Ventura Securities Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Jan 05, 2024Ventura Securities has had a glorious journey of 25 years till now from its inception in the year 1994.

The company has always valued its customers, taken care of their needs and requirements, and invested in upgrading itself to better the business and the clients.

This article is a Ventura Securities brokerage review where you can find the details like the products and the services provided by the company to the customers and the clients.

The article will also analyze and provide details about the different brokerage charges and the company’s plans for its customers.

The review is a detailed analysis of the company where you can find all relevant and important aspects of the company ranging from its trading platforms to the Demat account opening procedure.

Table of Contents

- Rating & Review

- Overview

- Brokerage Charges

- Other Charges

- Account Opening Charges

- Offers

- Account Opening Process

- Products & Services

- Research & Tips

- Exposure

- Trading Platforms & Apps

- Customer Care

- Complaints

- FAQs

- Open an Account with Ventura Securities Now!

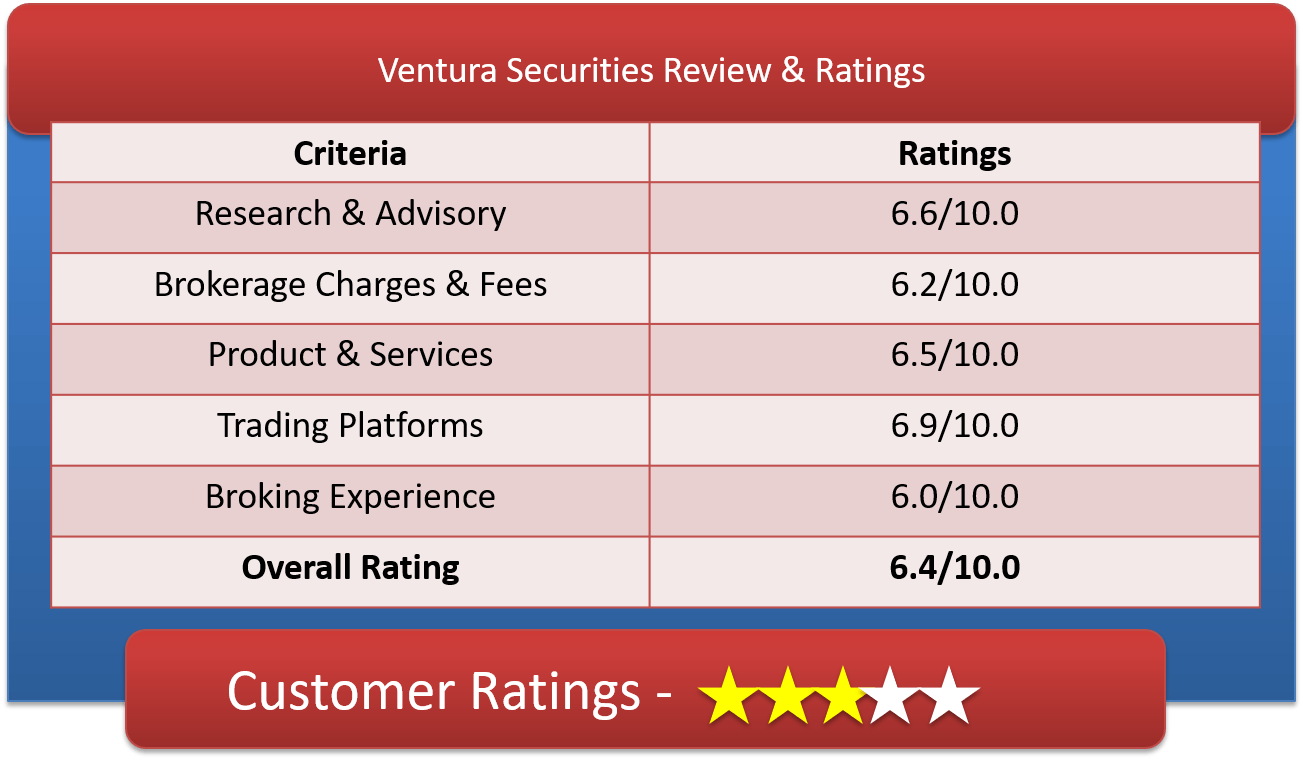

Ventura Securities Ratings & Review by Top10StockBroker

About Ventura Securities

| Overview | |

| Company Type | Public |

| Broker Type | Full-Service Broker |

| Headquarters | Mumbai, India |

| Founder | Sajid Malik |

| Established Year | 1994 |

Ventura is an up top entity which provides its services through its website and its mobile trading app. The company is recognized as being the Top Brokers in India which was started in 1994.

Ventura Securities was founded by Mr Sajid Malik as a full-service brokerage house in the city of Mumbai.

The company was primarily established as a stockbroker, which explored the other verticals of finance and introduced many other financial products.

Ventura Securities is a company in the public domain enlisted in the NSE and BSE and has membership in various organizations.

The company offers various products, ranging from equities to mutual funds and many others. It provides different financial services apart from regular broking services.

It has an array of investors from other countries apart from its domestic clients and customers.

The firm is under the directorship of Sajid Malik, who is the co-promoter of the company as well. The company’s CEO is Hemant Mahethia, who is also the director and co-promoter of the company.

He played a pivotal role in developing the company’s in-house trading software, which will discuss in later sections. The other two directors are Ganapathy Vishwanathan and Juzer Gabajiwala.

The firm is dedicated to research and advisory services and providing the best opportunities to the clients and thus employs the best brains in the country.

You can find all kinds of investment solutions under one roof with Ventura Securities.

Get a Call Back from Ventura Securities. Fill up this Form.

Ventura Securities Brokerage Charges

| Brokerage Charges & Fees | |

| Equity Delivery | 0.20% |

| Equity Intraday | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | Rs 50 per lot |

| Currency Futures | Rs 10 per lot |

| Currency Options | Rs 10 per lot |

| Commodity | 0.15% / Rs 50 per lot |

| Flat Monthly Fees, if any | Rs 3,500 per year |

| Minimum Brokerage | As per Transaction |

| Demat AMC Charges | Free |

| Trading AMC Charges | Free |

| Margin Money | Rs.1,000 |

The Ventura Securities brokerage charges are dependent on the amount of ‘Access Charges’ you opt for. You can pay different amounts, and the range is from Rs. 1000 to Rs. 72000.

This is a charge for using their trading terminal, which will be discussed later. The brokerage charges for the Equity delivery segment range within 0.20%.

For the intraday segment, equity futures are 0.03%, and the currency futures and options are Rs 10 per lot; for commodities, the charges vary within 0.15% / Rs 50 per lot.

The equity options trading segment charges vary within Rs 50 per lot.

More on Brokerage Charges

At the beginning of the year or when you are opening the account, you have to pay an access charge which is completely refundable provided you generate a specific amount of brokerage within the validity of that access charge.

The validity is normally one year, and in some cases (plans), it is for 6 months.

Supposedly, when you open the account, you choose Rs. 2000 plan, so for the next year, you have to pay brokerage at 0.35% for the equity delivery and 0.04% for the cash and commodities, intraday, and futures segment trading.

If you generate Rs. 2000 from the brokerage within one year, you can claim the refund of Rs. 2000 which you paid as Access charges. This way, you can reduce your brokerage charges to a great extent.

They will also help you calculate your investments which can be done with the help of the Ventura Securities brokerage calculator.

Similar Stock Brokers, you may also Like

Ventura Securities Charges

| Other Charges | |

| SEBI Turnover Charges | 0.00005% (₹5/Crore) |

| STT | Equity Delivery: 0.1% on both Buy and Sell Equity Intraday: 0.025% on the Sell Side *Equity Futures: 0.01% on Sell Side Equity Options: 0.05% on Sell Side(on Premium) Commodity Futures: 0.01% on the sell side (Non-Agri) Commodity Options: 0.05% on sell-side Currency F&O: No STT On Exercise transaction: 0.125% Right to entitlement: 0.05% on sell-side |

| Stamp Duty | (On buy side only) Delivery: 0.015%, Intraday: 0.003%, Equity Futures: 0.002%, Equity Options: 0.003%, and Currency F&O: 0.0001%.Commodity Futures: 0.002%, Commodity Options: 0.003% (MCX) |

| GST | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| Margin Funding Charges | |

| Reactivation Charges | Rs 20 per instruction |

| Account Closure Charges | Rs 30 per instruction |

| Dematerialisation Charges | Rs 50 per request |

| Pledge Creation | Rs 50 |

| Pledge Invocation | NIL |

| Margin Pledge/Unpledge/ Pledge closure | NIL |

| Margin Repledge | NIL |

The other charges of Ventura Securities include the transaction charges, which are levied at 0.00380% of the total turnover.

The other mandatory charges are the stamp duty levied as per the state’s stamp duty charges which are prevailing.

The GST is charged on the amount derived after adding the brokerage and the transaction charges of trade. The GST percentage is 18% on this amount.

The other two mandatory charges are STT and SEBI charges levied on the total turnover at 0.0126% and 0.00005%, respectively.

Ventura Securities charges its customers with few additional charges for its seamless and well-integrated services.

These charges are applicable in scenarios where customers use some specified services, like charges with respect to Dematerialisation, Rematerialisation, Pledge creation, closure, or invocation.

Compare Ventura Securities with Other Brokers

Compare Stock Brokers

Ventura Securities Demat Account Opening Fees

| Demat Services | |

| Trading Charges [One Time] | Rs 0 (Free) |

| Trading AMC [Yearly] | Rs 0 (Free) |

| Demat Charges [One Time] | Rs 0 (Free) |

| Demat AMC [Yearly] | Rs 0 (Lifetime Free) |

| Margin Money | Rs.1,000 |

| Offline to Online | No |

Ventura Securities is associated with CDSL and NSDL, which are the depository sources of the firm. The Ventura Securities Demat account opening charges are nil. There is no one-time fee for opening the trading and the Demat account with this firm.

The company does not even charge an annual maintenance fee from the customers for maintaining the Demat and the Trading account.

The account type offered by the company is a two-in-one account which means it provides Demat and trading accounts together.

The margin money requirement is Rs. 1000 as the minimum margin you have to keep with the company.

Ventura Securities Offers

| Offers | |

| Free Demat Account | Yes |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | Yes |

| Zero Brokerage for Loss-Making Trades | No |

Ventura Securities offers and its trading platform is incorporated with all the essential and exciting offers a trader will need for a successful trading experience. The generous offers include –

- Free Demat and Trading account. You have to pay no charges for opening an account with Ventura Securities.

- no annual maintenance fee you have to pay for maintaining the account yearly. You can run the account as long as you want.

- There are several discount offers available on the company’s brokerage which you can avail.

- The brokerage plan is quite flexible and has room for tailoring according to the need of the customers. For instance, if the customer wants to pay the lowest brokerage rates, he must opt for the plan with maximum Access charges.

- There is also referral offers that help the customers earn a few extra bucks by referring the company to other prospective investors who invest.

In this competitive regime where entities attempt to offer the best of services, Ventura Securities has also come forward with its unavoidable offers where they do not charge for the Account Opening, no Annual Maintenance Charges for a lifetime, and free call & trade trading.

Another feature of Ventura Securities, one of the Best Full-Service Brokers in India is its Refer & Earn where investors earn rewards by referral links amongst family and friends.

Additionally, it helps the entity to spread its reach and enhance its operations.

How to open a Demat Account with Ventura Securities?

Ventura Securities Demat Account opening process is quite simple, and it can be done in two different ways.

You can either visit the branch of this broker in your city, you can do it through a sub-broker of the company, or you can easily do it online.

Offline Account Opening Process

You can either go to the branch or visit a sub-broker office for the manual process. There you need to –

- Provide all the details in the application form for the Demat account opening. Make sure you provide all the details correctly.

- Then, you will be asked for the KYC documents like PAN and AADHAAR which are the two most important documents at present. You also have to submit a copy of your bank account statement and address proof, Voter ID, and similar documents, if any.

- Then, all the documents will be manually verified by the company’s executives, and then once everything gets approved, you will receive your login details for the account.

- You have options for a plan and deposit the access charges according to the plan you opt for.

- Then, you can start trading by logging into your trading account.

Online Account Opening Process

For opening the Demat account online, no need to visit any branch or sub-brokers office; you can do it from the comfort of your home. The process includes –

- Filling the Demat account opening form by clicking on the “Open Demat Account” button below. Submit the form by clicking on the submit button once you fill it out.

- Then, you have to upload the documents mentioned above. Here you have to upload the scanned copies of the documents on the site with the application form.

- The documents will be verified at the company’s end.

- Once your documents are verified, your login credentials will be mailed to you, and you can use them to log in and start trading.

Get a Call Back from Ventura Securities

Why Open Ventura Securities Trading Account?

There are ample reasons to open a Ventura Securities Trading Account, and the crucial ones are –

- Constantly growing and innovating: The best benefit that the clients get is through the firm’s constant upgrading methodology. They keep an eye on the market and update themselves by upgrading and introducing new and innovative products and services and bettering the ones already there.

- Advanced technology: Trading is now completely based on technology, and thus like a big broker house in the country, the firm knows the importance of the same and implements it. It keeps on bringing new features to its platform, websites, and services. The trading platforms are upgraded continuously to provide the best features and opportunities to the clients.

- Experienced Research and advisory team: It is important to act quickly without losing track in trading. Ventura Securities team members follow this approach only. They understand the market, research and analyze and then implement the same to reap the best benefits from the market. They are well equipped with the research tools and techniques to bring the best opportunities in trading in front of the client.

Other Reasons

- Value customers and relationships: It is one of the innate quality of this firm that it takes every partnership and relationship with its clients and customers very seriously and do everything possible to satisfy their requirements. They provide the best marketing strategies to the business partners, advise the best stocks to the clients, and maintain great relations with each of them. This can be referred to as the USP of the company.

- Wide range of services and products: It is not only restricting its services to stockbroking, but it also provides wealth management and other financial services. It has a wide range of products ranging from stocks and commodities to mutual funds and others.

- Broad clientele: It has a variety of clients from different parts of the country and even from other countries. It has plans for the NRIs, foreign investors, and PIOs, which stand for the Person of Indian Origin.

- Easy Fund transfer: Though the company does not provide banking solutions, it has an association with all major public and private sector banks in the country and abroad. This makes the fund-transferring process very smooth and easy for the client

Ventura Securities Products & Services

List of products & services provided to its clients

Ventura Securities Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

The list of Ventura Securities products includes various financial instruments and segments in which the company lets its customers trade in and invest.

The customers can trade equities of different companies in the country which are enlisted on the stock market of which Ventura Securities is a member.

Then it has commodities trading facilities, currencies you can trade, Futures and Options are obviously on the list, and mutual funds.

You can buy mutual fund units using your Demat account to store the units. This is beneficial for passive investors who do not want to directly invest in the share market.

Mutual funds include both lump sum and SIP investment plans. Ventura Securities offers a wide range of products and services to its customers to choose from.

With Ventura Securities, one can trade in Equity shares, Derivatives, Commodities, Mutual Funds and more. It is a one-stop destination for most investment products.

Also, the platform set forth by the entity plays a vital role in the execution of fast and reliable trading.

Ventura Securities Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | Yes |

| Trading Institution | No |

| Trading Exposure | Upto 5x |

The Ventura Securities services that are provided include Demat services and trading facilities on a variety of trading platforms.

The firm deliberately provides stock recommendations to clients and customers. There are intraday facilities available and IPO services as well.

The firm lets the investors invest in the new companies in the market who are entering the stock market by issuing shares.

Ventura Securities also provides portfolio management services or wealth management services.

Portfolio Management – Here, the entity offers services to promptly manage your portfolio, which lowers the risks associated with the investment. A portfolio is a tool for investors to invest in different stocks of various entities.

National Pension Scheme – Ventura Securities also offers its investors a platform to invest in the National Pension Scheme (NPS).

IPO – Investors can also bid for upcoming IPOs using the Ventura platform.

NRI Desk – Services of Ventura Securities extend to NRIs as well. They can also open an account with the entity and trade in securities.

Ventura Securities Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | Yes |

| Annual Reports | No |

| Company Stock Review | Yes |

| Free Stock Tips | No |

| IPO Reports | Yes |

| Top Picks | No |

| Daily Market Review | No |

| Monthly Reports | Yes |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

The research reports provided by the Ventura Securities research team are fundamental analysis, research reports of various companies and stocks and other financial assets, about their market value, market position, fair value, future predictions, etc.

The company reports are also inclusive of the research services of the company. The research team also dedicates itself to doing company stock reviews.

For the IPO services, the research team prudently works towards making the financial projection of the IPO offering companies and about the opportunities in those IPOs.

Apart from all these, there are monthly, weekly, and even daily market reports shared with the clients and customers.

The firm also provides offline advisory services to customers and allows Relationship managers to the clients who ask for the same.

Ventura Securities Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | 1x |

| Equity Intraday | Upto 5x |

| Equity Futures | 1x |

| Equity Options | 1x |

| Currency Futures | 1x |

| Currency Options | 1x |

| Commodities Future | 1x |

| Commodities Option | 1x |

The minimum Ventura Securities leverage level is 5 times the amount you have, and this limit is for the segments – currency options and currency futures, and commodities.

For equity futures, the exposure level is up to 1 time, whereas, for the equity delivery and equity options, it is 1 time at the maximum. The maximum exposure is provided for the equity intraday segment, up to 5 times.

Ventura Securities Margin Calculator will help you to calculate how much margin you will get if you invest or trade with Ventura Securities.

How to transfer shares in Ventura Securities from other Stock Brokers?

If individuals wish to transfer their shares from their current stock broker to Ventura Securities, they can easily do so. The process will be free of charge. The requirement is that the candidate’s name and PAN match both accounts.

Steps:

- All you have to do is fill in the DIS given to you while opening a Demat account.

- Submit it to the current stockbroker.

- The broker will further process it with the depository.

- The depository will verify it and transfer the shares.

- After the successful completion, the shares will be reflected in the new Demat account.

Ventura Securities Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platforms | No |

| Real-time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | No |

| Research Reports | Yes |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | No |

| Personalized Advisory | Yes |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | Yes |

| Email Alerts | Yes |

| Multi-Account Management | Yes |

Ventura Securities trading platforms are mostly built in-house, and they are way better than the ones readily available in the market.

These platforms are customized ones with arrays of features and facilities and a high level of technological advancements.

There are three kinds of platforms available from the stockbroker: desktop, web, and mobile phones.

Ventura Securities Trading Terminal – Ventura Pointer

This is the trading terminal of Ventura Securities which is downloadable on the desktop or laptop. It is software developed in-house in the firm by eminent experts. The features of this platform are –

- You can set up a market watch with your favourite stock

- Faster order placement across all the segments

- Share price charts are available

- Market depth details are also available on the screen

- You can customize the interface according to your need

- Fundamental data of the scrip are also available, which includes historical prices, news updates related to the stock, periodic results, P&L and Balance sheets, and many more details

- You can get an analysis of the scrip for the last 7 days on your screen

- There are separate windows for bulk trades, indices, action watches, and market summaries, as well as fundamental information

The system requirement is quite nominal; it can run on Windows 7 operating system and other versions like Windows XP, Vista, 8, 10, etc.

Ventura Securities Web Trading Platform – Ventura WEB

The web-based trading platform of Ventura Securities is known as Ventura WEB, and the site name is Ventura1.com.

You need your username and password to log in to this site, and this is a lightweight site that can be opened on a desktop and mobile phone, and other devices.

The features of this platform are lesser than the trading terminal; however, it supports all the basic functions and operations that you require to trade. The elements it includes are –

- Market Watch

- Real-time data and news updates

- Quick order placement

- Accessible through various browsers

Ventura Wealth App: Ventura Securities Mobile Trading App

This is the mobile application of this firm, which is also innovated, designed, and built in-house. This application provides access to all the operations you require to trade smoothly.

The features which make this application special are –

- You can trade across all segments – equities, commodities, derivatives, and all others.

- Within a blink of an eye, place orders, modify those orders if you need to, and also cancel them if they keep no longer profitable

- You get instant alerts for every happening in the market and your portfolio

- Read all the news and updates on the market on your mobile screen

- The market watch can be customized with your most tracked stocks

- Real-time charts are available

- Reports of different stocks, and companies- fundamental and technical available on this application

- You can view all the orders, holdings, margins, etc.

- Layers of security are provided to safeguard your interest and data

- You can track your portfolio with real-time data

To know more, check out Ventura Mobile Trading App

The system requirement for this application is Android or iOS. For the Android application, the version of the OS should be 4.0.3 and above, and for the latter, it should be 7.1 and more. The application size is 5.9 MB and 5.7MB, respectively, on the two OS.

Pointer and Ventura Wealth are trading platforms designed for offering easement in trading, analysis, research, and study for customers. Investors can easily access these platforms from their desktops, laptop, or mobile phones.

Keeping in view the importance of learning, Ventura Securities provides tutorial videos for its users to learn and explore various options and opportunities.

Ventura Securities Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll-Free Number | No |

| Branches | 65 |

The Ventura Securities customer care services are well known and appreciated because they are warm and friendly and provide you solutions to better your trading experiences all the time.

They have dedicated dealer support offline and online support. You can mail them your query and other requirements, and they will duly get back to you with the solution.

Ventura Securities Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 128 |

| Resolved in BSE | 99 |

| Lodged in NSE | 156 |

| Resolved in NSE | 142 |

Last year, complaints registered with NSE were 156, out of which 142 were resolved in the same year, and on BSE, out of 128 complaints registered, only 99 were resolved.

Ventura Securities Disadvantages

- There are no 3-in-1 account facilities

- The web-based platform for trading needs to be upgraded

- You have to pay hefty fees for using the trading terminal

Ventura Securities Conclusion

With the latest technologies and a wide variety of products and services, and ample scope for profitable trading,

Ventura Securities is ranked among one of the best stock brokers in the country. Few glitches can be sorted out easily and for the betterment of the customers.

Confused, about where to invest, which stock to buy, or which security will be prosperous for high returns, no worries, Ventura Securities will assist you in this regard too after making thorough research and after that proposing the right recommendations.

Ventura Securities also offers partner programs for the association.

Venture Securities Review FAQs

Check out the FAQs on Venture Securities

Is Ventura Securities safe for trading?

From its year of inception in 1994 to date, Ventura Securities has had a wonderful journey of 26 years.

As a company listed on NSE and BSE and with membership in various organizations, it has always valued its customers. Hence, it is a safe option for trading.

What is the brokerage of Ventura Securities?

Ventura Securities are full-service brokers. The brokerage charges for Equity delivery range from 0.20%.

For the intraday segment, equity futures are 0.03%, and the currency futures and options are Rs 10 per lot; for commodities, the charges vary within 0.15% / Rs 50 per lot. The charges for the equity options segment vary within Rs 50 per lot.

How to open Ventura Securities Demat online?

You can open Ventura Securities Demat online by clicking on the “Open Demat Account” button below and filling out the ‘Demat Account Opening Form.’

Upon submitting the form, you will have to upload the mentioned documents and then verify them. Once verified, the login credentials for your account will be mailed to you.

Can I invest in an IPO via Ventura Securities?

Yes, you can invest in an IPO via Ventura Securities. Simply fill out the application online through the Ventura Securities trading website, and the company takes care of the remaining work for you.

The process is simple and takes less than a minute. Insight into past IPO customers’ history is also offered.

What Leverage does Ventura Securities provide?

The minimum Ventura Securities leverage level is 1x of the amount you have and is applicable for currency options, currency futures, and commodities. The maximum leverage is provided for the equity intraday segment, up to 5x.

Does Ventura Securities have a trading App?

Yes, Ventura Securities does have a trading app called Ventura Wealth App. Suitable for both Android and iOS platforms, the app allows users to trade across all segments, get real-time market updates, view stock reports, track their portfolios, etc.

How to contact Ventura Securities customer care?

Ventura Securities has a warm and friendly customer care service that can either be contacted via email support or in person by visiting one of their 65 branches dispersed in the country.

The company provides aid for offline and online trading and offers a dedicated dealer.

Does Ventura Securities provide Research?

Yes, the firm is dedicated to its research and advisory services to provide the best opportunities to clients.

It offers extensive and all-inclusive research reports to its customers regarding various companies’ stocks and other financial assets, market value, market position, fair value, future predictions, etc.

Is Ventura Securities good for Beginners?

Yes, Ventura Securities is great for beginners, for the customer is provided with weekly, monthly, and annual reports and fundamental reports to educate them even without any prior knowledge.

In terms of IPO, they help with financial projections and opportunities. They also provide offline advisory services and relationship management support.

Who Founded Ventura Securities?

Mr Sajid Malik founded Ventura Securities, a full-service brokerage house in Mumbai, in 1994.

Today, the firm is under the directorship of Mr Sajid Malik, co-promoter of the company, Mr Ganapathy Vishwanathan, and Mr JuzerGabajiwala. The company’s CEO is Hemant Mahethia, who is also a director and co-promoter of the company.

Get a Call Back from Ventura Securities