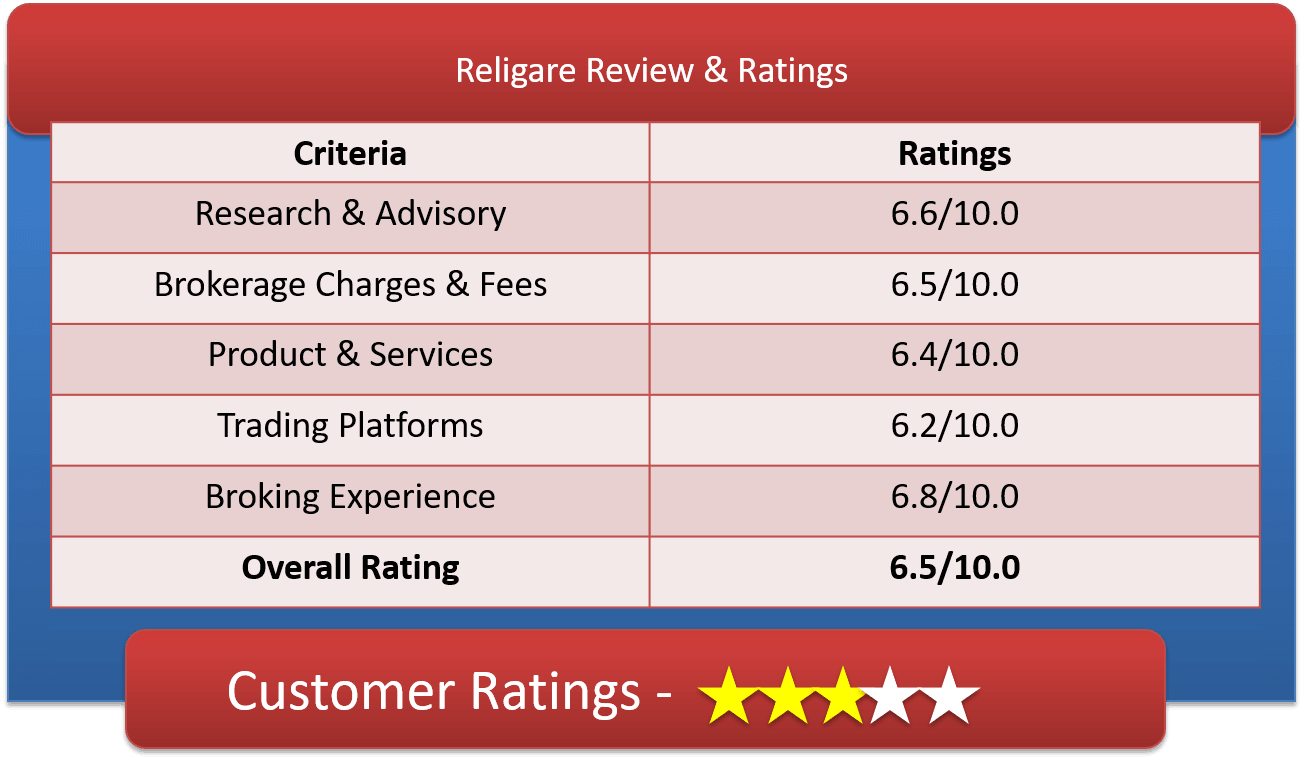

Religare Online Ratings & Review by Top10StockBroker

About Religare Broking Ltd

| Overview | |

| Company Type | Public |

| Broker Type | Full-Service Broker |

| Headquarters | Delhi, India |

| Founder / Director | Nitin Aggarwal & Manjushree Nitin Ghodke |

| Established Year | 1984 |

Religare Securities is a full-service broker that has been dominating the Indian stock trading industry more or less since the very year of its inception in 1994.

The nationally acknowledged brokerage giant came into being when Nitin Aggrawal & Manjushree Nitin Ghodke built the company within the premises of the national capital Delhi.

The company has been progressively evolving ever since. They have developed many fascinating remote trading tools and platforms that have helped many traders and investors across the nation gain profits on trades fruitfully.

Perhaps this is one of the major reasons they are reputed so much.

What’s even more fascinating is the fact that they have managed to constantly live up to the expectations of their respective traders and brokers for more than twenty-five years in a row through a considerably small network of merely fifty-six branches located at different places across the nation.

And, this feat there has been awarded many times over the years as well, starting right in the year 2008.

They received the award for ‘Best IPO Listing’ from Outlook Money NDTV Profit, ‘NSDL Star Performer Awards – 2016’ for being the Top Performer in New Account Opened (Non-Bank Category) and Best Performer in Account Growth Rate in 2016, ‘Regional Retail Member of the Year – North’ – NSE Market Achievers Awards in the year 2018 and many more.

Religare Enterprises Limited is a diversified entity which imparts all financial services and makes it the Best Share broker in India. It has all the requisite resources and the right insights to widen your investment vision and help you conquer your investing goals.

Open Demat Account with Religare Securities – Fill up the Form Now!

Religare Online Brokerage Charges

| Brokerage Charges & Fees | |

| Equity Delivery | 0.50% to 0.10% |

| Equity Intraday | 0.050% to 0.010% |

| Equity Futures | 0.05% |

| Equity Options | Rs 70 per lot |

| Currency Futures | 0.05% |

| Currency Options | Rs 30 per lot |

| Commodity Futures Trading | 0.05% |

| Commodity Options Trading | Rs 30 per lot |

| Minimum Brokerage | None |

| Demat AMC Charges | Free or Rs.350 per annum |

| Trading AMC Charges | Free |

| Margin Money | Not Needed |

As you must be able to conclude after taking a look at the aforementioned table of contents, Religare Online strictly charges 0.50% to 0.10% brokerage on Equity Delivery Trading, 0.050% to 0.010% brokerage on Equity Intraday Trading, and 0.05% on Commodity futures Trading, Equity Futures Trading and Currency Futures Trading respectively.

A sum of Rs.30 per lot in terms of brokerage on Currency Options Trading and commodity options, Rs.70 per lot in terms of brokerage on Equity Options Trading. Demat AMC fee is waived off from the 1st year & post 1st year; it is charged Rs.350 Annually.

Other Features

Apart from all the above, the company also doesn’t require their respective traders and investors to maintain a minimum Margin Money balance. They do not seek any charges for maintaining Trading Accounts, however.

Nonetheless, suppose you want to calculate the exact brokerage charges you will be required to pay for executing a trade consisting of multiple shares across various assets.

In that case, you must take the help of their Religare Brokerage Calculator Tool. The tool can be accessed online and calculate the exact brokerage required to be paid whenever a complex trade is executed.

The device can also help determine other charges to be paid in terms of taxes like SEBI Turnover Charges, Stamp Duty, STT, and GST.

For a detailed calculation of brokerage & other charges, check out our Religare Securities Brokerage Calculator.

Similar Stock Brokers, you may also Like

Religare Securities Charges

| Other Charges | |

| SEBI Turnover Charges | 0.00005% (₹5/Crore) |

| STT | Equity Delivery: 0.1% on both Buy and Sell Equity Intraday: 0.025% on the Sell Side *Equity Futures: 0.01% on Sell Side Equity Options: 0.05% on Sell Side(on Premium) Commodity Futures: 0.01% on sell-side (Non-Agri) Commodity Options: 0.05% on sell-side Currency F&O: No STT On Exercise transaction: 0.125% Right to entitlement: 0.05% on sell-side |

| Stamp Duty | (On buy side only) Delivery: 0.015%, Intraday: 0.003%, Equity Futures: 0.002%, Equity Options: 0.003%, and Currency F&O: 0.0001%.Commodity Futures: 0.002%, Commodity Options: 0.003% (MCX) |

| GST | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| Margin Funding Charges | |

| Reactivation Charges | Rs 25 per instruction |

| Account Closure Charges | Rs 50 per instruction |

| Dematerialisation Charges | Rs 2 per certificate |

| Pledge Creation | Rs 50 per request or 0.02% of the value of securities whichever is higher |

| Pledge Invocation | Rs 50 per request or 0.02% of the value of securities whichever is higher |

| Margin Pledge/Unpledge/ Pledge closure | Rs 50 per request or 0.02% of the value of securities whichever is higher |

| Margin Repledge | Rs 50 per request or 0.02% of the value of securities whichever is higher |

Rather clearly from the chart of contents presented to you above, Religare Securities require their respective traders and investors to pay an amount of 0.0126 % of the total turnover in terms of Securities Transaction Charge, 18 % on the sum of brokerage as well as transaction charges in terms of GST, 0.00370 % of the total turnover in terms of transaction charges, 0.00005 % of the total turnover in terms of SEBI turnover charges and a variable amount in accordance to the state laws in terms of Stamp Duty.

However, the Stamp Duty is minimal and does not impact the overall investment amount for the traders or investors to be put in.

Religare Online Other Charges

- Pledge Charges – To create a pledge, closure, confirmation, and invocation, the charges are the same, i.e., Rs 50 per request or 0.02% of the value of securities, whichever is higher.

- Closure and Reopening – You will be charged Rs 50 per request to freeze or unfreeze your account.

- Rematerialization – If you wish to place a request, you will have to pay Rs 20 per request + NSDL Charges.

- Demat processing charges – This charge is meagre of Rs 2 per certificate.

Demat Processing Charges – The sum is charged for converting securities paper certificates to electronic forms. Religare charges Rs. 2 for every certificate.

Conversion of Mutual Fund units represented by SOA into Demat – Rs. 20 is charged for every certificate converted from the SOA form to Demat.

Courier Charges for Demat/Remat/Repurchase/ Redemption – Religare also offers Demat, remat, and repurchase and redemption services. And for the same, it charges Rs. 30 per request as courier charges.

Demat Rejection Charges – Demat Rejection Charges charged by Religare are Rs 30 per rejection.

Pledge Creation/ Closure/ Confirmation/ Invocation – If you wish to avail of services in respect of the pledge, you will be required to pay Rs 50 per request or 0.02% of the value of securities, whichever out of the two is higher.

Freeze/Unfreeze Instruction – For freeze and unfreeze services, Religare charges Rs. 50 for every request made to it.

Delivery Instruction Booklet – Investors can also request the delivery instruction booklet. Investors will be required to pay Rs. 1 per leaf.

To know in detail, just click on this link Religare Securities Brokerage & Other Charges.

Compare Religare Securities with Other Brokers

Compare Stock Brokers

Religare Online Demat Account Opening Fees

| Demat Services | |

| Trading Charges [One Time] | Rs 500 |

| Trading AMC [Yearly] | NIL |

| Demat Charges [One Time] | NIL |

| Demat AMC [Yearly] | Rs 400 from the second year onward |

| Margin Money | Not Needed |

| Offline to Online | No |

Religare Securities has been known for its open-heartedness whenever it comes to accepting registration requests for opening a Trading or a Demat Account throughout the nation.

They have always welcomed traders and investors to join their firm to receive the benefits they offer. Anyone from within the nation can become a part of the company by simply opening up a Trading or a Demat Account for Free.

Case you opt to open up a Demat Account with them, you will also have to pay a sum of Rs.400 every year in terms of Annual Maintenance Charges. However, it is also waived for the 1st year.

Nonetheless, the account holder is not required to have any minimum account balance as Margin Money. All the transactions can be processed through either NSDL.

To know in detail, just click on this link Religare Securities Demat Account.

Religare Broking Offers

| Offers | |

| Free Demat Account | Yes |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | No |

| Zero Brokerage for Loss-Making Trades | No |

The above-mentioned chart has been brought to your attention to inform you about all sorts of charges related to Religare Securities’ offers that are presented to their respective traders and investors either regularly or occasionally for investment.

As you can see above, they extensively lay down offers in terms of Free Demat Account, Free Trading Account, Discount On Brokerage, and Flexible Brokerage Plans.

Nevertheless, they do not have any offer concerning Zero Brokerage fees for any or all Loss-making Trades, Trading Happy Hours, a month’s worth of time for brokerage-free trading, Holiday Offers or Referral Offers.

Religare financial services company imparts Top Full Service Broker facilities with its fascinating and intelligent offers to its customers.

Other Offers

- Free Demat account in just 10 minutes – Open your Demat account with Religare within 10 minutes. And open your accessibility to all the trading opportunities awaiting you.

- Free discount vouchers of up to Rs. 10000 – Win a voucher worth up to Rs. 10,000 and trade in your favourite stocks which can bloom your portfolio.

- Free trading up to Rs. 2500 for 30 days – Another attractive and fascinating offer of Religare is that the investor gets leverage of up to Rs 2500 for 30 days to trade in stocks and securities.

- Free research recommendations – Confused about which securities to invest in, whether to hold it or sell, no worries, Religare will help you through it with its thorough research recommendations.

- Free lifetime AMC offers – AMC stands for Annual Maintenance Charges. This is a sum the stockbroker charges annually from the investors for carrying out and maintaining the Demat and trading accounts. Religare does not charge any sum from its customers under certain circumstances.

How to open a Demat Account with Religare Online?

If you have been thinking of joining a brokerage firm as a trader or as an investor, the name of Religare Online must have hit you some time or other.

If that has ever happened to you, then it is the right time and the right place for you to learn how to join them for amazing benefits on trading across equity and derivatives throughout the Indian stock trading industry.

So, here is what you need to do:-

- Once you look underneath this section, you will find a green-coloured button that reads ‘Open Demat Account.’

- As soon as you click on that button, a new form will pop up on your computer screen.

- Read the entire form carefully, going through each word, phrase, line, and sentence.

- Fill up every little detail the form asks of you with the correct information.

- Upload the form and move ahead towards completing the KYC procedure.

- Concluding, the KYC procedure will require you to have your Aadhar Card, PAN Card, and a photograph to verify your age, identity, and address, respectively.

- Once you are done submitting the form and have concluded the KYC verification procedure, you will be contacted by an authority on behalf of the brokerage firm itself for the last set of verifications.

- You will be able to access your new account within a couple of hours after completing all the steps mentioned above and you will get the login details.

Open Demat Account with Religare Securities – Fill up the Form Now!

Why Open Religare Securities Trading Account?

Having a Trading or a Demat Account is one of the mandatory requirements as per the government of India and the numerous laws governing the wealth trading industry of the nation for trading across multiple segments of equity or derivative-based assets.

That, however, is not the only reason for a person to consider registering themselves as a Trader or an Investor with Religare Securities. Instead, you may consider any of the following reasons to open a Religare Trading Account:-

- They have been coined among the top leading brokerage houses in the nation. They have a considerable amount of exposure and a lot of experience in the Indian trading industry.

- The plethora of awards they have is more than enough to verify their expertise in the particular domain of trading services.

They have evolved their services with new-age technologies that are user-friendly and super effective in their respective tasks, all at once.

Religare Securities Products & Services

List of products & services provided to its clients

Religare Broking Products

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

Religare Broking takes pride in all they do. And the products they have to offer to their respective registered traders and brokers from around the nation are no exception to this.

As you can conclude after glancing at the table as mentioned above, they have exclusive products to offer in the domain of Systematic Investment Plans, Equity Trading, Currency Trading, Commodity Trading, Options Trading, Mutual Funds, and Futures Trading.

However, they have no products to offer in insurance, Banking, or Forex Trading.

Other Products

Equity – Equity, commonly known as equity shares, are units of a company with which the company offers investors to hold a stake in the issuer company.

Derivatives – Nowadays, investment options are not confined to shares or debentures, but investors have plenty of opportunities to invest in commodities with the means of derivatives. Here you do not directly buy the security or commodity, but you invest in securities that derive their value from those securities or commodities.

Currency – Through Religare, investors can also invest in the currencies of various countries.

Debt/Fixed Income – If not interested in any type of risk associated with securities, you can also invest in debt securities or fixed-income securities.

Mutual Fund – Mutual Fund is an investment pool where the company issue units of mutual fund to investors in exchange for money and invests such fund in varied securities.

ETF – ETF stands for Exchange Traded Funds. It is a basket of securities traded on the stock market like any other securities.

Religare Broking Services

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | Yes |

| Trading Institution | No |

| Trading Exposure | Upto 5x |

The table of contents, as mentioned above, has been deliberately placed in there to give you a fair idea about all the services that Religare Online comes up with for their respective registered traders as well as investors from across the nation, either occasionally or regularly.

They exclusively offer their services concerning Trading Services, Portfolio Management Services, Initial Public Offering Services, Stock Recommendations, Intraday Services, and Demat Services.

They offer these services with up to 5 times the average trading exposure. However, you may have also acknowledged that they do not have any services whatsoever, in terms of 3 in 1 Account, Robo Advisory, or Trading Institution.

Other Services

IPO – Initial Public Offering is a process where the equity shares of a company are offered in the capital market for the first time. The company’s capital is divided into small units called shares. Shares are of two types.

Tin FC – TIN FC stands for Tax Information Network– Facilitation Centre. It is an initiative that supports the collection, processing, monitoring, and accounting of direct taxes with the assistance of information technology.

NPS – National Pension Scheme is an innovative product introduced for channelizing savings and offerings good returns for its investors.

Demat Account – It is an account in which the investor holds its shares in dematerialized form. The objective is to convert the paper securities into a fungible format.

Trading Account – For executing buying and selling of shares, debentures, bonds, mutual funds, etc., investors require a trading account to undertake all these in today’s times.

More on Religare Services

Investment ideas – Religare offers Research and recommendations to its investors; based on the same, investors can make investment strategies. These recommendations are made after thorough research.

Research reports – Religare also offers research reports for the betterment and understanding of its customers. Research reports comprise all the details that will help investors.

Global Investing – With Religare, you can invest in securities available in many outside countries. This helps create a diversified portfolio, diverse good exposure, and lowers the risk.

General Insurance – Customers can also avail of the general insurance facility available with Religare. It works as a one-stop point for most financial requirements. Types of General insurance are fire, marine, motor, accident, and other miscellaneous non-life insurance.

Life Insurance – Religare also provides life insurance facilities. You can avail of its facility easily.

Car Health Insurance – Not limited to life insurance, one can also apply for car insurance where the insuring asset is your motor vehicle.

Religare Online Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | Yes |

| Annual Reports | Yes |

| Company Stock Review | Yes |

| Free Stock Tips | No |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | No |

| Monthly Reports | Yes |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

As with most of its other offerings, Religare Securities take tremendous pride in each and every one of its Research and Advisory related offerings.

They offer exclusive documents or services concerning Research Reports, Company Reports, Fundamental Reports, Company Stock Overviews, Annual Reports, Top Picks, Initial Public Offering Reports, Monthly Reports, Weekly Reports, A Relationship Manager, and Offline Advisory.

Nevertheless, you must also acknowledge that they do not have any services with respect to Robo Advisory or Free Stock Tips.

Portfolio Tracker – Track the profitability and prosperity of your portfolio and make the right decisions.

Smart Charts – It is a comprehensive means to watch and observe securities, stocks, and other important aspects connected in addition to that.

Stock Screener – This tool helps you research stocks and filter them according to their prices, market capitalization, dividend yield, or other factors.

Research Dashboard – You can research and analyze the trends of particular stocks’ overall market.

Instant Help – The representative of Religare are always available for your help with any query or issue from their helpline numbers and other facilities available in this regard.

Religare Securities Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | 1x |

| Equity Intraday | Upto 5x |

| Equity Futures | 1x |

| Equity Options | 1x |

| Currency Futures | 1x |

| Currency Options | 1x |

| Commodities | 1x |

| Margin Calculator | Available |

The aforementioned chart of contents has been deliberately placed in that particular section to bring to your concern about the kind of leverage you may expect from Religare Online in terms of elevated trading exposure compared to its other competitors.

If you take a close look at the chart, you will notice that the company provides an elevated trading exposure of Upto 1x with 24% interest per year on Equity Delivery Trading. It is up to 1x for Equity Futures, Upto 1x for shorting for Equity Options & Upto 1x for Commodities Trading.

They provide exposure of up to 1x on Currency Futures Trading, a direction of 1X for shorting on Currency Options Trading & exposure of up to 5x on Equity Intraday Trading.

More on Religare Securities Leverage / Exposure

The table above has been drafted in such a simple way that it should be self-sufficient in giving you every bit of detail on the kind of leverage you should be expecting from the firm.

However, if you want to calculate the specific leverage, you will be getting while executing a complex trade consisting of shares across different asset classes.

You should take the help of the firm’s dedicated Margin Calculator, otherwise known as the Religare Securities Margin Calculator.

The tool can be easily accessed online and comes equipped to help you with all your margin calculation requirements across several segments like Currency, F&O, Commodity, Intraday, and Delivery.

The tool can also come in handy if you are looking forward to calculating the number of extra shares you can buy with the elevated exposure you will be getting.

Religare Securities Margin Calculator will help you to calculate how much margin you will get if you invest or trade with Religare Securities.

How to transfer shares in Religare from other Stock Brokers?

- Investors will be required to fill out the Delivery Instruction slip with the recipient’s specifications. The transfer can be done through the market trade column or the off-market trade column.

- Submit the DIS with your stock broker from where the stock is required to be transferred to Religare.

- The same will be transferred to a depository, i.e., NSDL or CSDL as the case may be.

- When a clearing corporation settles the trade, it is called Market Trade. This is done through stockbrokers on a stock exchange.

- On the other hand, Off Market Trade does not involve the participation of clearing corporations.

Religare Online Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platforms | No |

| Real-time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | Yes |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | Yes |

| Personalized Advisory | Yes |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | Yes |

| Email Alerts | Yes |

| Multi-Account Management | Yes |

Religare Securities, an open conciliator for Religare Broking Ltd. and a full-service brokerage house, has been regarded for its exceptional services and ever-developing ways to help traders and investors throughout the nation.

They have developed four distinct trading platforms for their respective traders and investors to help them with remote trading facilities:-

Religare Online – Religare Web Trading Platform

Religare Securities have a dedicated remote trading platform that specifically works through the web-based browser for their respective registered traders and investors. The web-based app comes loaded with the following features:-

- Religare Securities web-based platform can run and showcase real-time data related to the market across several exchanges and indices.

- The web-based app can let the respective users add multiple watch lists alongside multiple trading items within the same list. The respective users can further customize these watch lists according to their requirements.

- The web-based app has been developed in such a way as to perform unhindered even during times of low bandwidth. This makes the web app highly efficient, specifically for the tier 3 and tier 4 cities where the data speed can become a troublesome factor in trading.

- The web-based app has been developed in a way to be able to grant access to the last ten days’ worth of Intraday Trading data and the previous five years’ worth of historical data related to the overall Indian trading industry.

- The web-based app is easy for the respective registered users to access from any place anytime only with a desktop or a laptop computer, thus making it very user-friendly.

Religare Securities Mobile Trading Platform

Pertaining to the fact that there are various kinds of traders and investors depending upon their respective trading techniques and approaches.

Religare Securities has come up with the idea of developing more than one mobile-based app to help their separate registered traders and investors with remote trading requirements.

They have two different mobile-based trading apps with an entirely different sets of features and user interfaces.

Religare Dynami App – Religare Securities Mobile Trading App

Religare Dynamic is yet another mobile-based platform that the brokerage firm has developed to be functional with Android as well as IOs based mobile devices.

Nevertheless, unlike the other mobile-based trading platform by the well-known brokerage firm, this one has some different features:-

- Religare Securities mobile trading app has been developed in such a way that it can enable the respective users to trade across several varying segments such as Equity, Currency, and Commodity.

- This particular mobile-based app has been developed to cater to a segment of traders and investors who do not want to get themselves indulged in complex calculations and analyses. Therefore the overall interface of the entire app has been kept rather simplistic.

- The mobile-based app can let the respective users add multiple watch lists alongside adding multiple trading items within the same list. The respective users can further customize these watch lists according to their requirements.

- The mobile-based trading platform has been developed to help the respective users in the best possible way. Thus, the app also provides active customization and personalization options to the respective users, along with a number of alerts and notifications set up.

Religare Securities On the Go – Religare Mobile Web Platform

Religare On the Go is a mobile-based platform that the brokerage firm has developed to be functional with Android as well as IOs based mobile devices.

Downloadable files have been made available by the company to access the app on their respective BlackBerry devices. This mobile-based trading platform comes with the following features:-

- The ability to allow the respective users to place multiple orders using only their mobile phones without constraining them in regional, national, or even international boundaries.

- The mobile-based app is well suited to display and showcase live quotes in real-time from various exchanges and indices according to the available bandwidth.

- The mobile-based app can let the respective users add multiple watch lists alongside adding multiple trading items within the same list. The respective users can further customize these watch lists according to their requirements.

- The mobile-based app has been developed to perfectly keep track of the respective user’s order book, trade book, market depth, stock portfolio, and more.

- The app comes equipped with loads of analytical tools that enable users to conduct in-depth analyses through market trends, indices, and other corresponding indicators.

Religare Securities Terminal Terminal

Religare Securities have its dedicated remote trading platform built as a Religare terminal-based trading platform that can be accessed as an executable file.

The particular platform can be used upon installation on Windows-based desktops. It comes integrated with the following features:-

- Although a bit old school in accordance with its looks, this particular platform has an astounding ability to enable the respective traders or investors to trade across equities, currency, mutual funds, commodities, and initial public offerings, all within one screen.

- The platform comes integrated with an advanced portfolio tracker and live market watch.

Other Trading Platforms

Religare Web Portal – You can access all the features of Religare from its Religare web portal. It is an easy-to-use tool that can cater to all your investing requirements. You can access it from your desktop or laptop, or mobile phone.

Religare Dynamic – The Mobile application designed for resolving all your investment-related queries. An easy, fast, and smooth application where you can watch your favourite stocks, invest in them, Research, and a lot more.

Religare DIET ODIN – A one-stop facility tool to cater to trade in cash, derivatives, mutual funds, IPOs, currencies, and commodities with one window. It is a mobile application with easy-to-use features.

Dynamic Wrap – It is a dedicated platform for investments in Mutual Funds, SIP and investment products. It will recommend you can research and watch different schemes from the app.

Religare Securities Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll-Free Number | No |

| Branches | 56 |

The chart mentioned above is meant to give you a clear hint of all the customer care services being extended by Religare Securities as a full-service brokerage house.

As you can see, the brokerage provides active support in terms of Email Support, Online Trading, Offline Trading, and a Dedicated Dealer with the help of their selective but short network of fifty-six different branches located throughout the country.

Nonetheless, they do not support 24 * 7 support, Chat Support or even a Toll-Free Number.

Religare Broking Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 126 |

| Resolved in BSE | 85 |

| Lodged in NSE | 188 |

| Resolved in NSE | 145 |

Religare Securities received one hundred and twenty-six complaints against them in the BSE and one hundred and eighty-eight complaints within the NSE last year.

A total of eighty-five and one hundred and forty-five complaints against them were resolved within the BSE and the NSE, respectively, last year.

Religare Securities Disadvantages

So, Religare Securities may have been known for its leading-edge technologies as well as its customer care services, but they still have a couple of flaws:-

- They still do not provide 24 * 7 Support for their respective traders or investors.

- They require their respective traders and investors to maintain a humongous Margin Money amount

Religare Online Conclusion

Religare Online has quite frankly owned up to its reputation with all its awards. Nonetheless, they still need to overcome a few simplistic flaws to become the best.

Nevertheless, we have done our research and dug deep into the reputed brokerage company to confirm if the company does serve as well as they boast about their services in terms of the products they have, the services they offer, the kind of brokerage they impose, the taxes they levy, the amount of leverage they extend.

Most importantly the effectiveness of all the trading platforms they have to offer to their respective trades and investors for remote trading facilities.

Religare Review FAQs

Here is the list of FAQs related to the Religare stockbroker:

Is Religare safe for trading?

Yes, Religare is one of the most trusted stocks broking houses to enter the market. They are stable and successfully established, with a wide customer base.

This makes them highly reliable and also profitable in many aspects.

What is the brokerage of Religare?

The brokerage is charged on a percentage basis, and this stockbroker charges the lowest percentage. So, for investment in segments of delivery you are taken from 0.50% to 0.10%, for intraday, it is 0.050% to 0.010%, and 0.05% for commodity or futures.

However, you are charged Rs.30 per lot for currency and commodity options segments.

How to open Religare Demat online?

Opening a Demat account is pretty seamless, as you can open one right from this page. Begin the process and hit the “Open Demat Account” button on this page.

When you click, you will see a pop-up appear, fill it up accordingly, and then the company will follow up with you.

Can I invest in an IPO via Religare?

Yes, there is a possibility of investing in the IPO if you are a Religare client. Everything is served right to you via online platforms.

Also, you can opt for the offline process, but you need to make sure that you have an end-to-end idea of the terms and conditions.

What Leverage does Religare provide?

There is leverage, also known as exposure facility, available for the clients of this stockbroking house. The leverage varies as per the segment you choose to invest in.

However, the highest exposure is provided in the intraday segment with up to 5x

Does Religare have a trading App?

Yes, a trading app is provided to the investors as present trading and investment in the stock market are very much inclined toward technology. Investors prefer the ones that provide the best online platforms to trade through.

How to contact Religare customer care?

The Religare stock broking house extends a lot of feasibility. First, this stockbroker has many branches spread throughout the country; hence, offline reach is a thing.

Rest assured, you can avail yourself of email assistance as well.

Does Religare provide Research?

Yes, this stockbroker is a full-service stockbroker, and hence, there is a provision for a Research facility.

This is probably great support provided from the stock broker’s end, and you can use them effectively to make profitable investment decisions.

Is Religare good for Beginners?

Of course, this stock broking house is a great place to begin your trading journey, as they are a full-service stockbroker, which gives the facility of Research and advisory services.

Also, the brokerage rate is pretty low compared to other brokers.

Who Founded Religare?

This stock broking company is a subsidiary of REL. Religare Enterprises Limited is a holding company headquartered in Delhi and has a suite of financial services offering to fulfil the very needs of the audience.

Open Demat Account with Religare Securities – Fill up the Form Now!