Reliance Securities Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Jan 05, 2024Reliance Securities, also known as Reliance Smart Money, is the forefront organization dealing with broking and distribution within the Indian stock trading industry for Reliance Capitals.

The brand is a legacy in itself and is among one the leading full-service brokerage houses in the nation. In short, they have built a fortress of fortune around their very brand in quite less than even two decades of operation.

Nevertheless, today we are not here to glorify the organization on its history but to rather question its ways of operation with regard to the products they offer, the services they dispense, and the kind of brokerage they charge.

Also, taxes, and other relevant charges they levy, the exposure on trading leverage they extend and most important of all, the efficiency of all the remote trading platforms they have to offer to their respective registered traders as well as investors.

Table of Contents

- Rating & Review

- Overview

- Brokerage Charges

- Other Charges

- Account Opening Charges

- Offers

- Account Opening Process

- Products & Services

- Research & Tips

- Exposure

- Trading Platforms & Apps

- Customer Care

- Complaints

- FAQs

- Open an Account with Reliance Securities Now!

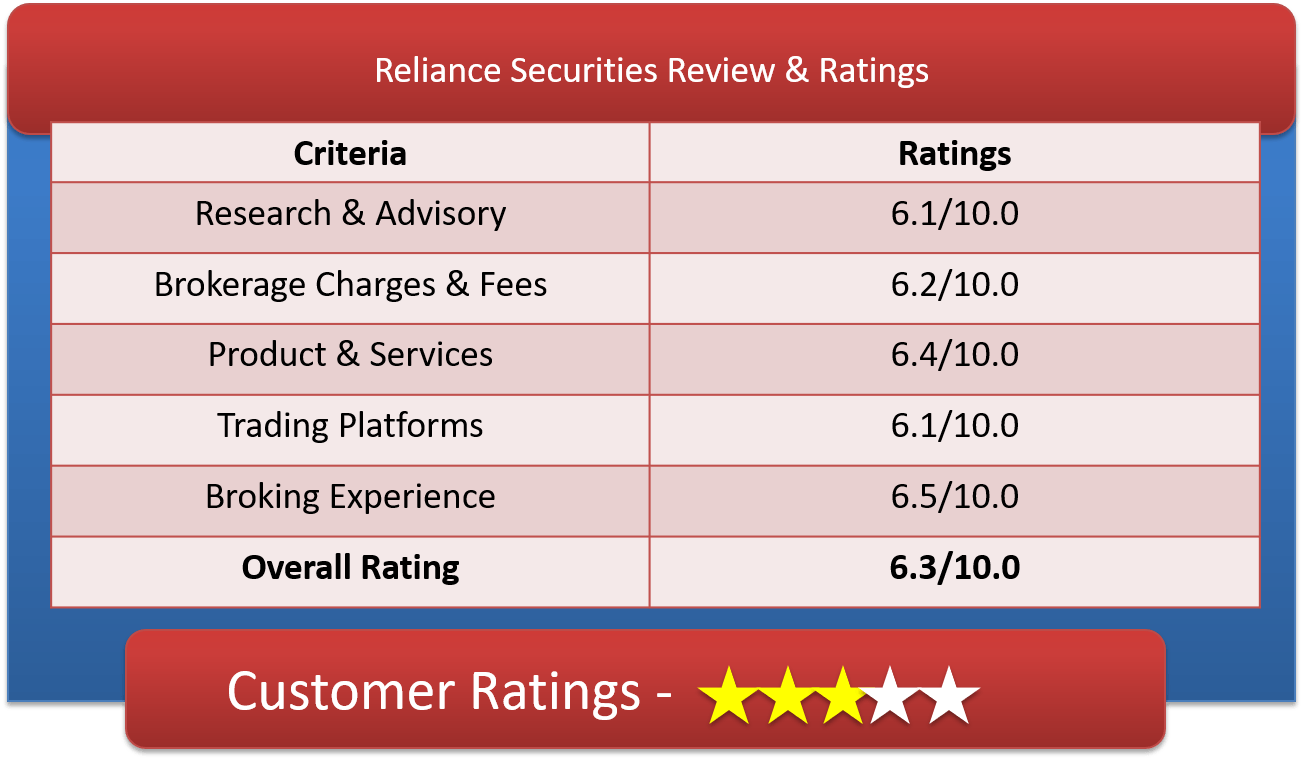

Reliance Securities Ratings & Review by Top10StockBroker

About Reliance Securities

| Overview | |

| Company Type | Public |

| Broker Type | Full-Service Broker |

| Headquarters | Mumbai, India |

| Founder | Anil Ambani |

| Established Year | 2005 |

Reliance Securities took over the responsibility of handling all the broking and distribution related to the Indian stock trading industry on behalf of Reliance Capitals after the firm was registered in 2005 by its founder Mr Anil Ambani with its headquarters being in Mumbai, Maharashtra.

It has since evolved as a full-service brokerage house and a giant in the Indian stock trading industry with the help of many state-of-the-art trading techniques and platforms.

They have come up with this in the past few years for their respective traders and investors located throughout the nation. Emerged from Reliance Capital, Reliance Securities strives and thrives as one of the recommended and Best Stock Brokers in India.

Their very mission statement reads ‘To simplify investments & trading for our customers through technology-backed, user-friendly, value-broking services.’

Open Demat Account with Reliance Securities – Fill up the Form Now!

Reliance Securities Brokerage Charges

| Brokerage Charges & Fees | |

| Equity Delivery | 0.30% |

| Equity Intraday | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | Rs 100 per lot |

| Currency Futures | 0.04% |

| Currency Options | Rs 100 per lot |

| Commodity | NA |

| Minimum Brokerage | As per Transaction |

| Demat AMC Charges | Free or Rs.400 per annum |

| Trading AMC Charges | Free |

| Margin Money | Rs.25,000 |

As mentioned above, the table has been positioned to brief you about all the charges that Reliance Securities imposes upon their respective clients in the form of brokerage.

By taking one glance at the table above, you can easily speculate that the full-service brokerage firm levies a charge of Rs. Rs. 100 per lot as their brokerage on Equity Options trading, Rs. 100 per lot as their brokerage on Currency Options Trading.

0.04 % as their brokerage on Currency Futures trading, 0.03% as their brokerage on Equity Futures Trading, 0.03% as their brokerage on Equity Intraday Trading, 0.30% as their brokerage on Equity Delivery Trading and a charge of Rs. 400 per year as the annual maintenance charge for maintaining Demat Account.

Other Features

Apart from these, the brokerage house has also made it mandatory for their respective clients to maintain a minimum balance of Rs. 25,000 in terms of Margin Money.

Nevertheless, the firm charges no brokerage for the annual maintenance of Trading Accounts.

The table is sufficient to brief you about the kind of brokerage you may expect from the company when trading across any of the segments mentioned above.

However, if you want to determine the kind of charges, you will be liable to pay in terms of brokerage when trading across multiple segments all at once.

You must refer to their dedicated Brokerage Calculator that goes by Reliance Securities Brokerage Calculator.

This tool can help you determine the exact brokerage you will have to pay in such situations and help you calculate the overall tax amount for SEBI Turnover Charges, Stamp Duty STT, and GST.

Similar Stock Brokers, you may also Like

Reliance Securities Charges

| Other Charges | |

| SEBI Turnover Charges | 0.00005% (Rs.5/Crore) |

| STT |

Equity Delivery: 0.1% on both Buy and Sell

Equity Intraday: 0.025% on the Sell Side *Equity Futures: 0.01% on Sell Side Equity Options: 0.05% on Sell Side(on Premium) Commodity Futures: 0.01% on sell-side (Non-Agri) Commodity Options: 0.05% on sell-side Currency F&O: No STT On Exercise transaction: 0.125% Right to entitlement: 0.05% on sell-side |

| Stamp Duty | (On buy-side only) Delivery: 0.015%, Intraday: 0.002%, Equity Futures: 0.002%, Equity Options: 0.002%, and Currency F&O: 0.0001%.Commodity Futures: 0.002%, Commodity Options: 0.002% (MCX) |

| GST |

18% on (Brokerage + Transaction Charge + SEBI Fee)

|

| Margin Funding Charges | NA |

| Reactivation Charges | Rs 40 per instruction |

| Account Closure Charges | NIL |

| Dematerialisation Charges |

For each request form, Rs 20 & Extra for each certificate, Rs 5

|

| Pledge Creation |

0.05% of transaction value or min Rs 20

|

| Pledge Invocation |

0.05% of transaction value or min Rs 20

|

| Margin Pledge/Unpledge/ Pledge closure |

0.05% of transaction value or min Rs 20

|

| Margin Repledge | Rs 25 per ISIN |

Taking a look at the chart as mentioned earlier will give you a proper idea of all the other but relevant charges that you will be needed to pay in terms of taxes.

As you can see, the firm charges 18 % GST on the overall sum of Brokerage and Transaction Charges, 0.00005 % SEBI Turnover Charges on the total Turnover value, 0.0350 % Transaction Charges on the Total Turnover Value, 0.0126 % Securities Transaction Tax on the Total Turnover Value.

The overall taxes to be paid by you over a certain trade across multiple asset classes can be determined by using the Reliance Securities Brokerage Calculator tool as well.

Other Charges

Delayed Payment Interest – Reliance Securities charges 21% per year in delayed payments. The interest is levied for all the debits, compounded monthly from the payin /payout date.

Call n Trade Charges – First 20 calls will be free every month. Above that, Rs. 20 per call will be levied on the investor. Also, Rs. 5 is charged for every inquiry.

Custody Charges – Custody charges are the sum paid for managing and taking care of investors’ investments. Reliance Securities charges no money from its customers in this regard.

Re-issue of DIS booklet – If you request a re-issue of your DIS booklet, Reliance Securities will charge Rs. 50 for the services.

Physical Ledger/Transaction Statement – Reliance Securities levies Rs. 40 per contract note and 40 per statement.

To know in detail, just click on this link Reliance Securities Brokerage & Other Charges.

Compare Reliance Securities with Other Brokers

Compare Stock Brokers

Reliance Securities Demat Account Opening Fees

| Demat Services | |

| Trading Charges [One Time] | Rs 0 |

| Trading AMC [Yearly] | Rs 0 |

| Demat Charges [One Time] | Rs 0 |

| Demat AMC [Yearly] | Rs 400 |

| Margin Money | Rs.25,000 |

| Offline to Online | No |

Reliance Securities has always embraced the traders and investors from across the nation who want to join the well-acclaimed full-service brokerage house by allowing them to open up a Demat or a Trading Account.

Anyone throughout the nation who is interested in joining the brokerage firm as a trader or as an investor can open up a Trading or a Demat Account with them without having to pay even a single rupee.

Furthermore, the brokerage house does not charge anything in annual maintenance corresponding to Trading Accounts.

However, in the Demat Account case, the company requires the users to pay a sum of Rs. 400 every year in terms of annual maintenance charges.

The brokerage house has also made it mandatory for the traders and investors to maintain a minimum balance of Rs. 25,000 in terms of Margin Money to trade in without any hindrance.

The transactions can all be made through either NSDL or CDSL. To know in detail, just click on this link Reliance Securities Demat Account.

Reliance Securities Offers

| Offers | |

| Free Demat Account | Yes |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | No |

| Zero Brokerage for Loss-Making Trades | No |

Reliance securities converge its trading facilities in a way that lays down the most beneficial features and offers in favour of its customers.

The chart, as mentioned above, has been deliberately positioned in that particular place to provide you with a clear picture of all the offers that the brokerage house comes up with either occasionally or regularly.

As you can speculate from the chart, Reliance Securities extends exclusive offers for their respective registered traders and investors based on Free Trading Accounts, Discount On Brokerage, Free Demat Accounts, and Flexible Brokerage Plane.

Reliance Securities is an integral part of the largest group and one of the Best Full-Service Broker in India and does not usually offer services like Trading Happy Hours, Provision to charge Zero Brokerage for Loss Making Trades, Holiday Offers, Referral Offers, or month worth of trading without any brokerage whatsoever.

Other Offers

0 brokerage for 30 years – Reliance Securities plans where no brokerage is charged for the trading. So, if you fall under the circumstances and terms, you can take advantage of the offer.

0 AMC for first-year – AMC is Annual Maintenance Charge. It is the sum charged by the stockbroker for providing the Demat and Trading account services.

Reliance Securities charges no AMC for the first year from opening the Trading and Demat account with Reliance Securities.

0 Account opening fees – With Reliance Securities, you do not have to pay any fees or charges for opening an account.

Open a free account with Reliance Securities and enjoy all its services. Well-built platforms, thorough research stocks, researched recommendations, and other facilities.

How to open Demat Account with Reliance Securities?

As a full-service brokerage house, Reliance Securities has gained humongous respect within the Indian trading and Broking space in the past few years by serving their respective registered traders and investors with utmost zeal.

Therefore, if you too happen to be a great fan of their work and want to join them as a trader or as an investor, then it is the right time and the right place for you to learn what you need to do:-

- You will find a green coloured button reading ‘Open Demat Account.’

- Click on that button to open up a new form on your computer screen.

- Go through the entire form, carefully reading each line, sentence, and paragraph.

- Once you are done reading the entire form, you will be required to fill form with the correct details.

- As soon as you have filled up the form, submit the form and proceed with the KYC procedure.

- To conclude the KYC procedure, you will need to have your Aadhar Card, PAN Card, and a photograph with you and upload them to the website to verify your age, identity, and address, respectively.

- You may expect a call from one of the authorized personnel on behalf of the brokerage house as soon as you have completed the KYC procedure, who will take care of the final few verification formalities.

- You will be granted full access to your new Trading or Demat Account as soon as you have completed all the procedures mentioned above within a couple of hours and get the login details in your email address.

Open Demat Account with Reliance Securities – Fill up the Form Now!

Why Open Reliance Securities Trading Account?

Frankly speaking, if you belong to the Indian judiciary territory and want to trade or invest within the Indian Trading and Broking Space in any or multiple asset classes, you must have a Demat or a Trading Account as per the Indian Government and the laws of the nation.

Nevertheless, there are far more compelling reasons for you to consider joining Reliance Securities Trading Account:-

- They are one of the big names with a lot of experience and exposure to full-service financial brokering.

- It has been recognized many times for its tremendously satisfying customer care services by the maestros of the domain.

- In the last decade, they have showcased ceaseless growth in terms of technological aspects.

Reliance Securities Products & Services

List of products & services provided to its clients

Reliance Securities Products

| Products | |

| Equity Trading | Yes |

| Commodity Trading | No |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

As per the chart, as mentioned above of contents that have been deliberately placed in that particular position to grant you detailed information about Reliance Securities’ line of financial products.

It can be easily speculated that the full-service brokerage firm offers products with regard to Equity Trading, Options Trading, Futures Trading, Currency Trading, Mutual Funds, and Systematic Investment Plans.

However, the company does not have to offer any product regarding Commodity Trading, Forex Trading, Banking or Insurance.

Other Products

Structured Products – Reliance securities offer Structured Products in the form of Nifty-linked debentures (NCDs). These help the customer with wealth creation and portfolio protection tools.

Stocks for SIP – You can invest in SIP with Reliance Securities. SIPs are Systematic Investment Plans where the investor is required to invest a fixed sum at a regular period, say monthly.

High Dividend Payers – A blooming investment depends on various factors, and one such factor is the Dividend. Reliance Securities classifies all the stocks into different categories so that the investor can identify the most suitable stock for them.

Top 3 Stocks in Sectors – Reliance Securities also classifies stocks based on the sectors and ranks them according to their performance in the market.

Buzzing Stocks – Want to know which are the most traded stocks currently in the market Reliance Securities gathers up all the information. Through its varied platforms, Reliance showcases the buzzing stocks of the market.

Potentially Good Stocks – Don’t know which stock to buy. Reliance Securities will recommend you the best potential stock that can enhance your saving and multiply them highly.

Reliance Securities Services

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | Yes |

| Trading Institution | No |

| Trading Exposure | Upto 5x |

The chart above has been tactically designed to give you a proper idea about Reliance Securities’ range of services they have to offer to their respective registered traders as well as investors.

Just a glimpse at the table will give you a proper idea that the brokerage firm provides active services with regards to Demat Account Services, Trading Account Services, Initial Public Offering Services, Stock Recommendation Services, Intraday Services, and Portfolio Management Services with up to 5 times the average trading exposure.

However, the brokerage firm does not provide any services regarding 3 in 1 accounts, Robo Advisory, or Trading Institutions.

Other Services

Loans – A loan is a sum lent from an individual or institution that is required to be paid back to the lender after a time as per the conditions led out between the parties. You can avail of this facility from Reliance Securities.

IPO – Investors can participate in the IPOs and enhance their investment portfolio. In IPOs, companies offer their equity shares for the first time capital to raise funds.

PMS – PMS stands for Portfolio Management Services. Reliance Securities offers well researched and well-built portfolio for its customers. PMS is designed to operate as per your investment goals.

Trade Edge – Trade Edge is another interesting product of Reliance Securities made to offer to embellish investors’ investment opportunities.

Blue Chip Stocks – Reliance Securities also offers Blue Chip Stocks to its customers. Blue Chip Stocks are stocks of highly large and financially strong companies.

Turnaround Companies – Reliance Securities offers well-scrutinized products with high returns depending on the holding period and other factors.

Robo Assist – To resolve and answer customers’ queries, Reliance Securities has designed a Robo Chat advisory feature that will be your assistant anywhere and anytime.

R-Absolute Portfolio – Reliance offers you a basket of about 5-6 stocks that can yield up to 15% results within one year. They make the recommendations according to your goals.

Cement Basket – Reliance Securities offers multiple types of baskets to choose from for its customers for the best investment optimization. And one such basket is Cement Basket which embodies Cement stocks.

Earning Basket – Confused about which stocks to buy and which stock should be a part of your basket. Reliance Securities has developed innovative baskets of stocks for various investment goals.

Reliance Securities Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | Yes |

| Annual Reports | Yes |

| Company Stock Review | Yes |

| Free Stock Tips | No |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | No |

| Monthly Reports | Yes |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

As you can speculate after looking at the table mentioned above of content Reliance Securities provides extensive Research and Advisory Related Materials to their respective registered traders as well as investors throughout the nation.

This is with regards to Monthly Reports, Weekly Reports, Offline Advisory, Initial Public Offerings, Top Picks, Research Reports, Company Reports, Annual Reports, Company Stock Overviews and Fundamental Reports.

However, they have no provision to provide any research and advisory-based materials concerning Free Stock Tips or Daily Market reviews.

Reliance Securities Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | 1x |

| Equity Intraday | Upto 5x |

| Equity Futures | 1x |

| Equity Options | 1x |

| Currency Futures | 1x |

| Currency Options | 1x |

| Commodities | 1x |

The table of contents, as mentioned just above, this particular section has been tactically designed to give you the proper idea about Reliance Securities’ provisions for letting out additional leverage on trading exposure for various asset classes.

As you can see within the table mentioned earlier, they provide additional exposure up to 5 times on Equity Intraday Trading, up to 1 time on Equity Delivery Trading, up to 1 time on Currency Futures trading, up to 1 time on Currency Options Trading, up to 1 time on Equity Futures Trading and up to 1 time on Equity Options Trading.

Nevertheless, the company does not provide any additional exposure to Commodities Trading.

Reliance Securities Margin Calculator will help you to calculate how much margin you will get if you invest or trade with Reliance Securities.

How to transfer shares in Reliance Securities from other Stock Brokers?

To transfer shares from another stockbroker to Reliance securities, you will need to –

- Fill and sign the DIS and submit the same with your present stock brokers.

- The transfer can be done in two ways, Manual and online.

- Submitted Delivery Instruction Slip will be further submitted with Depository, i.e., CSDL or NSDL.

- After verification and authenticity, the Depository will process the transfer of shares from another stockbroker to Reliance securities.

- The transferred shares will then be reflected in your new Demat Account.

Reliance Securities Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platforms | No |

| Real-time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | Yes |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | Yes |

| Personalized Advisory | Yes |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | Yes |

| Email Alerts | Yes |

| Multi-Account Management | Yes |

Being the forefront representative of the Reliance Capitals, Reliance Securities has always been an enthusiastic company in growth, especially by integrating new-age technological aspects.

They have continually been developing ways to help their respective registered traders and investors throughout the nation by introducing brilliant tools and platforms for the sake of remote trading options.

As of today, they primarily offer four distinct platforms to help their respective clients throughout the nation:-

Reliance Tick – Reliance Web Trading Platform

Reliance Securities has its dedicated remote trading platform specifically developed to function through and over a web-based browser for its respective registered traders and investors across the nation.

This particular web-based trading platform has been named Tick Web, and it comes loaded with the following features:-

- Reliance web-based trading platform comes integrated with a Stock Analytics feature that can provide the traders and investors with their respective health score, ranking, peer group performance, industry position, financial position, and more by using a unique scoring methodology.

- The web-based trading platform comes integrated with the Market & Sector Analytics feature. This particular feature can help the users stay informed about the current ongoing within the market in real-time with the help of multiple charting options meant to be displayed in a simplified visual yet insightful format.

More Features:

- The web-based trading platform comes integrated with a feature called News Analytics. This particular feature enables the respective traders and investors to obtain positive, negative, or neutral news along with their respective sources and sentiment through multiple analyses and filtrations.

- The web-based trading platform comes integrated with a feature called Derivative Insights. This particular feature enables the respective registered traders and investors to obtain long & short built-up, unusual events, covering F&O trades & a lot more at merely a glance.

- The web-based trading platform comes integrated with a feature called Trade Analytics. This particular feature enables the respective registered traders and investors to analyze their respective trading decisions & behaviour to help them figure out their pros and cons and, therefore, trade profitably. This feature also enables the users to get the details of the winning as well as losing trades on the basis of sectors, holdings and a lot more.

- The web-based trading platform comes integrated with a feature called Portfolio Highlights. This particular feature enables registered traders and investors to study and evaluate their portfolios under their risk tolerance capabilities, past performances, and exposure in real-time. This feature also grants valuable insights to the respective users to help them make informed decisions.

Reliance Securities Trading Terminal – Reliance Tick PC

Reliance Securities have built up its own Desktop Based Trading platform called the Reliance Tick PC to facilitate their respective registered traders and investors across the nation to commence remote-based trade across the Indian Stock Trading Industry.

The app has been developed to function perfectly with Windows 32 and 64-bit variants of Windows 7, Windows 8, and Windows 10, respectively. It comes equipped with the following features:-

- The desktop-based app comes equipped with the ability to let the respective users access many shortcut keys to execute complex trade and analysis-related tasks with rather ease. The user can also create their own set of shortcut keys at their convenience.

- As a desktop-based remote trading platform, Tick PC enables users to execute complex and critical analyses with the help of multiple technical indicators and historical charting data.

- The desktop-based trading platform also comes integrated with the Span Margin Calculator which can be brought to active use by the respective traders and investors to get accurate information about the kind of margin required to execute a certain trade.

- Desktop-based software also enables the respective registered traders and investors to create multiple customizable watch lists consisting of different sets of stocks to be able to segregate all their respective trading-related information.

- The desktop-based software has been developed to allow the respective users to customize and create scrip alerts based on the stock price they want to trade at. This feature especially comes in handy when the respective users do not have the time to be online and yet do not want to miss out on an opportunity to trade in or out the best possible deals.

Reliance Tick Pro Mobile App – Reliance Securities Mobile Trading App

Reliance Securities have developed its own mobile-based remote trading platform called the Reliance Tick PRO App, which has been developed to be compatible with Android as well as IOs based smartphones.

The app can be found across both Google’s Play Store and Apple’s App Store, with over one lakh downloads and an average rating of 3.8 and 2.5 ratings, respectively. The app comes integrated with the following features:-

- The mobile-based trading platform has been developed to easily help registered traders and investors analyze big data. The app has more than twenty robots and eight scanners that can go through over twenty-five thousand contracts and five thousand securities every second.

- The app comes integrated with a variety of Robo advisors that can help the respective users customize investment strategies according to their risk profiles within a single click.

- The app has been developed to help the respective users make informed and swift decisions by giving them detailed information on stocks from authentic social media and global market sources.

- The app has been deliberately designed to help the respective registered traders and investors be informed about their respective profit potentials over a certain amount of options trades

More on Reliance Securities Trading Platform

Web – Access and understand Reliance Securities through its website and analyze your requirements. Research, learn, acknowledge, trade, and fulfil your trading desires with the platform. The web will offer you a Trader-like experience.

EXE – Made for your convenience, operate it in the comfort of your home, office, or a café. Tick PC is made for your convenience. Some features of Tick PC are – Shortcut Keys, Charts, Span Margin Calculator, Multiple Watchlist, and Scrip alert.

Mobile – Open yourself to the world where everyone wins with high-yielding securities. Research, analyze and invest in your watch stocks from anywhere at your fingertips with the mobile application of Reliance securities.

Algo – Algo trading is another fantastic platform for Reliance securities. Your automated trading partner to bring profit-making opportunities to you. It offers Pre-canned Execution Algorithms, Chart-based Trading, Customized Algos, APIs, etc. Try the platform and take advantage of it.

Reliance Securities Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll-Free Number | No |

| Branches | 80 |

You can easily guess the kind of customer service support you may expect from Reliance Securities by taking a moment to look at the chart mentioned above of contents.

The above table shows that the well-acclaimed brokerage house provides active support regarding Offline Trading, Online Trading, Email Support, and Dedicated Dealers through the help of their network of eighty branches located throughout the country.

Nevertheless, it must also be acknowledged that they do not provide any support regarding 24 * 7 Support, Chat support, or have a Toll Free Number.

Reliance Securities Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 145 |

| Resolved in BSE | 121 |

| Lodged in NSE | 198 |

| Resolved in NSE | 174 |

Reliance Securities, as a full-service brokerage firm, received a total of one hundred and forty-five complaints against them in the BSE and one hundred and ninety-eight complaints within the NSE last year.

Out of which, a total of one hundred and twenty-one and one hundred and seventy-four complaints against them were resolved within the respective segments.

Reliance Securities Disadvantages

Now, Reliance Securities have come a long way in serving its respective customers satisfactorily. However, they still need to look out to rectify a few things within their organization:-

- They still do not have any toll-free number for their respective customers to reach out to.

- They do not have any products across the Commodities trading segment.

Reliance Securities Conclusion

There isn’t much to be said about Reliance Securities apart from the fact that they have been serving enthusiastically all of their respective clients across the decades.

Nonetheless, they can still look out at a few flaws in their organization and aim to become the best there is.

You can watch and analyze the Budget of 2022 from the website of Reliance securities and gain insights into the essential aspects of the same.

Reliance Securities is a trading platform that serves its customers with ample learning prospects. You can learn about the capital market, trading, how to invest, and a lot more.

Reliance Securities Review – FAQs

Here is the list of FAQs related to the Reliance stockbroker:

Is Reliance Securities safe for trading?

Reliance Securities is an organization that is at the forefront of trading in the Indian stock market. Its legacy and wide range of experience are proof enough of its high standards in safety and reliability for trading.

Reliance Securities looks to create user-friendly and value-laden broking services for its customers.

What is the brokerage of Reliance Securities?

Reliance Securities is a full-service brokerage company. The brokerage can range from 0.15 – 0.50% for Equity Delivery Trading to 0.015-0.050% for Equity Intraday Trading, Equity Futures Trading, and Currency Futures Trading.

How to open Reliance Securities Demat online?

By clicking on the green button labelled “Open Demat Account,” a new form will appear on your screen. You can read, fill and submit the form and then proceed to the KYC procedure.

Once these steps have been completed, you can expect a call from authorized personnel. After the procedures are completed, you will have full access to your account within a few hours.

Can I invest in an IPO via Reliance Securities?

Yes, you can invest in an IPO via Reliance Securities in a hassle-free manner. You can take the online route and simply fill in the requisite details on online screens.

The company will then handle your paperwork based on your filled-out information.

What Leverage does Reliance Securities provide?

Reliance Securities provisions for letting out additional leverage on trading exposure vary between asset classes. The leverage can go as high as 5x on Equity Intraday and as low as 1X on Currency Future Options.

Does Reliance Securities have a trading App?

Yes, Reliance Securities does have a trading app for both Android and iOS platforms called Tick PRO.

Meant as a remote trading platform, the app has provisions for analyzing a hefty amount of data, automated advisors, information about profit potentials, etc., and has over 1 Lakh downloads.

How to contact Reliance Securities customer care?

Reliance Securities offers customer care for both online and offline trading. Customers can acquire this either in email support or in person from one of its 80 branches located throughout the country.

The company also provides a dedicated dealer.

Does Reliance Securities provide research?

Yes, Reliance Securities provides extensive research to registered traders and investors throughout the nation. The company offers timely research reports and insights.

Is Reliance Securities good for Beginners?

Yes, Reliance Securities is a great option for beginners. Its thorough research and advisory support, combined with multiple reports, make it a good choice for beginners.

Reliance Services serves its clients with its mission statement which is “to simplify investments and trading for our customers through tech-backed, user-friendly, value-broking services.”

Who Founded Reliance Securities?

The foundations for Reliance Securities were laid in 2005 by Mr Anil Ambani.

After the firm was registered with its headquarters in Mumbai, Reliance Securities took over handling broking and distribution related to the Indian stock trading industry on behalf of Reliance Capitals.

Open Demat Account with Reliance Securities – Fill up the Form Now!